AI’s Dual-Edged Impact on the Stock Market Rally

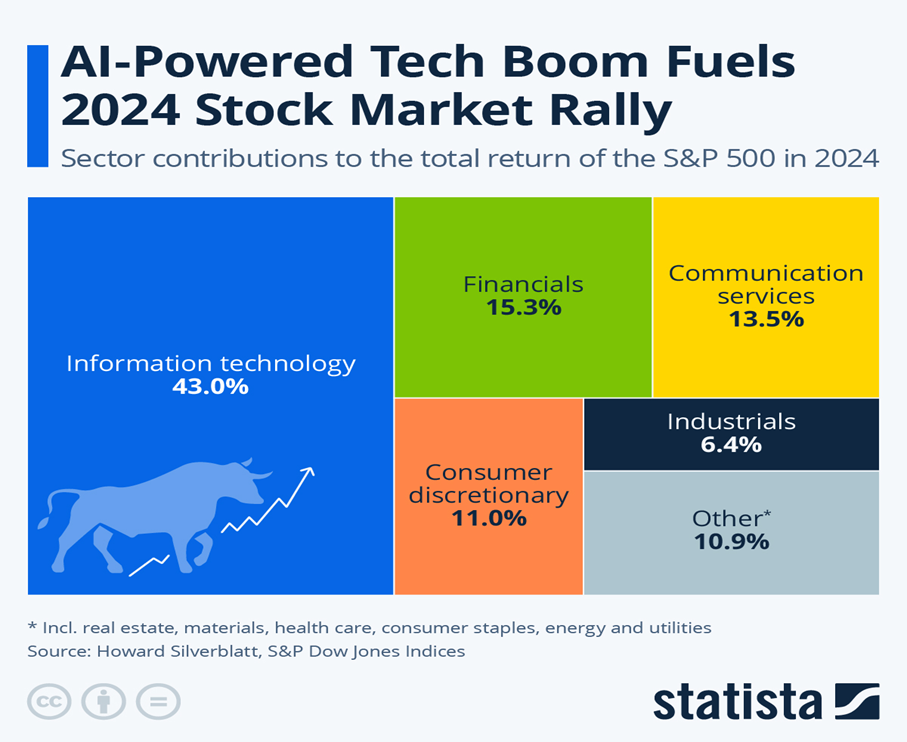

The year 2024 has witnessed a relentless surge in global equity markets, with major indices frequently touching new all-time highs. At the heart of this rally lies a single, dominant force: Artificial Intelligence (AI). From advanced language models to sophisticated data analytics, AI has captured the imagination of investors, promising a new era of productivity and unprecedented technological advancement.

The Rocket Fuel: AI Ignites the Tech Giants

The most visible impact of AI has been its transformative effect on the technology sector. Companies at the forefront of AI development – from chip manufacturers to software developers and cloud service providers – have seen their valuations soar. Investor enthusiasm is driven by several factors:

- Explosive Demand for Infrastructure:

The development and deployment of AI models require massive computational power. This has led to insatiable demand for high-performance chips, advanced data centers, and specialized hardware, creating a bonanza for infrastructure providers.

- Productivity Promise:

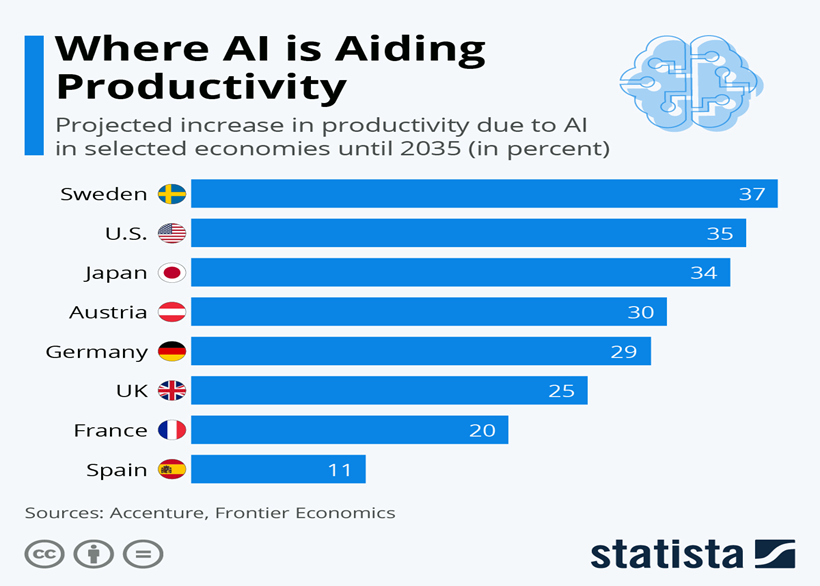

AI is heralded as a game-changer for corporate productivity, capable of automating tasks, enhancing decision-making, and fostering innovation across industries. Companies integrating AI are projected to gain significant competitive advantages.

- Positive Earnings Surprises:

Many AI-centric companies have consistently beaten earnings expectations, validated the investment thesis and further stock price appreciation. This trend is exemplified by companies like Micron Technology, whose recent positive outlook, driven by AI server demand, sent its stock climbing.

The S&P 500 and Nasdaq Composite in the U.S. have been the primary beneficiaries, with a disproportionate amount of their gains attributable to a handful of “Magnificent Seven” tech giants. This has created a self-reinforcing cycle where strong performance attracts more capital, further propelling valuations.

The Canadian AI Play: Beyond the Magnificent Seven

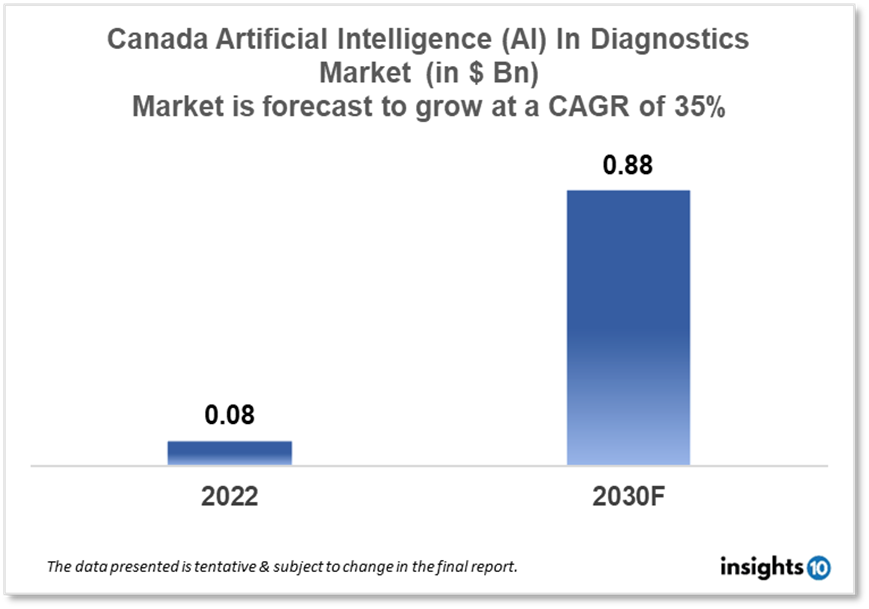

Canada’s role in the AI story, while less prominent in terms of direct AI software giants, is crucial in the underlying infrastructure. The country is rich in critical minerals (like lithium, nickel, and cobalt) essential for the advanced batteries and components required by AI data centers and supporting technologies.

For instance, companies like Lithium Americas (LAC), with its significant Thacker Pass project in Nevada, stand to benefit from the massive demand for lithium-ion batteries needed for energy storage in data centers and electric vehicles that are increasingly connected to AI systems. U.S. government investment in such projects underscores the strategic importance of secure critical mineral supply chains in the AI era.

While Canada has its own burgeoning AI research and startup scene, its public markets are more directly exposed to AI’s enabling elements rather than its pure-play software applications, offering a different, yet vital, investment thesis.

AI’s potential to revolutionize industries and generate unprecedented wealth is undeniable. It has injected new energy into the stock market, rewarding innovation and technological leadership. However, investors must recognize the dual nature of this rally. While the promise of AI offers long-term growth, the current market dynamics – marked by extreme concentration in a few mega-cap tech stocks – present a tangible risk.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.