The Rise of SPACs: Benefits and Potential Risks

Special Purpose Acquisition Companies (SPACs) have gained significant attention in recent years as an alternative investment vehicle. SPACs are shell companies formed with the sole purpose of acquiring or merging with an existing private company to take it public.

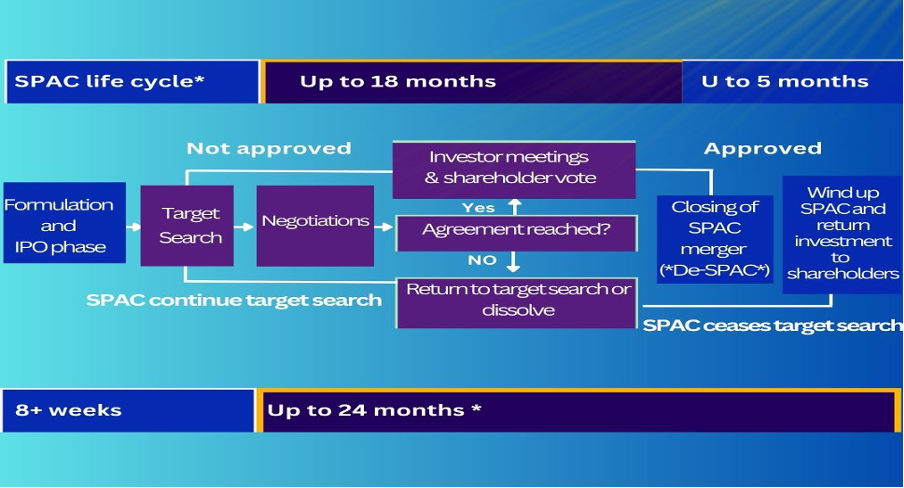

The process of a Special Purpose Acquisition Company involves several key steps. Here is a general overview of the typical SPAC process:

- Formation: A group of sponsors, often experienced investors or industry professionals, forms a SPAC. They establish the company, file necessary paperwork with regulatory authorities, and provide the initial capital.

- Initial Public Offering (IPO): The SPAC conducts an initial public offering to raise capital from investors. In the IPO, the SPAC offers units, which typically consist of one share of common stock and a fraction of a warrant. The proceeds from the IPO are placed in an interest-bearing trust account.

- Target Identification: Following the IPO, the SPAC has a limited timeframe, typically around two years, to identify and acquire a target company. The sponsors utilize their expertise and networks to identify potential acquisition targets that align with the SPAC’s criteria.

- Letter of Intent (LOI) and Due Diligence: Once a target company is identified, the SPAC negotiates a letter of intent (LOI) or a definitive merger agreement. This agreement outlines the terms of the acquisition, including the purchase price, structure, and conditions. The SPAC then conducts thorough due diligence on the target company to assess its financials, operations, and growth prospects.

- Shareholder Approval: Once due diligence is complete, the SPAC presents the proposed merger to its shareholders for approval. Shareholders vote on the merger agreement, and a majority approval is typically required for the transaction to proceed.

- Financing and PIPE: In many cases, additional financing is required to complete the merger. The SPAC may enter into agreements with private investors through a Private Investment in Public Equity (PIPE) transaction. This additional capital further supports the acquisition and provides funds for the target company’s growth.

- SEC Review and Filing: Before the merger is completed, the SPAC and the target company need to comply with regulatory requirements, including filing registration statements with the U.S. Securities and Exchange Commission (SEC) and obtaining necessary approvals.

- Merger Completion: Once all necessary approvals are obtained and regulatory requirements are fulfilled, the merger is completed. The SPAC acquires the target company, and as a result, the target company becomes a publicly traded entity. The shares of the target company replace the SPAC’s shares, and the merged entity begins trading on a stock exchange.

It’s important to note that the specific details and timelines of the SPAC process can vary from case to case. However, the outlined steps provide a general overview of how SPACs typically operate.

While SPACs offer certain benefits to investors, they also come with potential risks that should be carefully considered..

Benefits of Investing in SPACs

- Access to High-Growth Companies: SPACs provide retail investors with an opportunity to invest in high-growth, private companies that may not otherwise be accessible to them. By investing in a SPAC, individuals can participate in the potential upside of a promising company that goes public through the SPAC merger process.

- Flexibility and Optionality: SPAC investors have the flexibility to participate in the initial public offering and subsequent merger, or they can redeem their shares and receive their original investment back with interest. This flexibility allows investors to tailor their investment strategy based on their risk appetite and market conditions.

- Experienced Management Teams: SPACs are typically led by seasoned industry professionals, including successful entrepreneurs, executives, or investors who have a track record of identifying attractive investment opportunities. Investors can benefit from the expertise and network of these management teams in identifying and acquiring promising companies.

- Efficient Investment Process: Compared to traditional initial public offerings (IPOs), SPACs offer a faster and more streamlined process for companies to go public. This efficiency can provide investors with a quicker path to potential returns, as the merger and listing process can be completed in a matter of months rather than years.

There have been several successful SPACs. Here are a few notable ones:

- DraftKings Inc. (DKNG): DraftKings (DKNG): DraftKings is a sports betting and fantasy sports company that went public through a SPAC merger with Diamond Eagle Acquisition Corp. in 2020. The company’s stock price has more than doubled since the merger, and it is now one of the most valuable SPAC-backed companies.

- Virgin Galactic Holdings Inc. (SPCE): Virgin Galactic is a space tourism company that went public through a SPAC merger with Social Capital Hedosophia in 2019. The company’s stock price has been volatile since the merger, but it has generally trended upwards.

- Opendoor Technologies (OPEN): Opendoor is a real estate company that buys and sells homes online. The company went public through a SPAC merger with Chamath Palihapitiya’s Social Capital Hedosophia II in 2020. Opendoor’s stock price has more than doubled since the merger.

- Churchill Capital Corp IV (CCIV): Churchill Capital Corp IV is a SPAC that merged with Lucid Motors in 2021. Lucid Motors is an electric vehicle company that is seen as a potential rival to Tesla. The company’s stock price has more than quadrupled since the merger.

- SoFi Technologies (SOFI): SoFi Technologies is a financial technology company that went public through a SPAC merger with Social Capital Hedosophia VI in 2021. The company’s stock price has more than doubled since the merger.

- OpenAI (merged with SPAC): In December 2020, OpenAI, the organization behind ChatGPT, announced a merger with a SPAC called Social Capital Hedosophia Holdings Corp. V. The merger aimed to provide additional funding for OpenAI’s research and development of artificial general intelligence (AGI).

These examples highlight the potential of SPACs to facilitate the public listing and growth of innovative companies across various industries. However, it’s important to note that individual SPAC investments can vary widely in their performance.

Potential Risks of Investing in SPACs

- Lack of Operational Track Record: Unlike traditional public companies, SPACs are often newly formed entities with limited or no operating history. This lack of operational track record makes it challenging for investors to assess the long-term viability and success of the acquired company.

- Uncertainty Surrounding Target Acquisition: When investing in a SPAC, investors typically do not know which company the SPAC will ultimately acquire. This uncertainty can make it difficult to evaluate the investment’s potential risks and returns accurately. Moreover, the target company may not align with investors’ investment objectives or may face unforeseen challenges after the merger.

- Dilution and Redemption Risk: If a SPAC fails to find a suitable acquisition target within the specified timeframe (usually two years), it may be forced to liquidate, resulting in a loss for investors. Additionally, the merger process often involves the issuance of new shares, which can dilute the ownership stake of existing SPAC shareholders.

- Volatility and Price Fluctuations: SPAC shares can be subject to significant price volatility, particularly during the period between the announcement of the target acquisition and the completion of the merger. Investors may experience price fluctuations that can impact the overall return on their investment.

It is important to recognize the potential risks associated with SPACs.

Examples of failed and controversial SPACs

There have been instances of SPACs that did not achieve successful mergers or failed to generate the desired outcomes for investors:

- WeWork (WE): WeWork is a shared workspace company that went public through a SPAC merger with Bow Street Holdings in 2019. However, the company’s valuation was highly inflated, and it soon became clear that WeWork was not a profitable business. The company’s stock price plummeted, and it was forced to withdraw from the public markets.

- Paysafe Limited (PSFE): Paysafe is a payments company that went public through a SPAC merger with Foley Trasimene Acquisition Corp. II in 2020. However, the company’s stock price has fallen by more than 50% since the merger. This is due to a number of factors, including concerns about the company’s growth prospects and the overall market for SPACs.

- Lordstown Motors Corp (RIDE): Lordstown Motors is an electric vehicle company that went public through a SPAC merger with DiamondPeak Acquisition Corp. in 2020. However, the company has been plagued by production delays and quality control issues. Its stock price has fallen by more than 90% since the merger.

- Nikola Corporation (NKLA): Nikola, an electric vehicle (EV) startup, went public through a SPAC merger in June 2020. However, in September 2020, a short-seller report alleged fraud and misleading statements by Nikola, which led to a significant drop in the company’s stock price. The company’s founder eventually stepped down, and the stock has struggled to recover its initial hype and valuation.

- MultiPlan Corporation (MPLN): MultiPlan, a healthcare cost management solutions provider, completed a SPAC merger in October 2020. However, in September 2021, a research report raised concerns about the company’s business practices and contract pricing, which led to a decline in its stock price. The report alleged that MultiPlan’s revenues and earnings were overstated. As a result, several lawsuits were filed against the company and its executives.

- Clover Health Investments Corp. (CLOV): Clover Health, a health insurance technology company, merged with a SPAC in January 2021. In February 2021, Hindenburg Research published a report questioning the accuracy of Clover Health’s business model and accused the company of misleading investors. The stock price dropped significantly following the report’s release.

- Electric Last Mile Solutions (ELMWQ): Electric Last Mile Solutions is an electric vehicle delivery van company that went public through a SPAC merger with Spartan Acquisition Corp. II in 2021. However, the company has been unable to secure the necessary funding to bring its products to market. Its stock price has fallen by more than 90% since the merger.

The Rapid Rise and Fall of SPACs in recent years

SPACs have experienced a rapid rise in popularity and activity. The number of SPACs has increased dramatically in recent years. The number of SPAC IPOs has seen a significant surge. In 2020, there were 248 SPAC IPOs, raising a total of $83.3 billion. This represented a substantial increase compared to previous years. In 2019, there were just 59 SPAC IPOs, raising $13.6 billion.

There are a number of reasons for the surge in SPACs. One reason is that they offer a faster and more efficient way for companies to go public. SPACs can typically complete their mergers and take companies public in a matter of months, while traditional IPOs can take several months or even years. Another reason for the surge in SPACs is that they offer investors a chance to get in on the ground floor of promising companies.

SPACs typically target private companies that are already generating revenue and have a clear path to profitability. This gives investors the opportunity to invest in companies that they believe have the potential to be major successes.

The surge in SPACs has also been fuelled by the availability of cheap capital. Low interest rates have made it easier for SPACs to raise money from investors. This has led to a flood of SPACs entering the market, with more than 600 SPACs raising over $160 billion in 2021.

The amount of capital raised through SPAC IPOs has reached record-breaking levels. In 2020, SPACs raised a total of $83.3 billion, surpassing the previous record of $13.6 billion in 2019. The trend continued into 2021, with SPAC IPOs raising more than $100 billion in the first quarter alone

The surge in SPACs has not been without its critics. Some argue that SPACs are a form of “casino capitalism” that allows investors to bet on the future success of unproven companies. Others argue that SPACs are often used by unscrupulous promoters to take advantage of investors.

The rapid rise of SPACs has also raised concerns and prompted regulatory scrutiny. The U.S. Securities and Exchange Commission (SEC) has been closely monitoring SPAC activity and considering potential regulatory reforms to ensure investor protection and transparency.

There were 86 SPAC IPOs in 2022, compared to 610 in 2021, according to S&P Global Market Intelligence data. The dramatic decline coincided with a broader IPO slowdown and rising interest rates as investors lost their appetite for risk and regulators set their sights on the SPAC market. IPOs by SPACs in 2022 raised a combined $13.42 billion, compared with $160.75 billion in 2021, according to Market Intelligence data. The reversal of the SPAC market coincided with increased regulatory scrutiny and rising interest rates.

There have been a number of cases of fraudulent promoters using SPACs to take advantage of investors. This has damaged the reputation of SPACs and led to a decline in investor confidence. Despite the recent decline, SPACs are still a popular way for companies to go public. SPACs offer a number of advantages over traditional IPOs, and they are likely to appeal to both companies and investors in the years to come.