Why Every Investor is Talking About Semiconductors

The semiconductor industry is stealing the spotlight in 2025, and for good reason. From powering AI chips to enabling autonomous vehicles and 5G networks, semiconductors have become the backbone of modern innovation. Investors around the globe are pouring billions into semiconductor stocks, making it one of the most closely watched sectors on Wall Street.

🌐 Global Demand is Exploding

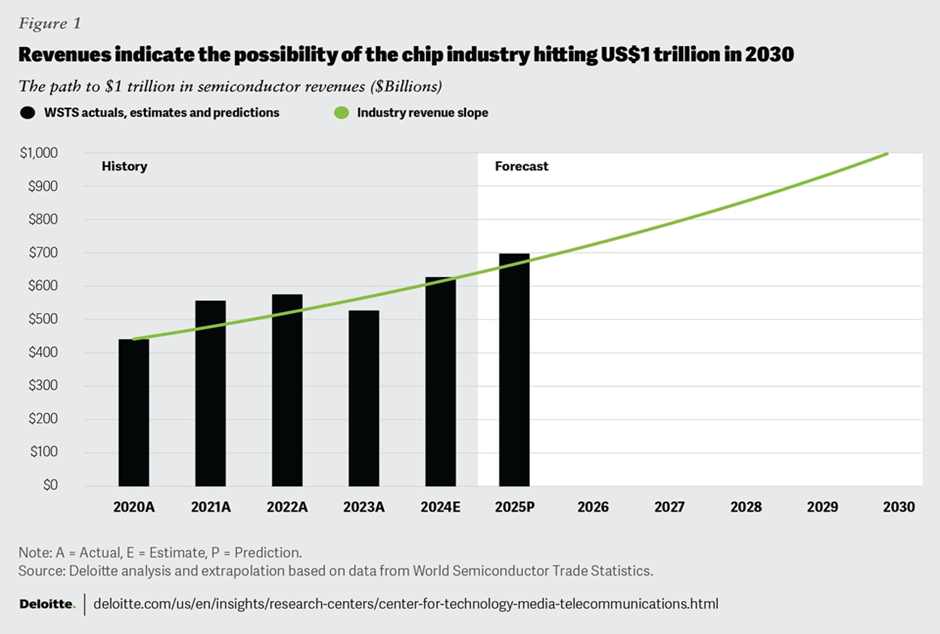

The rise of artificial intelligence, cloud computing, and edge devices is driving unprecedented demand for chips. Major players like NVIDIA, Intel, AMD, and TSMC are expanding aggressively to keep up. The global semiconductor market is projected to exceed $1 trillion by 2030, and investors are betting on this growth now.

Source: Link

🧠 AI and Machine Learning: The Chip Gold Rush

AI workloads require high-performance GPUs and accelerators. This is where NVIDIA stock continues to dominate, followed by AMD and even custom chip efforts by big tech companies like Google (TPUs) and Apple (M chips). The semiconductor industry is no longer cyclical—it’s structural.

🚗 EVs and Autonomous Cars Need More Chips

Electric vehicles (EVs) and autonomous driving systems require hundreds of chips per vehicle. Tesla, Rivian, and traditional automakers are all fighting for chip supplies. As a result, companies specializing in automotive semiconductors like NXP Semiconductors and ON Semiconductor are also seeing massive investor attention.

📈 Geopolitical Risk Makes Chips a Strategic Asset

The U.S.-China tech war, restrictions on AI chip exports, and Taiwan’s critical role in global chip supply have turned semiconductors into a geopolitical chess piece. The CHIPS Act in the U.S., which allocated $52 billion in funding, further signals the long-term value governments place on chip independence and national security.

💰 Why Investors Are Loading Up on Semiconductor ETFs and Stocks

Whether through individual stocks or semiconductor ETFs like SOXX, investors are positioning themselves in this high-growth sector. These investments offer exposure to companies that are not only growing revenue rapidly but also hold a strategic edge in global tech.

🔍 Conclusion: Semiconductors Are the New Oil

In today’s digital economy, data is the new oil—and semiconductors are the engines. With every major innovation relying on advanced chips, semiconductor investing is becoming a must for any serious portfolio.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.