Why now may be a good time to invest in Peyto Exploration & Development Corp. (TSX:PEY)

Peyto Exploration & Development Corp. (TSX:PEY) is a Canadian oil and gas company based in Calgary, Alberta. It was founded in 1998. The company specializes in the exploration, development, and production of natural gas in Western Canada.

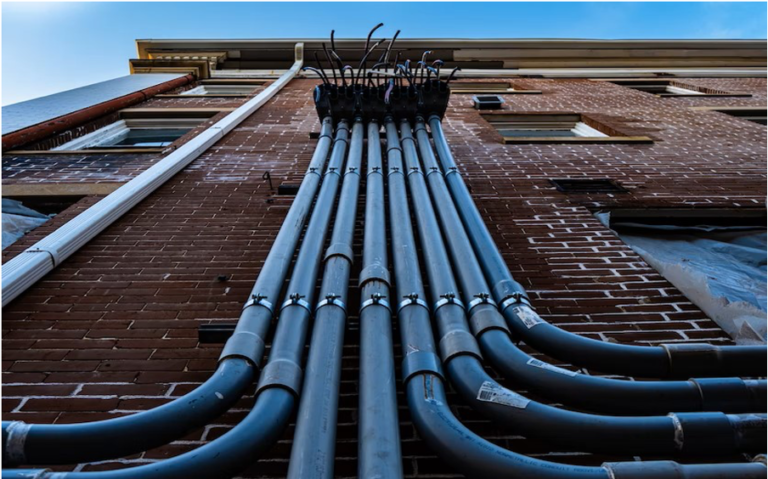

The company operates primarily in the Deep Basin region of Alberta, which is known for its abundant natural gas reserves. The company’s operations include the drilling of new wells, the production of natural gas, and the transportation of gas to market via pipelines.