Why this Top-Ranked stock is a worthy investment: Flex Ltd. (NASDAQ:FLEX)?

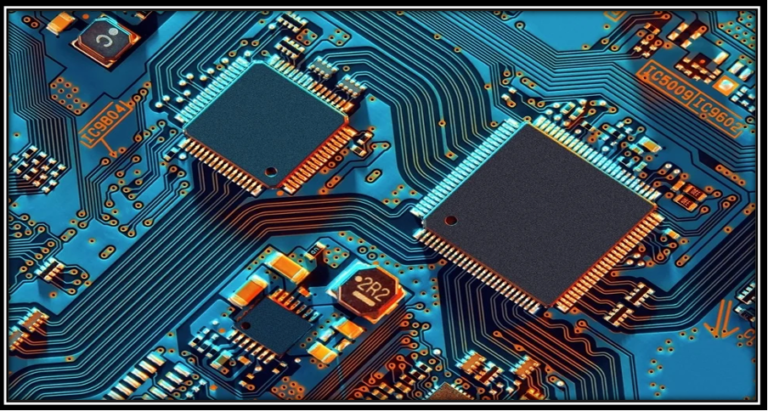

Flex Ltd. (NASDAQ: FLEX) is a US-based tech company founded in 1969 by Joe and Barbora-Ann Mckenzie for making circuit boards for other companies but over the decades it has managed to capture the market in other areas too.

Areas in which it expanded itself are Flex Reliability Solution under which Automotive, Healthcare, and Industrial product and services comes. The second segment is Flex agility Solution under which Cloud services, Communications, Consumer devices, and Lifestyle comes. The third segment is Nextracker which deals with renewable energy.