Why is this giant electric utility worthy of investment: Exelon Corporation :(NASDAQ:EXC)?

Exelon Corporation (NASDAQ: EXC) is an American energy company headquartered in Chicago, Illinois. It is one of the largest electric utility holding companies in the United States, serving approximately 10 million customers across Illinois, Maryland, and Pennsylvania. Exelon operates a diverse portfolio of energy generation assets, including nuclear, natural gas, wind, solar, and hydroelectric power.

The company was formed in 2000 through the merger of PECO Energy Company and Unicom Corporation, creating a company with a strong presence in both regulated and competitive energy markets. Exelon’s regulated utilities include Commonwealth Edison (ComEd), Baltimore Gas and Electric (BGE), PECO Energy, Atlantic City Electric, Delmarva Power & Light (DPL), and Potomac Electric Power Company (Pepco).

In addition to nuclear power, the company has a growing portfolio of wind farms, solar installations, and hydroelectric facilities. It is actively involved in promoting clean energy and reducing greenhouse gas emissions.

Highlights and News Updates

- On June 30th, 2023, CEO of Exelon, Butler said that large companies have kept pushing their diversity initiatives, as well as being consistent about identifying talent and nurturing it.

- On June 29th, 2023, ComEd announced that it has introduced a new enhancement to its private rooftop and community solar calculators to make it easier for customers to learn more about costs, benefits, and savings as demand for these options continues to grow and contribute to the goals of Illinois’ Climate and Equitable Jobs Act (CEJA), one of the nation’s most ambitious plans for renewable energy development.

- On June 26th, 2023, 56 homes were fully electric through ComEd’s Low-Income Whole Home Electrification Program.

- On June 20th, 2023, ComEd was awarded a federal infrastructure grant of nearly US $15 Mn to enhance grid reliability and help close the digital divide on Chicago’s South and West Sides.

- On June 13th, 2023, ComEd’s Energy Efficiency Program exceeded its 2022 goals and saved 11 million MWhs of electricity for its customers.

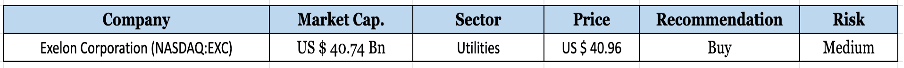

Key Data

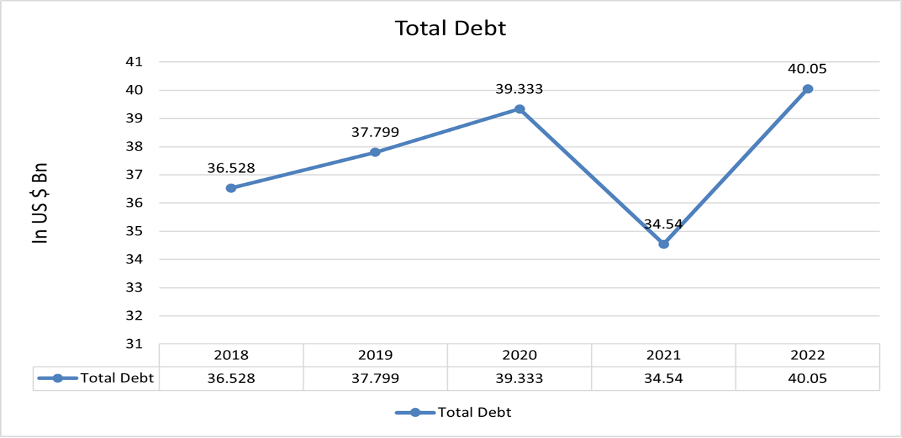

First Quarter 2023 Highlights

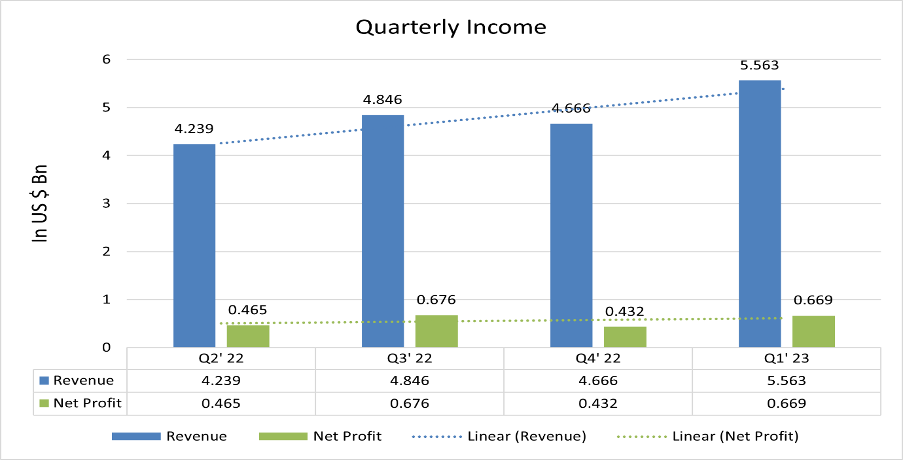

- Revenue of the company stood at US $5.563 Bn up by 4.43% from the previous year’s first quarter.

- Net profit stood at US $669 Mn up by 12% compared to the previous year’s first quarter.

- Highest income was seen from ComEd US $241 Mn, then BGE US $200 Mn, PECO US $166 Mn, and PHI US $155 Mn.

- EBITDA stood at US $1.97 Bn up by 2.08% compared to the previous year’s first quarter.

- EPS stood at US $0.67 up 10.4%.

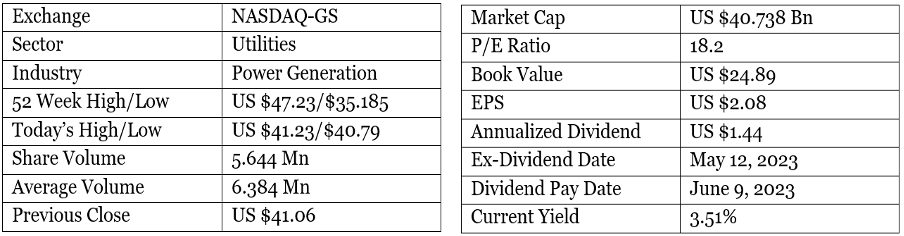

Financials

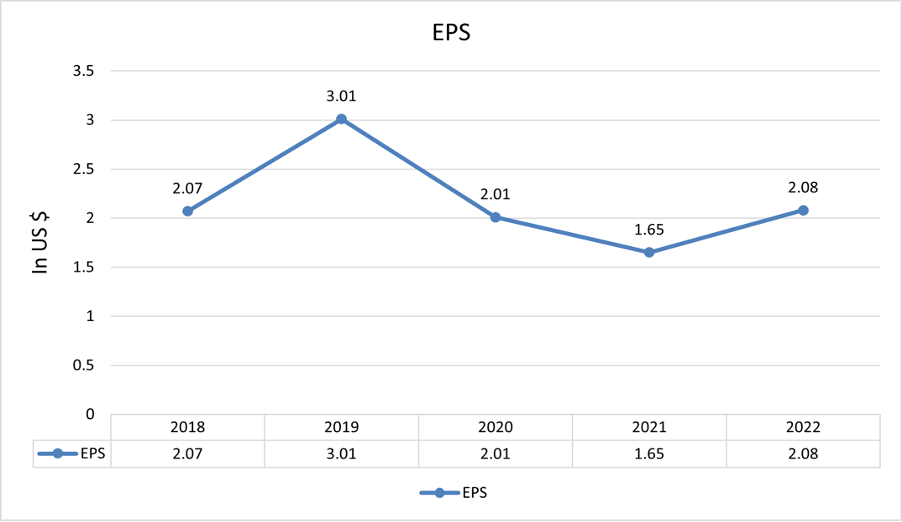

The revenue of the company is in a growing phase. It dropped a little in FY2020, but it recovered the loss in FY2021. The net profit of the company is also positive which is good for the company’s survival and for its growth.

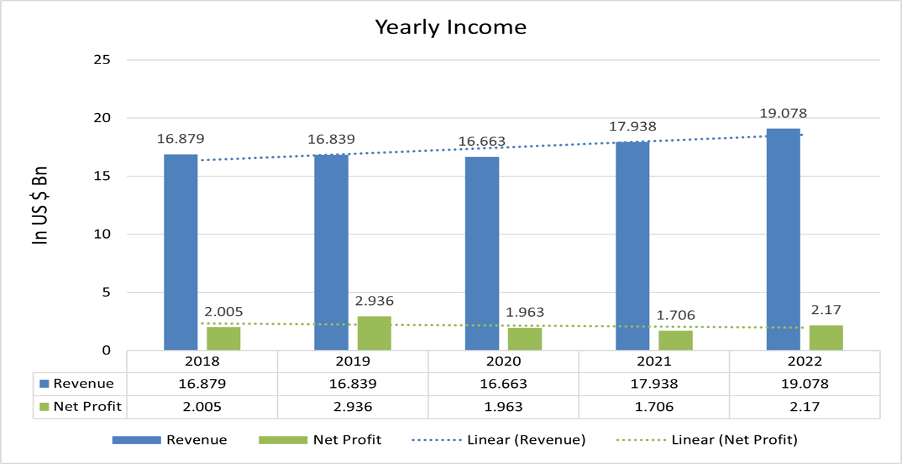

The company’s debt is at a high level. Despite having assets valued at US $95.349 billion, the company has experienced a significant decline in its asset value by 28.31%. Additionally, the retained earnings of the company has plummeted by 72.86% to US $4.597 billion. The burden of debt poses a significant challenge for the company.

The company’s quarterly revenue continues to experience growth. Additionally, the company’s net profit remains positive, further contributing to its financial stability.

Currently, the EPS of the company is US $2.08 up by 26% compared to last year’s EPS.

Forecast

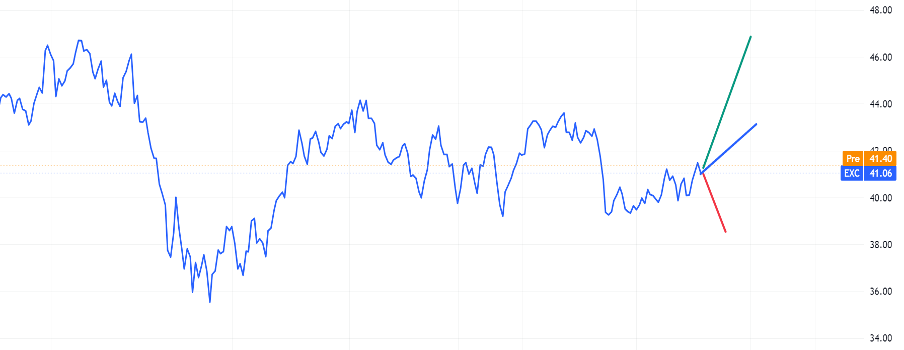

Currently, the company is trading at US $40.96 with a 1-year projected target of around US $47 and a low estimation of US $38.50; the average price target is US $43.

Technical Analysis

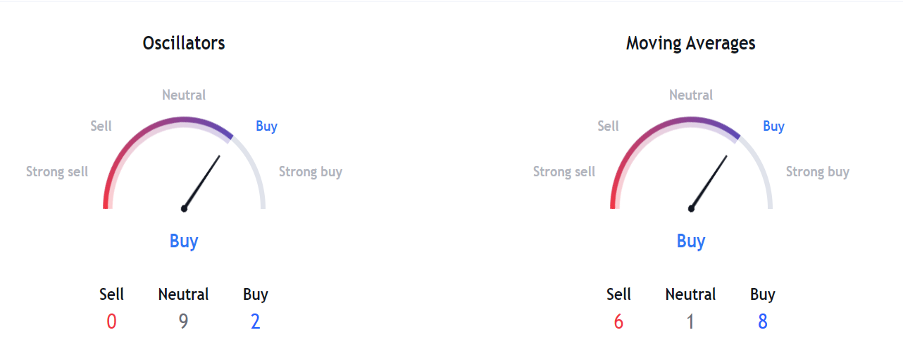

- The stock’s price action analysis indicates an upward trend in the stock’s value.

- Right now, RSI (53.31) indicator is above 50 which shows it is a good time to invest in this stock.

- The stock has the potential to bounce back up to 15% from the current market price.

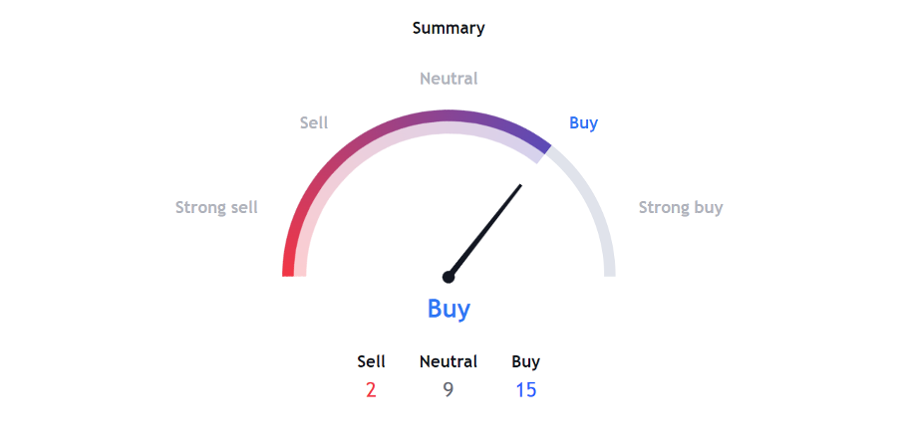

Indicators Summary – Buy

- Market sentiments are bullish, and stock can go up further.

- Stock is taking support above 50 days EMA.

- VWAP is also giving bullish signals.

ESG Factor

Exelon Corporation is one of the largest nuclear power producers in the United States. It operates the largest fleet of nuclear power plants in the country, with 21 reactors at 12 different facilities. These nuclear plants play a significant role in providing clean, reliable, and carbon-free electricity.

Exelon Corporation not only focuses on nuclear power but also actively invests in renewable energy sources. The company has been building a robust portfolio of wind farms, solar installations, and hydroelectric facilities. By engaging in these ventures, Exelon plays an active role in promoting clean energy and working toward the reduction of greenhouse gas emissions.

Exelon has a strong commitment to sustainability and has set ambitious goals for reducing carbon emissions, including a target to achieve net-zero emissions by 2050. The company also focuses on energy efficiency, grid modernization, and innovative technologies to enhance the reliability and resilience of the electric grid.

Risk factors

Exelon Corporation faces a range of risks in its operations. One significant risk is its high debt burden, which exposes the company to interest rate and refinancing risks. Inflation is another factor to consider as rising energy prices can lead to a decrease in the company’s profit. Moreover, Exelon operates in a competitive industry with numerous players, intensifying market competition.

As a company involved in nuclear energy, Exelon can also face the risk of potential disasters at its plants. Such incidents can have severe negative consequences, including reputational damage and significant impacts on neighbouring communities. Additionally, environmental concerns surrounding the company’s operations may lead to legal battles, creating further challenges and uncertainties.

Stock Recommendation

Exelon has a diversified energy portfolio, which includes nuclear power plants, natural gas facilities, and renewable energy assets. This diversification helps mitigate risks associated with fluctuations in energy prices, environmental regulations, and shifts in energy demand. It also positions Exelon to adapt to changing market dynamics and capture opportunities in the transition toward cleaner energy sources.

As the demand for clean energy continues to rise and environmental regulations become stricter, Exelon’s focus on clean energy may provide a competitive advantage and potential growth opportunities. Electricity and natural gas are essential commodities and demand for these services tends to be relatively stable, which is beneficial for the company’s future.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $40.96 as of July 7th, 2023.

| CMP (USD) (July 7, 2023) | US $40.96 |

| Target Price | US $47.50 |

| Recommendation | Buy |