Gold and Stocks Hit Record Highs: A Rare Market Phenomenon

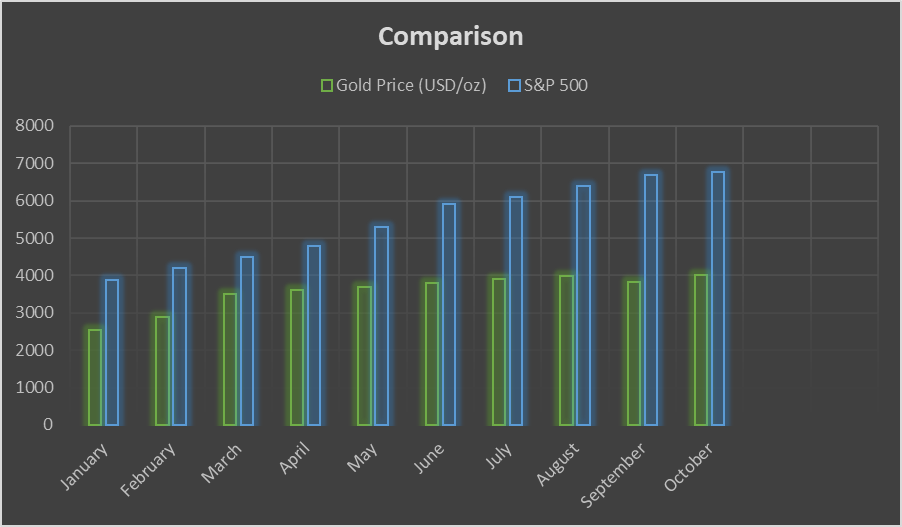

Gold and the U.S. stock market have surged to historic all-time highs, creating a unique moment in global financial markets. In October 2025, gold crossed the $4,000 per ounce mark for the first time ever, while the S&P 500 jumped past 6,700 points. This simultaneous rally reflects a powerful mix of geopolitical uncertainty, monetary policy shifts, and economic optimism — a rare alignment of forces that’s shaping investor behavior worldwide.

Gold Soars on Geopolitical Tensions and Policy Expectations

Gold has gained nearly 50% year-to-date, driven by an extraordinary cocktail of macroeconomic and geopolitical tailwinds.

- Geopolitical Conflicts:

- The Russia–Ukraine war continues to fuel global instability and supply chain disruptions.

- Rising tensions in the Middle East have heightened safe-haven demand.

- Trade disputes between major economies have further unsettled markets.

- Political crises in France and Japan have added to global uncertainty, pushing investors toward gold as a store of value.

- Monetary Policy Tailwinds:

- Anticipation of multiple Federal Reserve rate cuts in early 2026 is lowering real yields, making gold more attractive.

- A weaker U.S. dollar amplifies gold’s upward momentum.

- Record inflows into gold ETFs reflect strong institutional demand.

Key milestone: Gold surpassing $4,000/oz signals broad-based global demand, with record retail prices in India and other key markets.

U.S. Stock Market Reaches Record Levels

While gold rallies on fear, equities are rallying on hope. The S&P 500 touched 6,760 points in October 2025 — up more than 16% year-over-year. This remarkable climb is underpinned by:

- Monetary easing expectations: Markets are pricing in a Fed pivot that would reduce financing costs, boost liquidity, and support valuations.

- Earnings resilience: U.S. corporates have shown strong profitability despite macro headwinds.

- Improving trade sentiment: A partial rollback of tariffs has reduced pressure on multinational earnings.

- Sector rotation: Investors are favoring growth and tech sectors, which historically outperform in easing cycles.

The Fed Factor: A Key Catalyst

The Federal Reserve’s anticipated rate cuts are a central pillar behind both rallies. As inflation moderates, investors expect multiple cuts starting in 2026 — boosting risk assets like equities and hard assets like gold simultaneously.

- Gold benefits from lower real yields and a weaker dollar.

- Equities benefit from lower discount rates and stronger growth expectations.

- Bonds also see increased inflows as investors position for a looser policy environment.

A Rare Dual Rally

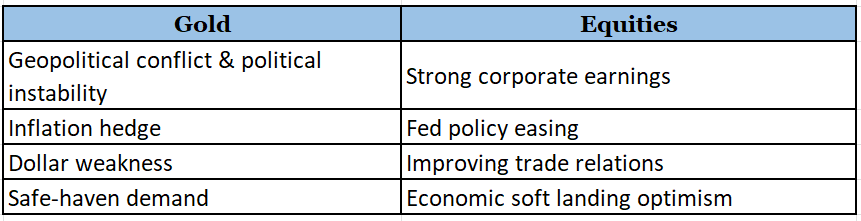

Historically, gold and equities move in opposite directions. Gold thrives during uncertainty, while equities shine in growth phases. But 2025 is different — different forces are pushing both assets upward at the same time:

This rare alignment reflects a bifurcated investor mindset: seeking both growth and protection at once.

Investment Implications

For investors, this environment underscores the importance of balance and diversification:

- Gold allocations can hedge against geopolitical risk, inflation, and currency volatility.

- Equity exposure can capture upside from economic resilience and easier monetary conditions.

- A barbell strategy, combining both defensive and growth assets, may offer the most resilient portfolio in this dual-market rally.

If rate cuts proceed as expected and geopolitical risks remain elevated, this “gold + stocks” rally could extend well into 2026.