The future of nuclear energy generation: NuScale Power Corporation (XNYS:SMR)

NuScale Power Corporation (XNYS: SMR) is an American company that is involved in the design, development, and marketing of a new small modular light water reactor nuclear power plant. This plant will supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications. The company was founded in 2007 and its headquarter is located in Tigard, Oregon, United States.

NuScale’s SMR is a scalable version of pressurized water reactor technology, where multiple modules operate together to provide the desired power output This technology is a new type of nuclear power that offers many benefits over traditional nuclear power plants.

Highlights and News Update

- The company’s stock has recently seen a significant increase in its value, with a 16% hike in the past week and 49% gains over the past year. This could be due to various factors such as positive developments in the company, investor sentiment, or market conditions.

- On January 12th, 2023, NuScale Power hit a major development milestone for its Carbon Free Power Project. The company successfully completed the U.S. Nuclear Regulatory Commission’s design review of the project. This was a thorough evaluation of the design of the NuScale Power Module, the central component of the Carbon Free Power Project.

- On January 4, 2023, NuScale Power and RoPower announced that they had signed a contract for Phase 1 of Front-End Engineering and Design (FEED) work on Romania’s first Small Modular Reactor power station.

- On December 22, 2022, NuScale Power announced the completion of its Standard Plant Design project, which finalizes the design of its Small Modular Reactor technology and makes it ready for deployment and operation at customer sites.

- On December 9, 2022, NuScale Power announced that it has appointed Karin Feldman as Interim Chief Operating Officer (COO)/Chief Nuclear Officer (CNO) of the company. Ms. Feldman will be responsible for the overall management and operation of NuScale’s Small Modular Reactor technology development and deployment.

- On December 1, 2022, NuScale Power announced the signing of a research collaboration agreement to investigate the production of Clean Hydrogen using its SMR technology. The agreement aims to investigate the potential for NuScale’s SMRs to produce hydrogen through the electrolysis of water, as a sustainable and low-carbon energy source.

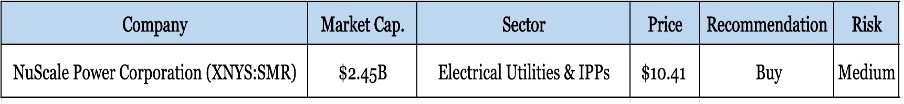

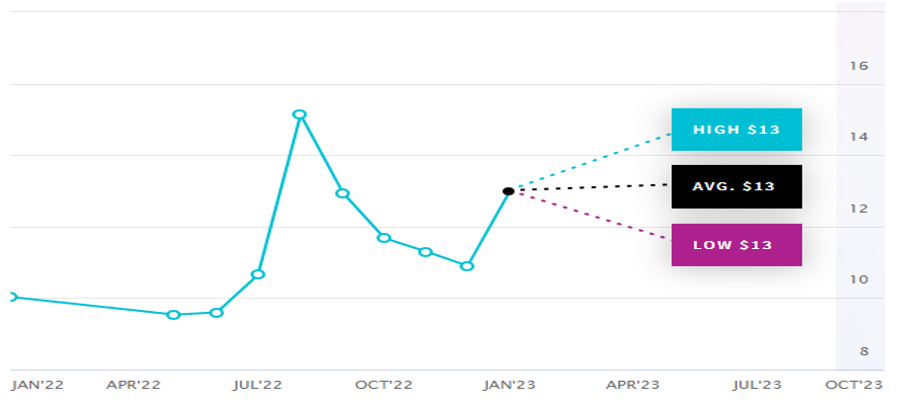

Key Data

Third Quarter 2022 Highlights

- Revenue of $3.2 million and a net loss of $(49.6) million for the three-month period ending September 30, 2022, compared to $0.3 million and a net loss of $27.1 million, respectively, for the same period in 2021. The nine-month period generated $8.4 million in sales and a net loss of $(94.4) million, compared to $1.3 million and $(74.4) million, respectively, for the same period in 2021..

- As of September 30, 2022, 51.8 million Class A Common Stock were outstanding, 173.9 million were issuable upon the exchange of NuScale LLC Class B Units, 31.5 million were issuable upon the exercise of outstanding stock options and warrants, and 2.1 million were time-based awards that vest between one and three years.

- Healthy balance sheet with cash and equivalents totalling $268.6 million, short-term investments totalling $50 million, and no debt shown at all.

- Continued progress on five short-term strategic goals, including making headway in attempts to capture the next committed customer and getting the supply chain ready for production.

- A new Energy Exploration Centre (E2) was recently established at Idaho State University, making it the fourth such facility .This is an interactive instructional and outreach tool that simulates the running of a nuclear power station, but it also serves as a valuable source of extra money.

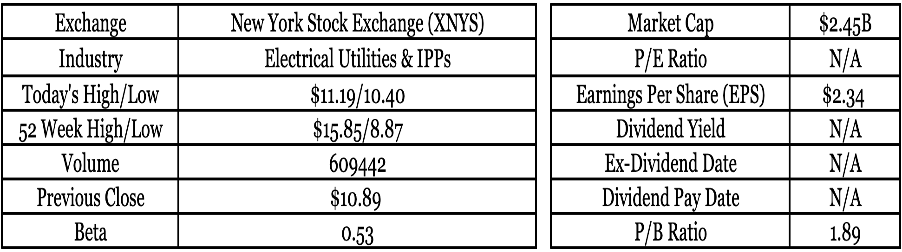

Earnings

The company reported earnings of -$0.19 for the third quarter of 2022, less than the estimate of -$0.08.

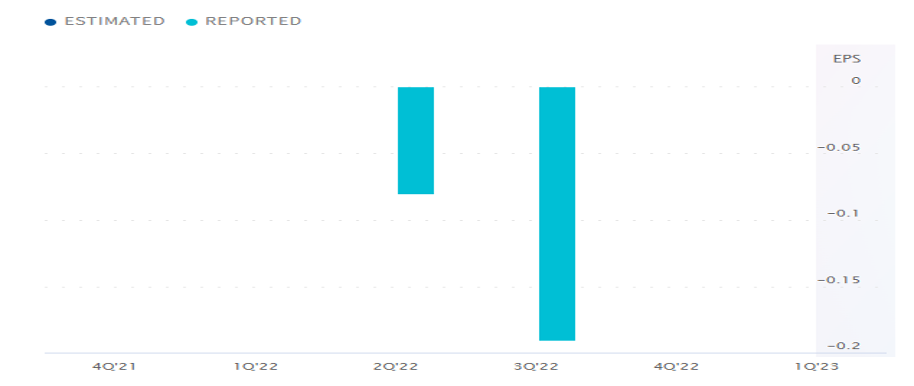

Forecast

According to projections made by analysts for SMR’s price over the next year during the course of the past three months. The price objective ranges nearly to $13.

Risk Factors

- It is a bet on the future as the company generates limited revenue to date.

- Since the company has not yet begun construction of reactors, particularly in big numbers, the cash burn rate is expected to increase in the future, and some sort of refinancing will be required at some point.

- For the next three years, it is anticipated that earnings will fall by an annualised rate of 8.7% on average.

- NuScale’s SMR will be ready to offer modules to clients by 2027. This gives competitors time to design better systems or cause another technical interruption.

Stock Recommendation

Nuscale Power Corp was in the 74th percentile of Utilities – Electric corporations by market cap with $2.45 billion. Quarterly sales rose 966.7% year-over-year. Warmer-than-average summers may increase electrical utility usage. Long-term, industrial sales growth will assist power utilities. Utility capital spending will drive this increase for a few coming years.

MarketFacts gives a “Buy” rating on the stock at the Closing Price of $10.41 as of January 17th, 2022.

| CMP (USD) (January 17, 2022) | $10.41 |

| Target Price | $14.50 |

| Recommendation | Buy |