Why Northland Power Inc. (TSX:NPI) is one of the best value wind energy stocks?

Northland Power Inc. (TSX:NPI) is a Canadian-based independent power producer that develops, builds, owns and operates clean and green power infrastructure assets. Founded in 1987, Northland Power has a long history of developing and operating renewable energy projects in Canada, Europe, and other global markets. The company’s portfolio includes wind, solar, and hydroelectric power facilities with a total capacity of over 2.6 gigawatts (GW).

Northland Power is committed to creating sustainable energy solutions that meet the growing demand for clean energy while reducing greenhouse gas emissions. The company has a strong track record of delivering sustainable and responsible energy solutions that benefit the environment, local communities, and its investors.

It is publicly trading since 1997. Northland owns and has an economic interest in 3.0 GW (net 2.6 GW) of operating capacity. Northland has a long history of developing, building, owning, and operating clean and green power infrastructure assets and is a global leader in offshore wind.

Highlights and News Updates

- On February 26th, 2023, Northland Power’s full year 2022 earnings beat expectation. Revenue was up by 17% from FY2021, net income up by 357%, and profit margin 33% up from 8.5% FY2021.

- On February 10th, 2023, Northland Power and partners execute major agreements for Oneida Energy Storage Project. It will be Canada’s largest battery energy storage project.

- On February 3rd, 2023, Northland Power announced 2023 financial guidance, expanded Canadian development portfolio, and established its 2040 net zero target.

- On December 14th, 2022, Northland Power announced strategic partnership in Hai Long with Gentari.

- On November 26th, 2022,Northland Power announced redemption of series 3 preferred shares.

- On April 27th, 2022, Northland Power launched new brand, reinforcing commitment to build a sustainable future.

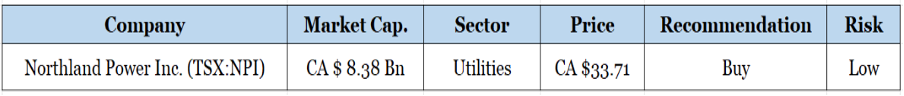

Key Data

Fourth Quarter 2023 Highlights

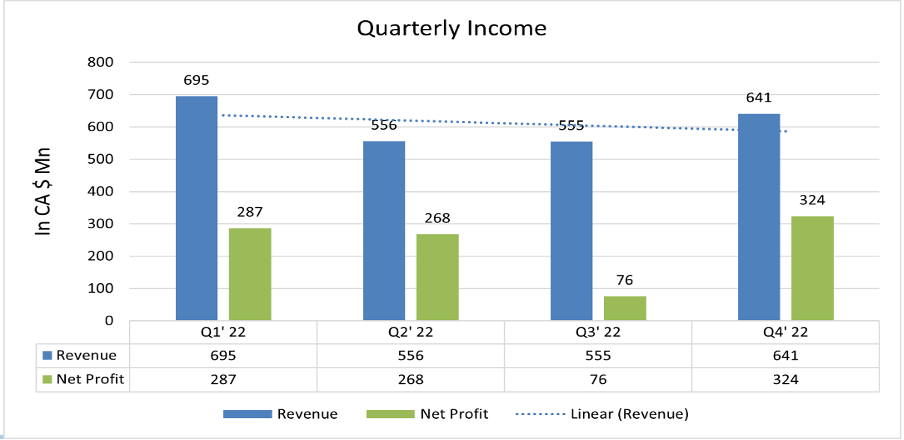

- Sales of CA $641 Mn in the fourth quarter of 2022, was in line with fourth quarter of 2021 CA $640 Mn.

- Adjusted EBITDA decreased in the fourth quarter to CA $353 Mn from CA $364 Mn in 2021.

- Net income increased in the fourth quarter to CA $324 Mn from CA $130 Mn in 2021.

- Electricity production in gigawatt hours (GWh) was 3009 in fourth quarter by 6.4% from fourth quarter of 2021.

- Free Cash Flow per share (a non-IFRS measure) decreased in the fourth quarter to CA $0.06 from CA $0.69 in 2021 and increased on a full-year basis to CA $1.61 from CA $1.40 in 2021.

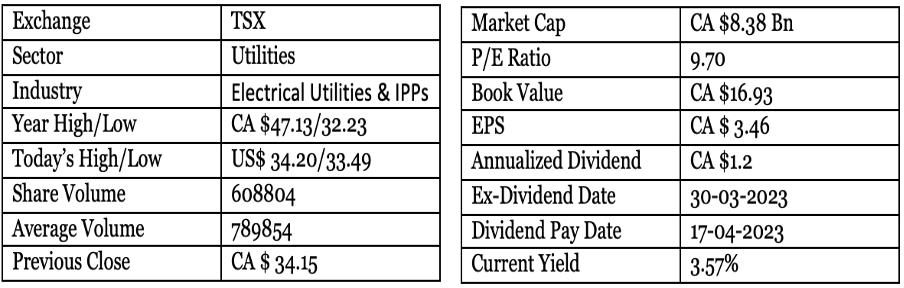

Financials

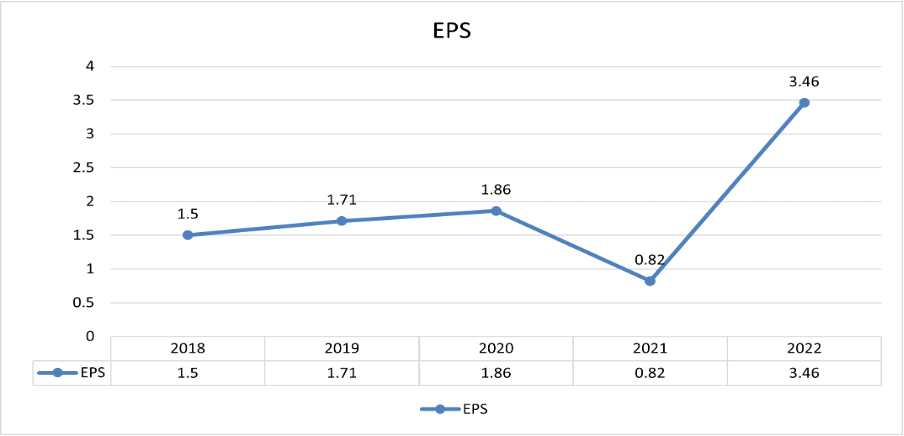

Financials of the company are quite stable. Revenue grew at CAGR of 12.35% and net profit is stable too. However net profit fell in FY2021 due to increase in operating expenses which should not be much of a concern because energy sector is capital intensive sector

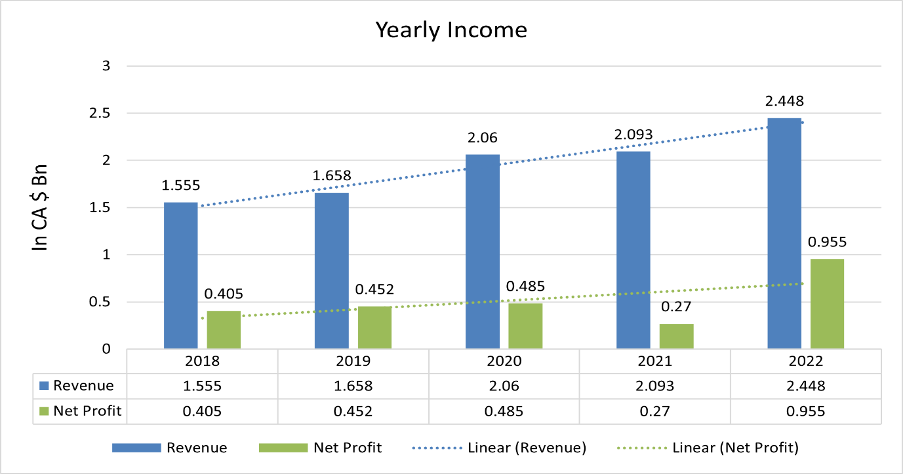

It can be seen from the total debt graph that the company has also paid massive portion of its debt in FY2021 this is also a reason why net profit of the company decreased in FY2021.

Company’s assets side of the balance sheet is also very strong as it has assets worth CA $14.222 Bn and total liabilities at CA $9.498 Bn it also includes total debt of CA $6.962 Bn. So, the debt can be paid off easily.

Quarterly revenue of the company is also on good track. However, it fell in Q2 and Q3 but annually it grew 16.96% from previous year and profit also grew 253.70% which is a good progress.

Right now, EPS of the company is at CA $3.46 which is better than last year. EPS of the company is in a good uptrend due to importance of energy it expected to grow more in future.

Forecast

Right now, the company is trading at CA $33.71, with 1-year projected high estimation target of around CA $45, a low estimation of CA $32; and average price target of CA $40.

The balance sheet of the company is strong, the numbers on the income statement is growing well and the cashflow of the company is also good. Right now, there are nine ongoing projects around the world. The company is using its cash to expand business in Taiwan, Japan and in continents like Asia, Latin America, and Europe.

The Company remains well positioned to fund its growth objectives. Northland Power has access to CA $1.3 Bn of available cash on hand and an approximately CA $583 Mn of capacity on its corporate revolving credit facility as of December 31, 2022, which can be utilized to fund growth projects.

Technical Analysis

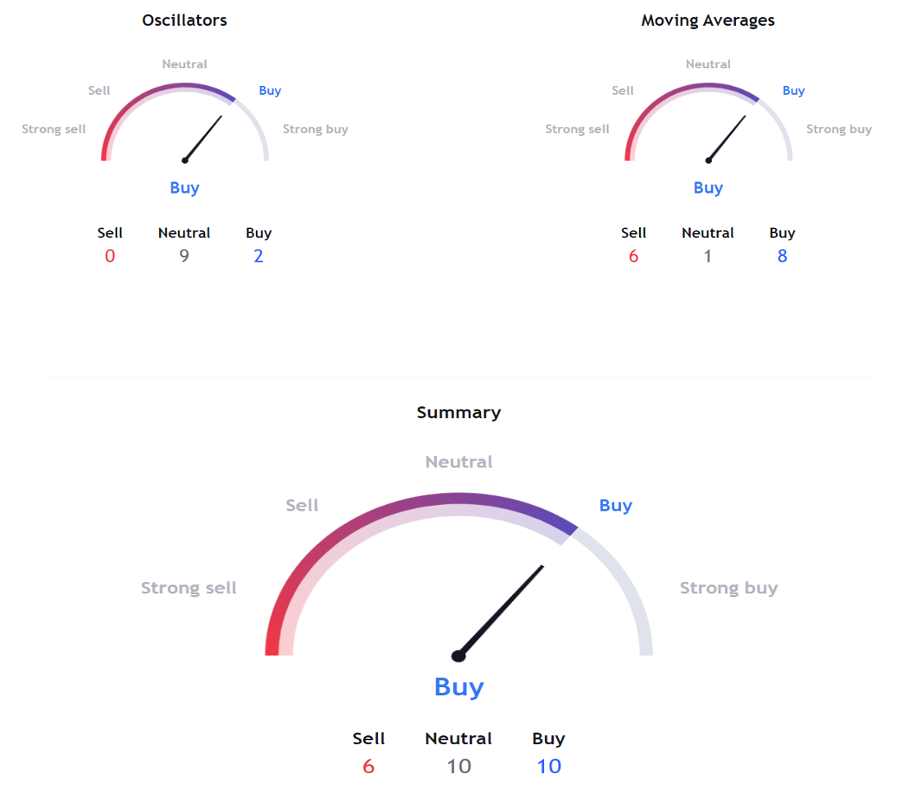

- The stock has fallen by 30% in last eight months and it has made a pole and flag pattern and it is expected to bounce back.

- The stock has potential to bounce back up to 32% from current market price.

- Right now, RSI (43.19) indicator is giving bullish divergence by crossing above 14-day EMA and is below 50 which show it is good time to invest in this stock.

- It is near 50-day EMA and is expected to cross it upside.

Indicators Summary – Buy

- The price action analysis of the stock is indicating a positive uptrend in the stock. Market sentiments are bullish.

- MACD is also giving a buy signal.

- VWAP is also giving us a buy signal.

- Analysts are bullish on this stock.

Risk factors

By looking at the financial and after reading company’s annual report of the last three years we came in a conclusion that the company doesn’t possess any serious risk except a few which are.

- It is exposed to currency fluctuations; the company operates in various places around the world and it is exposed to loss from currency fluctuation.

- Other is change in any laws in the country in which it is operating will limit the capacity of the company.

Stock Recommendation

The intrinsic value of the stock is approximately CA $190, but it is currently trading at CA $33.71. Northland Power Inc is currently undervalued and due the importance of energy, the demand of energy will increase in future and the stock will bounce up; thus, it is an excellent time to invest in the stock with a positive outlook on the future. Future looks bright for NPI as the governments all around the world are trying to switch their energy needs toward renewable sources. With strong financials the company is well positioned in this sector and is expected to do good in upcoming years. Which makes is a good investment opportunity.

Northland power is operating in this field from more than three decades. The company has grown tremendously since its establishment in 1987.

MarketFacts gives a “Buy” rating on the stock at the Closing Price of CA $33.71 as of March 15th , 2023.

| CMP (CAD) (March 15, 2023) | CA $33.71 |

| Target Price | CA $42.50 |

| Recommendation | Buy |