Bank Stocks Tumble on U.S. Lender Jitters: What’s Behind the Sell-Off?

Bank stocks experienced a sharp decline on October 16, 2025, as growing jitters over credit quality and mounting risks in US regional lenders sent shockwaves through financial markets. Shares of major banks including Citigroup, Wells Fargo, and Zions Bancorp were hit hardest, reflecting investor concerns about exposure to bad and fraudulent loans. The turmoil followed recent disclosures by regional banks regarding significant loan losses and legal actions against borrowers, fueling fears of broader credit stress reminiscent of earlier banking crises.

Market Impact

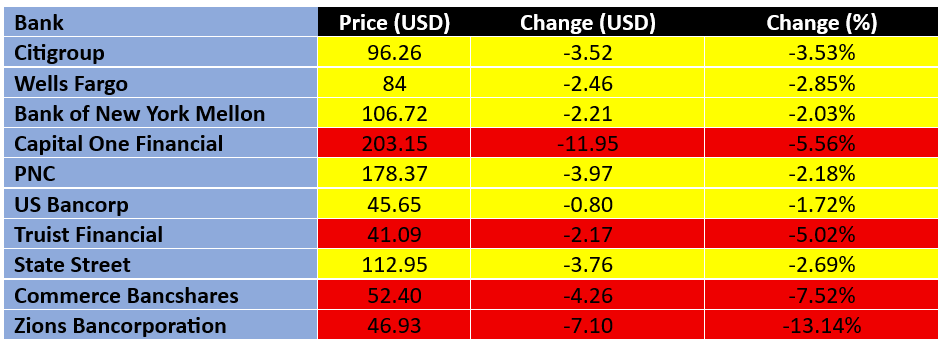

The Dow Jones U.S. Banks Index fell by around 3.5% on the day, with individual banks posting notable losses. Zions Bancorporation suffered the steepest drop of 13.14%, followed by Commerce Bancshares with a 7.52% decline. Other large lenders such as Capital One Financial and Truist Financial also saw declines exceeding 5%. This sell-off triggered a global ripple effect, impacting banking stocks in Europe and Asia as well. Meanwhile, safe-haven assets like gold hit fresh highs as investors sought refuge from market volatility.

Major US Bank Stock Performance on October 16, 2025

This recent stock selloff highlights the fragile state of certain segments within the US banking system and the potential systemic risks that could emerge if credit conditions worsen further, making it a key area of focus for market participants and regulators alike.

What are the main factors?

The main factors causing stress among U.S. regional banks in October 2025 are:-

- Bad Commercial Real Estate Loans:- Regional banks are highly exposed to commercial real estate debt especially office and multifamily properties which now face falling valuations, higher vacancy rates and steep refinancing challenges.

- High Interest Rates:- The interest rate environment is putting pressure on borrowers’ ability to service debt, raising default risks for both real estate and other lending segments.

- Recent Loan Fraud and Credit Quality Concerns:- Disclosures from banks such as Zions Bancorp and Western Alliance about large charge-offs and fraudulent loans have amplified concerns about creditworthiness and systemic risk.

- Consumer Loan Deterioration:- Rising delinquencies in credit cards and auto loans signal increasing financial pressure on households, with net charge-off rates now exceeding pre-pandemic levels.

Overall, the confluence of commercial real estate distress, high interest rates, loan fraud, deteriorating consumer credit, and a lack of diversification is driving the current wave of instability among U.S. regional banks.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.