Tech Stocks Gaining Momentum: Why NVIDIA and Intel Are Back in Focus for Growth Investors

In today’s market, US stock market research often highlights technology leaders driving innovation and delivering strong returns. Among them, NVIDIA (NVDA) and Intel (INTC) stand out not only for their market dominance but also for their roles in shaping emerging sectors like AI, cloud computing, and data infrastructure. Let’s explore why these US tech stocks are drawing attention and how they fit into broader investment strategies for growth-oriented investors.

🚀 NVIDIA: A Leader in Emerging Technology Stocks

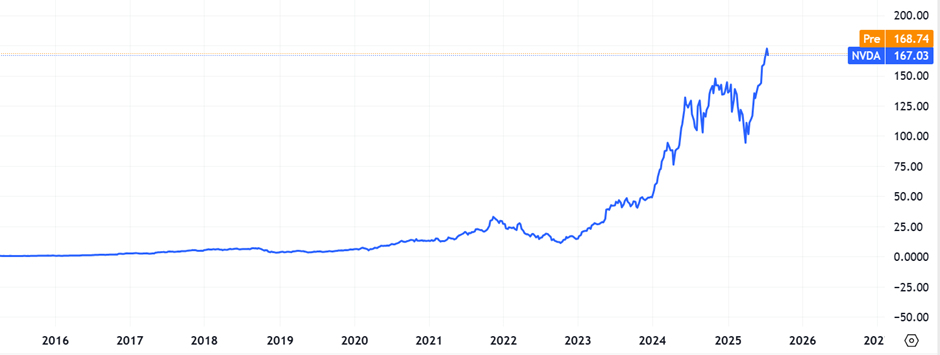

NVIDIA has been at the forefront of AI stocks analysis and emerging technology stocks, with its graphics processing units (GPUs) powering everything from gaming to data centers and autonomous vehicles. Investors seeking top-performing S&P 500 companies have watched NVIDIA’s revenue growth and margins expand significantly, driven by demand for machine learning and cloud services.

- Key Driver: Surging demand for AI chips and data‑center hardware.

- Why It Matters: For those looking at fastest-growing AI stocks in the US, NVIDIA remains a prime candidate.

💻 Intel: Rebuilding Momentum in US Equities

Intel, long known as a semiconductor giant, has been refocusing on innovation and capacity expansion. With new investments in manufacturing and a push into high‑performance computing, Intel is positioning itself as a competitor in the US tech stock research landscape.

- Key Driver: Heavy investment in next‑gen chip fabrication and partnerships.

- Why It Matters: US equities analysis shows Intel’s turnaround story is attracting both institutional and retail interest.

📊 What This Means for Investors

Investors exploring emerging growth stocks or speculative stock picks often balance large‑cap innovators like NVIDIA and Intel with small-cap investment ideas. While micro‑caps and Canadian penny stocks may offer high upside, established tech leaders provide stability and exposure to cutting-edge trends.

- Diversification Tip: Blend US mid-cap stocks and penny stock research with tech blue chips for a balanced portfolio.

🌱 Sector Rotation: Technology Meets Green Energy

Much equity research for small-cap investors now intersects with sustainability themes. For instance, NVIDIA’s chips are integral in EV market analysis and battery technology stocks, while Intel’s efficiency initiatives align with broader renewable energy stocks trends.

🔔 How to Stay Ahead

Professional analysts and independent stock research firms offer custom investment reports that combine US equities analysis, TSXV and OTC market analysis, and deep dives into leading tech names. This helps investors uncover hidden gems on NASDAQ and TSX while staying informed on speculative micro-cap winners.

✅ Key Takeaways

- NVIDIA leads in AI and cloud computing, driving tech growth.

- Intel is investing heavily to regain market share in semiconductors.

- Blend large-cap tech with small-cap stock research for diversified exposure.

- Use independent equity research to find opportunities across sectors, from gold stocks to hedge against inflation to emerging technology stocks.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions in an increasingly complex world.