How the Proposed U.S. Strategic Bitcoin Reserve Impacts the National Debt Debate

The proposed U.S. Strategic Bitcoin Reserve, initiated by President Donald Trump in March 2025, marks a historic pivot in reserve management—shifting from purely gold and fiat assets to bitcoin and digital currencies. This move directly impacts the national debt debate, offering a new narrative for financial stability and potentially reducing the government’s reliance on traditional methods of debt management.

Strategic Bitcoin Reserve Overview

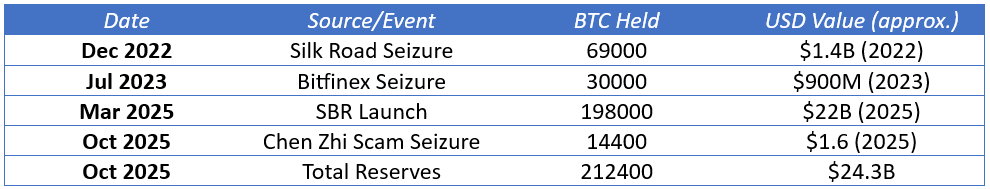

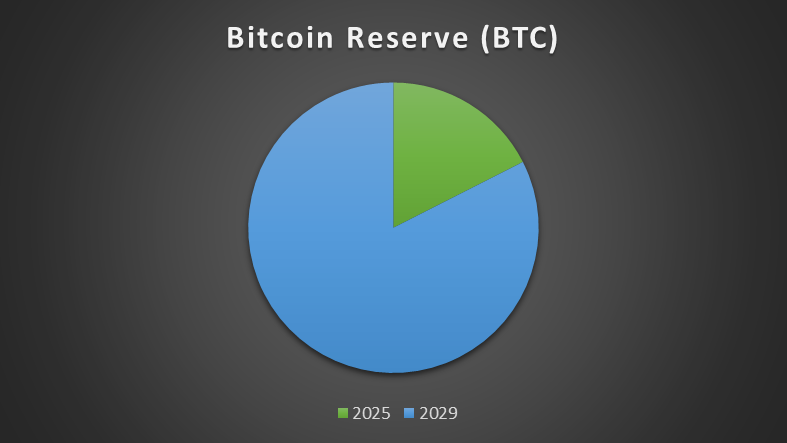

President Trump’s executive order established the Strategic Bitcoin Reserve (SBR), a federal asset pool capitalized primarily with bitcoin seized via law enforcement actions and civil forfeiture. As of October 2025, the U.S. government holds over 212,000 BTC, valued above $24 billion, making it the world’s largest state holder. Plans include expanding the reserve to 1 million BTC over five years, but any further purchases must be budget-neutral, with no incremental burden for taxpayers.

Reserve Launch and Major Seizures

The US government’s cryptocurrency holdings have expanded rapidly since 2022, mainly through major forfeiture cases such as the Silk Road and Bitfinex seizures, and more recently, the $14 billion Bitcoin seizure from an international scam operation.

National Debt Context

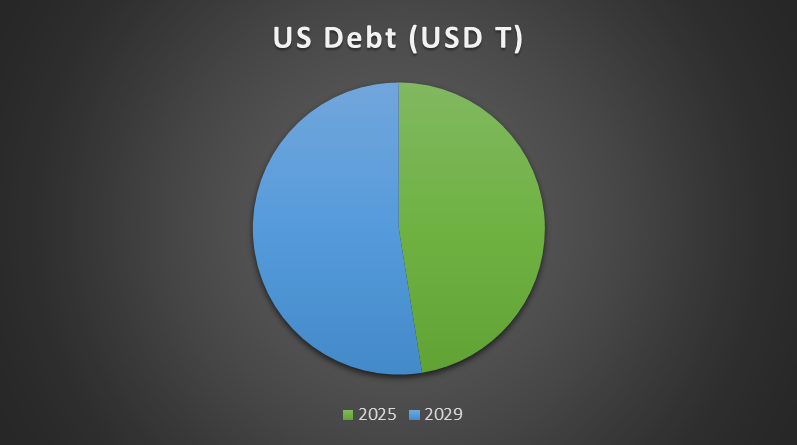

The national debt exceeded $37.4 trillion in September 2025. VanEck’s projections suggest that if the SBR expands to 1 million BTC by 2029 and if Bitcoin’s compound annual growth rate (CAGR) remains at 25%, Bitcoin could theoretically reduce the U.S. debt by up to 18% over 20 years. However, this theory relies on optimistic assumptions about sustained bitcoin price growth and ignores debt accumulation rates, which currently outpace GDP growth.

Conclusion

The SBR represents a dramatic policy experiment with possible benefits (reserve diversification, enhanced financial credibility) and substantial risks (volatility, policy uncertainty). Its actual impact on the national debt remains speculative. For the US, integrating bitcoin into sovereign reserves reframes the debt debates, showing both the allure and limitations of digital assets for public finance.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.