Consumer Price Index Explained

The Consumer Price Index (CPI) in Canada is a measure of the average change over time in the prices paid by Canadian households for a basket of goods and services. The basket includes items such as food, clothing, shelter, transportation, health care, and entertainment.

Statistics Canada calculates the CPI on a monthly basis by collecting data from thousands of retail locations across the country. The index is based on a 2002 base year, with a value of 100 set for that year. The current CPI value represents the percentage change in the price level compared to the base year.

The CPI is an important economic indicator because it is used to measure inflation, which is the rate at which prices for goods and services are increasing. The Bank of Canada uses the CPI to help guide monetary policy, including setting interest rates. It also helps individuals and businesses make decisions regarding budgeting, investments, and pricing.

How is CPI determined

To calculate the CPI, Statistics Canada collects price data from thousands of retail locations across the country. The prices are collected monthly for each item in the basket, and the data is weighted based on the relative importance of each item in the average Canadian household’s budget.

The CPI is calculated using a formula that compares the total cost of the basket of goods and services in the current period to the cost of the same basket in a base period. The base period is set to a value of 100, and the current CPI value represents the percentage change in the price level compared to the base period.

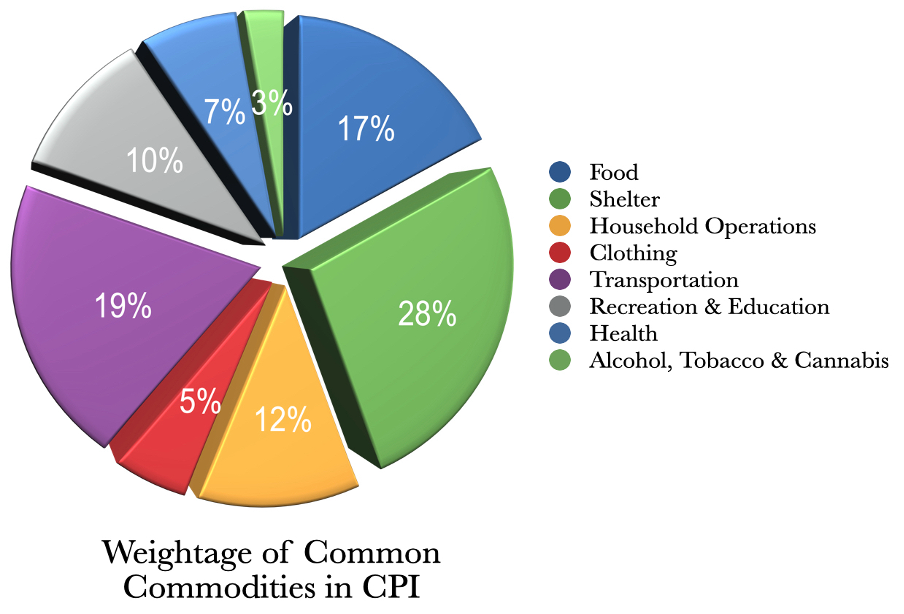

The basket of commodities and their weightage in the Consumer Price Index (CPI) in Canada is determined by Statistics Canada and is updated periodically to reflect changes in consumer spending patterns. The most recent update was in 2017, and the current basket of commodities and their weightage as of 2021 is as follows:

- Food (17.0% weightage)

Includes items such as bread, meat, vegetables, fruits, and dairy products.

- Shelter (27.5% weightage)

Includes items such as rent, mortgage payments, and property taxes.

- Household operations, furnishings and equipment (11.7% weightage)

Includes items such as furniture, appliances, cleaning supplies, and home repairs.

- Clothing and footwear (5.1% weightage)

Includes items such as shirts, pants, shoes, and accessories.

- Transportation (19.3% weightage)

Includes items such as gasoline, public transportation, and vehicle purchases.

- Health and personal care (6.6% weightage)

Includes items such as prescription drugs, dental care, and personal grooming products.

- Recreation, education and reading (10.0% weightage)

Includes items such as sports equipment, toys, tuition fees, and books.

- Alcoholic beverages, tobacco products and recreational cannabis (2.8% weightage)

Includes items such as beer, wine, cigarettes, and cannabis.

Note that the weightage of each item in the basket represents its relative importance in the average Canadian household’s budget. This means that changes in the prices of items with higher weightage will have a greater impact on the overall CPI.

Example

Suppose we have a hypothetical basket of goods and services with the following items and prices in the base year (Year 1) and suppose that in Year 2, the prices of these items have changed as follows:

To calculate the CPI for Year 2, we need to follow these steps:

Determine the weight of each item in the basket. Let’s assume that each item has an equal weight of 25%.

Calculate the price change for each item by subtracting the Year 1 price from the Year 2 price and dividing by the Year 1 price.

For example, the price change for apples is:

($1.20 – $1.00) / $1.00 = 0.20 or 20%

Calculate the price index for each item by adding 1 to the price change and multiplying by 100. For example, the price index for apples is:

(0.20 + 1) x 100 = 120

Calculate the weighted average of the price indexes by multiplying each price index by its weight, summing the results, and dividing by 100.

For example, the CPI for Year 2 is:

(120 x 0.25) + (108 x 0.25) + (108.3 x 0.25) + (110 x 0.25) / 100 = 111.075

Therefore, the CPI for Year 2 is 111.075, which means that prices have increased by 11.075% compared to the base year.

Importance of CPI

The Consumer Price Index is an important economic indicator for several reasons:

- Measuring inflation: The CPI is the primary measure of inflation in Canada. It tracks the change in prices of a basket of goods and services over time, allowing policymakers and economists to assess whether prices are rising or falling and by how much. This information is used to make decisions about monetary policy, such as setting interest rates, and to adjust social security benefits and other payments to account for changes in the cost of living.

- Reflecting consumer spending patterns: The CPI is based on the expenditures of Canadian households, so it provides insight into how consumers are spending their money. The basket of goods and services used in the CPI is updated periodically to reflect changes in consumer spending patterns, so the CPI is a more accurate reflection of consumer behaviour than other measures of inflation.

- Comparing prices across regions and countries: The CPI allows for comparisons of price levels across regions and countries. For example, the CPI can be used to compare the cost of living in different Canadian cities or to compare the inflation rates in Canada and other countries.

- Providing information to businesses and consumers: The CPI provides information to businesses and consumers about changes in the price of goods and services, which can help them make decisions about pricing, production, and consumption.

In summary, the CPI is a key economic indicator in Canada that provides valuable information about inflation, consumer spending patterns, and price levels, and is used by policymakers, economists, businesses, and consumers to make decisions and adjust their behaviour accordingly.

Is taxation taken into account in CPI?

No, taxation is not directly included in the Consumer Price Index (CPI) in Canada. The CPI measures the changes in prices of goods and services that consumers purchase, but it does not directly account for taxes paid on those purchases. For example, if the price of gasoline increases due to higher taxes, the CPI would capture the increase in the price of gasoline, but it would not differentiate between the price increase due to taxes and the price increase due to other factors.

However, indirect taxes such as the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) are included in the CPI. This is because these taxes are added to the prices of goods and services at the point of sale and are therefore reflected in the final price paid by consumers. As a result, the CPI includes the impact of these taxes on the overall price level.

In summary, while taxation is not directly included in the CPI in Canada, the impact of indirect taxes on the prices of goods and services is reflected in the CPI.

Wrapping Up

Statistics Canada uses a rigorous statistical procedure to determine the Consumer Price Index, which results from hundreds of employees working monthly to gather data.

Historically, StatCan collected CPI data by sending interviewers to shops to gather prices. Since recent updates, most information is collected digitally, with some establishments sending cashier data directly to StatCan.

The Personal Inflation Calculator from Statistics Canada helps Canadians determine how inflation may affect their lifestyles and budgets based on the Consumer Price Index