What makes Telus Corporation (TSX:T) a top dividend stock?

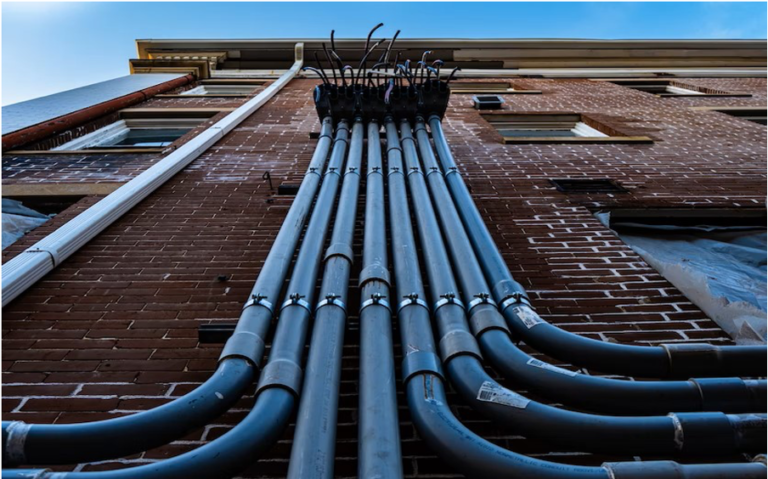

Telus Corporation (TSX: T) is one of the largest telecommunications companies in Canada. Headquartered in Vancouver, British Columbia, TELUS operates as a leading national provider of telecommunications products and services, including wireless and wireline voice and data communications, internet, and television.

Beyond its telecommunications services, TELUS has also diversified into other areas. TELUS Health, a subsidiary of TELUS, is a leading provider of digital healthcare solutions, electronic medical records, and telehealth services. TELUS International focuses on providing digital customer experience solutions and business process outsourcing services globally.