Why should this fast-growing large-cap stock be a part of your portfolio:Marvell Technology, Inc. (NASDAQ:MRVL)?

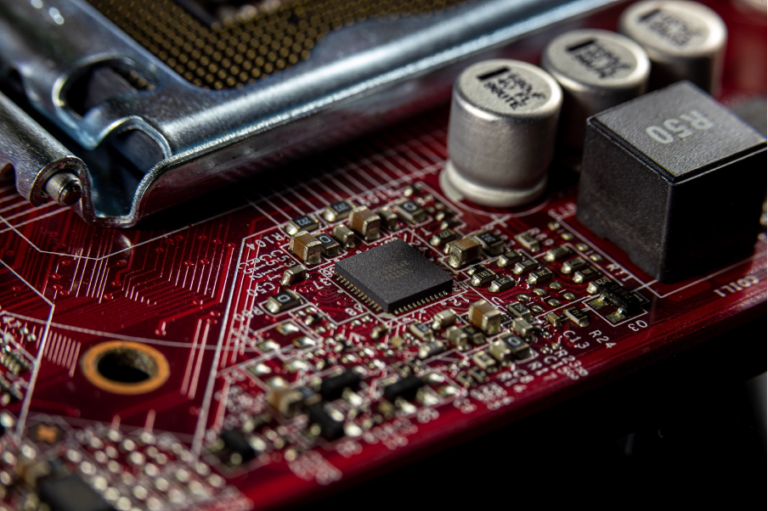

Marvell Technology, Inc. (XNAS: MRVL) is a semiconductor and associated technology developer and manufacturer based in Santa Clara, California, specializing in networking and storage applications. Founded in 1995, the corporation has over 6,000 workers as of 2021, over 10,000 patents globally, and $4.5 billion in yearly sales. Marvell provides processors, optical connectors, application-specific integrated circuits (ASICs), and merchant silicon for Ethernet applications to the data center, carrier, corporate, automotive, and consumer end markets. The company is an aggressive buyer, with five significant acquisitions since 2017 assisting it in pivoting away from older consumer apps and into the cloud and 5G sectors.