Should You Consider Investing into this Electric Car Producer: Lucid Group Inc.(NASDAQ:LCID)

Lucid Group, Inc. (NASDAQ: LCID) is a technology and automotive company that develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using their own equipment and factory.

Key Highlights

- Starting production of customer delivery vehicles in September 2021.

- Hosted commissioning event for more than 150 customers, members of the media, institutional investors, and sell-side analysts, among other Lucid stakeholders Kicked off AMP-1 Phase 2 expansion expected to add 2.85M sq. ft. of production footprint to AMP-1.

- After completion of Phase 2, Lucid’s production capacity at AMP-1 will increase to 90,000 vehicles per year across the Lucid Air and Lucid’s Project Gravity SUV.

- LCID opened its latest retail location, the Lucid Studio at Tysons Corner Center in the Washington, DC, Metro Area. This location marks the 11th location of the growing network of Lucid Studios and furthers the company’s presence in the Eastern Seaboard area.

- Stock is currently trading above its crucial short-term (50-day) and long-term (200-day) SMA support levels, a bullish indicator

| Start of Production | September, 2021 |

| Reservations | Greater than 13,000 |

| Order Book | Over $1.3B |

| Cash on Hand | $48B |

| Earnings | |

| Revenue | 232.000K |

| Revenue Growth (1 year) | — |

| Gross Margin | -13.31 |

| Net Income | -524.403M |

| Revenue | 232.000K |

| Revenue Growth (1 year) | — |

| Gross Margin | -13.31 |

| Net Income | -524.403M |

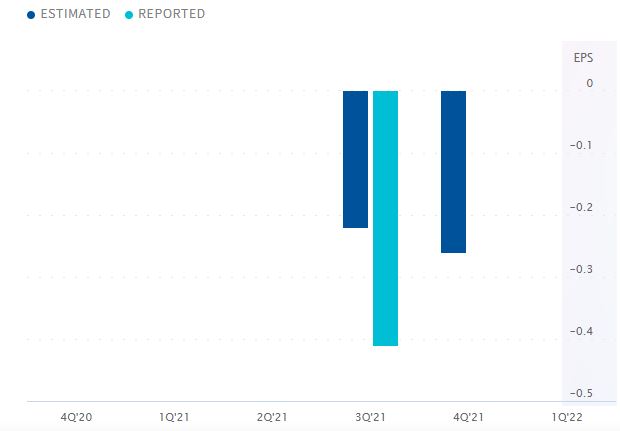

Earnings Per share

| Balance Sheet | |

| Cash | 4.797B |

| Total Assets | 6.139B |

| Long Term Debt | — |

| Total Liabilities | 1.294B |

| Debt/Equity Ratio | 0.045 |

| Current Ratio | 18.51 |

| Shareholders | |

| Dividend Yield | — |

| Annual Dividend | — |

| ROA | -0.0854 |

| ROE | -0.1082 |

| ROIC | -0.1036 |

| Ownership | |

| Institutional Ownership | 0.0651 |

| Insider Ownership | 0.0222 |

| Shares Outstanding | 1.646B |

Last 6 months Chart

Stock Recommendation:

Basis the frequent media & news coverage and company’s recent announcements, a short-term gain can be expected & Basis the strong order & production projections MarketFacts anticipates a long-term growth into the stock as well.

We recommend a “Buy” rating on the stock at the closing Price of $18.95 as of September 13, 2021