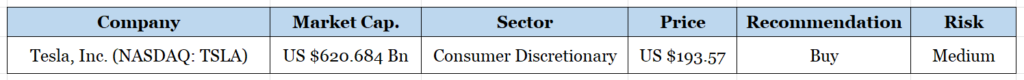

Tesla (Nasdaq: TSLA): Leading EV company, poised for long-term growth

Tesla, Inc. (Nasdaq: TSLA) is an American electric vehicle (EV) and clean energy company founded in 2003 by Martin Eberhard and Marc Tarpenning. Elon Musk, JB Straubel, and Ian Wright joined the company shortly after its inception, with Musk eventually becoming CEO and dominating figurehead. Tesla’s mission is to accelerate the world’s transition to sustainable energy.

The company is known for its electric vehicles, including the Tesla Roadster, Model S, Model 3, Model X, Model Y, and the Cybertruck (in development). Tesla vehicles are renowned for their long-range capabilities, high performance, and innovative technology, including Autopilot, Tesla’s advanced driver-assistance system.

In addition to electric vehicles, Tesla also produces energy storage products, such as the Powerwall, Powerpack, and Megapack, which are used for residential, commercial, and utility-scale energy storage applications. The company also manufactures solar panels and solar roof tiles through its subsidiary, SolarCity.

Highlights and News Updates

- On February 8th, 2024, Tesla Stock Rises as Chinese Production Falls.

- On February 8th, 2024, Tesla pays US factory workers between US $22 to US $39 per hour- Business Insider.

- On February 8th, 2024, China’s passenger vehicle sales shrank 14.1% in January from the prior month, the first such slide since August, data from the China Passenger Car Association (CPCA) showed on Thursday.

- On February 8th, 2024, Tesla Model Y Performance Hits Sweet Spot for EV Incentives in Canada After Price Drop.

- On February 8th, 2024, Cathie Wood Backs Tesla Despite Sharp Downturn, Says Robotaxis Will Help ‘Change the Landscape Entirely.’ Ives Says, ‘Could Not Agree More’.

- On February 7th, 2024, Tesla asks which jobs are critical, stoking layoff fears – Bloomberg News.

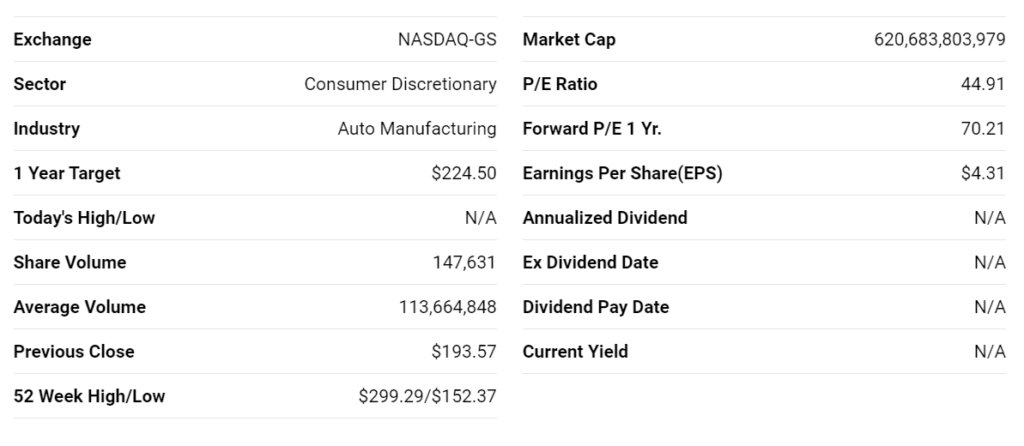

Key Data

Fourth Quarter 2023 Highlights

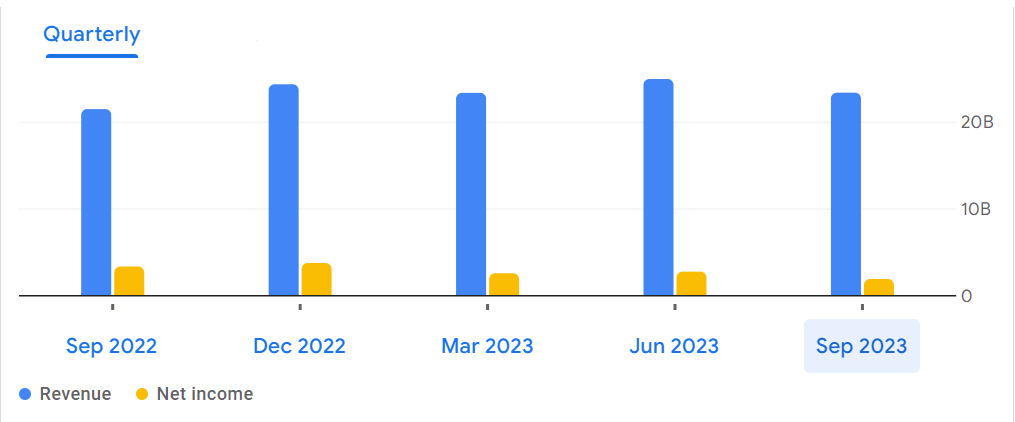

- Revenue stood at US $25.167 billion up by 3.49% compared to last year’s fourth quarter.

- Gross profit stood at US $4.438 billion down by 23.18% compared to last year’s fourth quarter.

- The company booked a net profit of US $7.928 billion up by 113% compared to last year’s fourth quarter.

- Diluted per share stood at US $2.27 compared to last year’s fourth quarter of US $1.07.

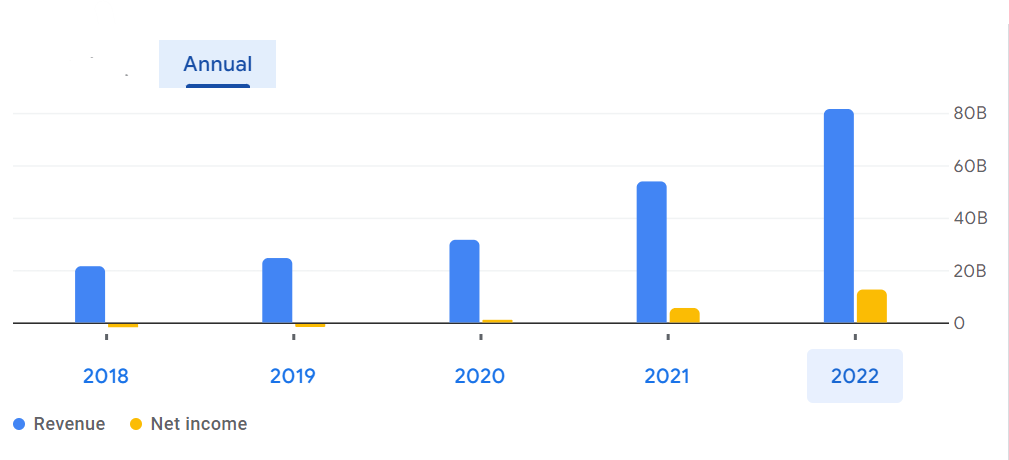

Financials

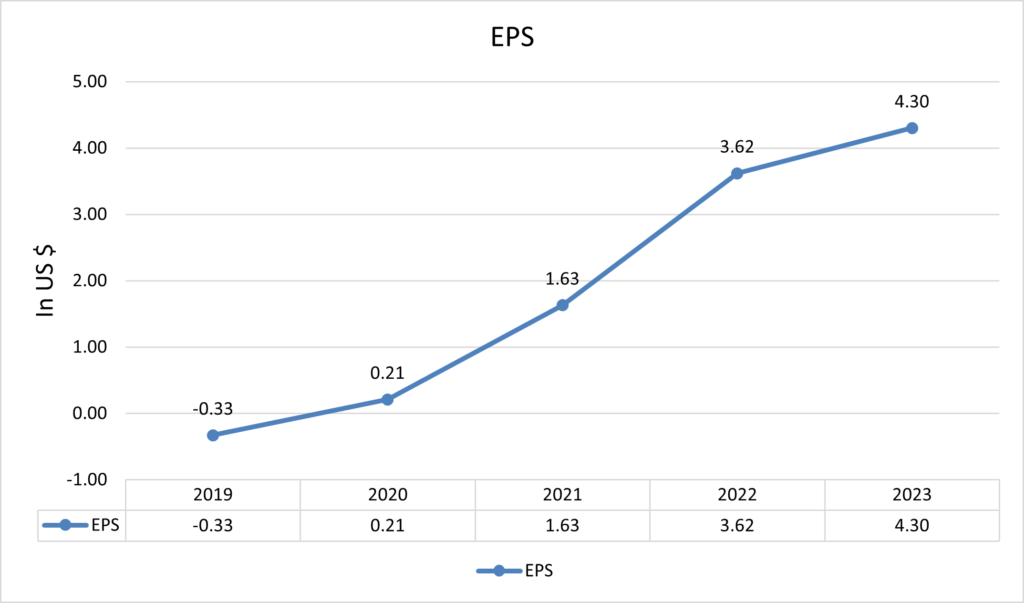

It’s impressive to see such a substantial growth in revenue and net profit, especially attributed to the rise in demand for electric vehicles (EVs). The increase in gross profit from US $2.22 billion in FY2017 to US $17.66 billion in FY2023, marking a growth of 695%, clearly indicates the company’s strong performance in capitalizing on the EV market trend. This growth not only reflects increased sales but also potentially improved operational efficiency and cost management strategies.

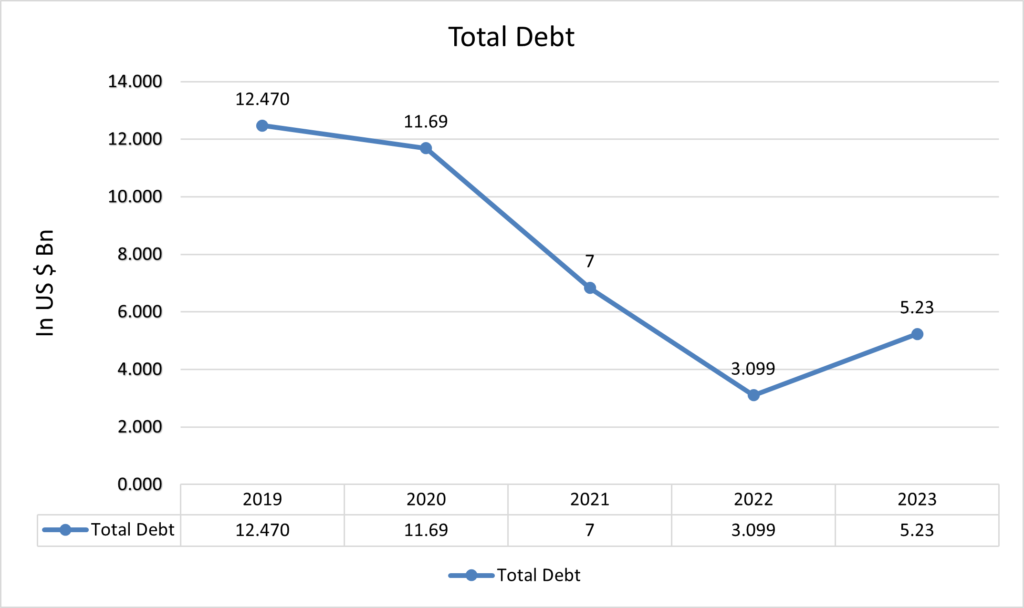

It’s reassuring to know that the company’s debt is under control, especially considering its significant assets and cash reserves. With assets worth US $106.62 billion, including a substantial cash reserve of US $16.4 billion, the company appears to be in a strong financial position. This suggests that they have the resources to manage their debt obligations comfortably without encountering any significant issues. Maintaining a healthy balance between debt and assets is crucial for ensuring financial stability and flexibility, and it sounds like the company is effectively managing this aspect of its operations.

Tesla’s quarterly revenue has seen some fluctuations, but overall the company has demonstrated solid performance. Despite occasional declines, Tesla remains strong in the electric vehicle market, driven by factors like production numbers, demand, and market conditions. Investors typically look at various metrics, not just quarterly revenue, to gauge the company’s health, including profitability and long-term growth prospects.

Currently, the EPS of the company is US $4.30 up from US $3.62 compared to last year’s EPS.

Forecast

Right now, the company is trading at US $193.57 with a 1-year projected target of around US $263 and a low estimation of US $171; the average price target is US $225.

Technical Analysis

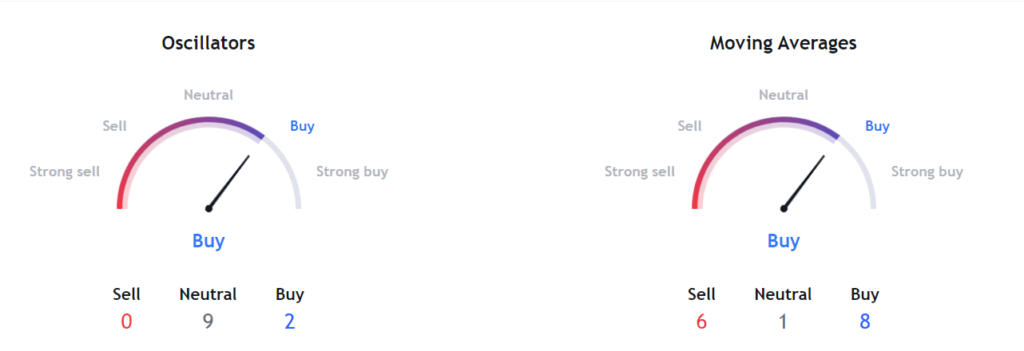

- The stock has corrected more than 26% in 1 month and is expected to bounce back.

- Right now, the RSI (39.52) indicator is below 50 and it is giving a bullish divergence, it is a good time to invest in this stock.

- The stock has the potential to bounce back up to 16%-35% from the current market price. Analysts are bullish on this stock.

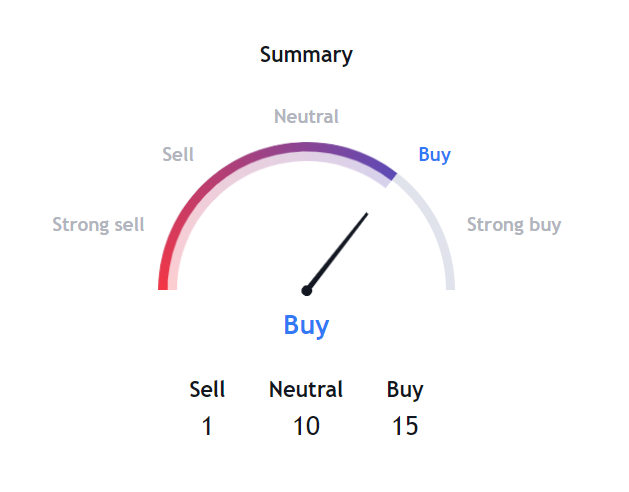

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock. Market sentiments are bullish.

- MACD (-11.49) indicator is giving a bullish signal.

- VWAP (197.20) indicator is bullish on the stock.

Risk factors

Tesla faces several risks, including:

- The company’s ambitious production targets may strain its manufacturing capabilities, leading to delays or quality control issues. Disruptions in the supply chain, such as shortages of key components or materials, could also impact production.

- The electric vehicle market is becoming increasingly competitive, with traditional automakers and new entrants launching their own EVs. Tesla’s market share and pricing power could be affected by intensified competition.

- Tesla’s aggressive growth strategy and significant capital expenditures could strain its financial resources and lead to cash flow problems or increased debt levels. Economic downturns or fluctuations in the financial markets could also impact Tesla’s access to capital.

- Tesla’s reliance on lithium-ion battery technology and its suppliers for battery cells could be affected by fluctuations in battery prices, shortages of raw materials, or disruptions in the battery supply chain.

Stock Recommendation

Tesla is known for its cutting-edge technology in electric vehicles, battery storage, and solar energy. Its vehicles offer high performance, long-range capabilities, and advanced features like Autopilot, which is a semi-autonomous driving system. Tesla’s mission is to accelerate the world’s transition to sustainable energy. By producing electric vehicles and renewable energy products, Tesla aims to reduce greenhouse gas emissions and mitigate climate change. Tesla vehicles are renowned for their acceleration, handling, and safety features.

Models like the Model S and Model 3 have received high praise from customers and automotive reviewers for their driving experience and design. Tesla has expanded its presence worldwide, with manufacturing facilities, sales, and service centers in multiple countries. Its global footprint enables it to tap into diverse markets and access new customers. Tesla is known for its culture of innovation and willingness to take risks.

The company continuously improves its products through over-the-air software updates and introduces new features and models to meet evolving customer needs. Tesla has a devoted customer base and strong brand loyalty. Owners often praise their Tesla vehicles for their performance, technology, and customer service, contributing to high customer satisfaction ratings.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $193.57 as of February 10th, 2023.

| CMP (US) (February 10, 2024) | $193.57 |

| Target Price | $263 |

| Recommendation | Buy |

The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.