Ramaco Resources, Inc. (NASDAQ: METC): Navigating Cyclical Markets and Global Commodity Fluctuations

Ramaco Resources, Inc. (NASDAQ: METC), headquartered in Lexington, Kentucky, is a U.S.-based coal company that specializes in metallurgical coal, which is crucial for steel production. Operating mainly in the Appalachian region, the company focuses on producing low-cost, high-quality coal through its vertically integrated operations that span coal production, processing, and marketing. Ramaco’s financial performance is closely tied to global steel demand and the price of metallurgical coal, making it subject to market fluctuations.

Despite these challenges, the company is focused on expanding its operations by acquiring additional mining assets and maintaining cost efficiency. However, it also faces risks, including volatile coal prices, regulatory changes regarding environmental policies, and the potential decline in steel demand as industries explore greener alternatives. As one of the few publicly traded metallurgical coal companies, Ramaco holds a unique position in the market, though its stock price can be volatile, reflecting the cyclical nature of the coal and steel industries.

Highlights and News Update

- On August 8th, 2024, Ramaco Resources, Inc., a leading operator and developer of high-quality, low-cost metallurgical coal in Central Appalachia reported financial results for the three months and six months ended June 30, 2024.

- On May 31st, 2024, Evan H Jenkins, serving as GENERAL COUNSEL for Ramaco Resources, has recently purchased a total of 8,927 shares of Class A common stock.

- On May 10th, 2024, Ramaco Resources reported first-quarter net income of US $2 million and adjusted EBITDA of US $24.2 million, both down significantly from the fourth quarter of 2023.

Key Data

Second Quarter 2024 Highlights

- The Company had adjusted earnings before interest, taxes, depreciation, amortization, certain non-operating expenses, and equity-based compensation (“Adjusted EBITDA”, a non-GAAP measure), of US $28.8 million, compared to US $24.2 million in the first quarter of 2024.

- Company had net income of US $5.5 million, compared to US $2.0 million in the first quarter of 2024.

- The Board declared the quarterly Class A common stock cash dividend of US $0.1375 per share for the third quarter of 2024.

Financials

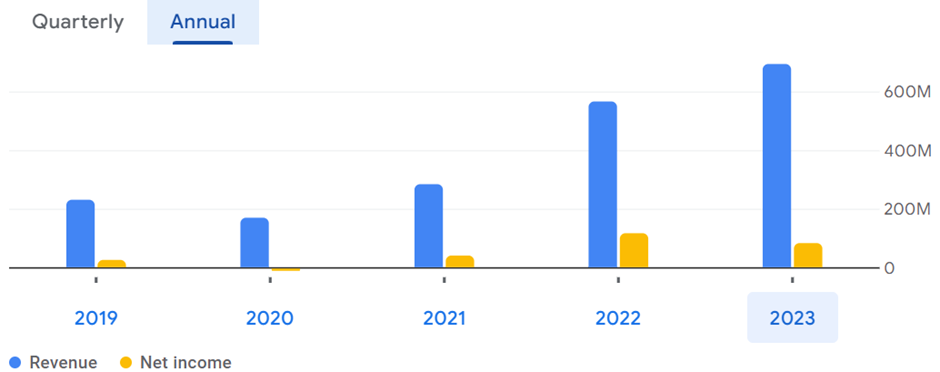

Ramaco Resources has demonstrated strong revenue growth over the past few years, with total revenue increasing from US $168.9 million in 2020 to US $693.5 million in 2023, reflecting its successful expansion and higher demand for metallurgical coal. However, alongside this growth, the cost of revenue also rose significantly, from US $145.5 million in 2020 to US $493.8 million in 2023, which caused a decline in gross profit from US $232.7 million in 2022 to US $199.7 million in 2023. Despite this, the company managed to maintain a solid gross profit margin and scale its operations.

Operating income, which turned from a loss of US $19.1 million in 2020 to a profit of US $95.2 million in 2023, also highlights the company’s efficiency. However, it did experience a decline from the US $150.4 million posted in 2022, signaling rising costs as a challenge. Additionally, interest expenses grew from US $1.2 million in 2020 to US $8.9 million in 2023, likely due to increased debt to support expansion.

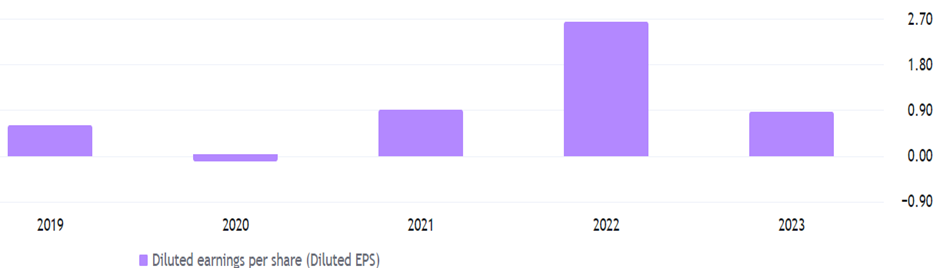

Net income followed a similar trend, improving from a loss of US $4.9 million in 2020 to a profit of US $82.3 million in 2023, though it also declined from US $116 million in 2022. This suggests Ramaco’s profitability is facing some pressure, likely due to rising operational costs and interest expenses. While the company has shown strong growth overall, the recent decline in profitability indicates it may face challenges in maintaining margins as it navigates higher costs and interest obligations.

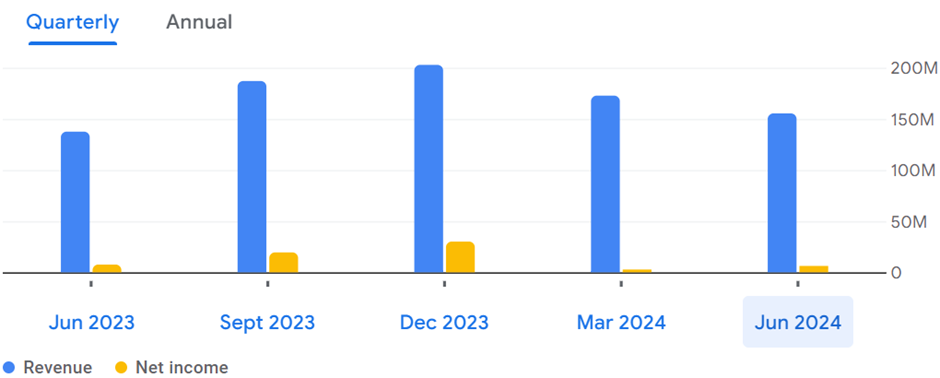

Ramaco Resources has experienced fluctuating financial performance from Q3 2023 to Q2 2024, with notable declines in revenue and profitability. Revenue dropped from US $202.7 million in Q4 2023 to US $155.3 million in Q2 2024, reflecting potential challenges in market demand or coal pricing. There is a significant contraction in gross profit, which fell from US $63.3 million in Q4 2023 to US $32.5 million by Q2 2024, putting pressure on profit margins.

Operating income also decreased sharply, dropping from US $37.3 million in Q4 2023 to just US $5.4 million in Q2 2024, signaling that the company struggled to maintain profitability despite steady operating expenses. Interest expenses remained stable, indicating no significant changes in debt levels. However, the sharp drop in net income, from US $30 million in Q4 2023 to US $5.5 million in Q2 2024, underscores the mounting pressures on the company’s profitability. Overall, Ramaco’s financial performance in recent quarters reflects the challenges of managing high costs and declining revenue, with profitability suffering as a result.

Over the four-year period, the company has shown significant growth in its assets, increasing from US $228.6 million in 2020 to US $665.8 million in 2023, nearly tripling its asset base. This growth is largely driven by a substantial rise in fixed assets, alongside a major increase in current assets over the same period.

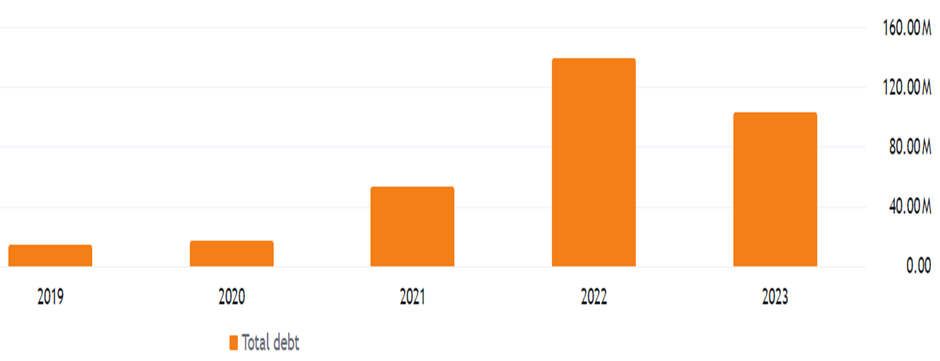

Liquidity has improved as well, with cash and cash equivalents rising dramatically from US $5.3 million in 2020 to US $42 million in 2023, indicating strong financial health and flexibility to manage short-term obligations. In terms of debt, the company experienced fluctuating total debt levels, peaking at US $138.1 million in 2022 before reducing to US $100.6 million by the end of 2023. This decline suggests an effort to deleverage and improve financial stability, although total debt remains significantly higher than in 2020. Additionally, retained earnings in 2022 and 2023 were US $140 million and US $91.9 million.

Right now, the EPS of the company is at US $2.13 compared to last year’s EPS of US $2.60.

Forecast

Right now, the company is trading at US $11.51, with a 1-year projected target of around US $17.24 and a low estimation of US $8.98; the average price target will be US $15.24.

Technical Analysis

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Right now, RSI (56.70) gives a positive sign, which shows it is a good time to invest in this stock. It is also giving a bullish divergence.

- The stock has the potential to bounce back up to 32%-50% from the current market price.

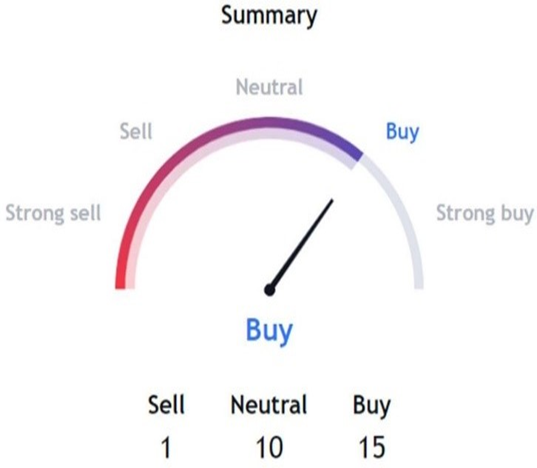

Indicators Summary- BUY

- Market sentiment is bullish, and stocks can go up further.

- 100 days EMA and 50 days EMA also gives a positive sign pushing the price upwards.

- VWAP is also giving us a buy signal.

Risk factors

There are some risks involved with Ramaco Resources, Inc.

- Ramaco’s revenue and profitability are highly sensitive to global coal price fluctuations, driven by supply-demand imbalances, economic conditions, and steel production cycles. As its coal is primarily used in steel production, the company’s performance is closely tied to the cyclical nature of the steel industry. Economic downturns or reduced steel demand, especially from key markets like China, could negatively impact sales.

- As countries and industries increasingly shift towards cleaner energy sources, demand for coal, including metallurgical coal, could decline in the long term. This global trend poses a strategic risk to Ramaco’s business model, which is dependent on coal for steelmaking.

- Given its increasing interest expenses, Ramaco faces risks related to rising interest rates, which could raise borrowing costs. Additionally, any downturn in cash flow could make it harder for the company to service its debt or invest in growth projects.

- The company relies on a well-functioning supply chain to transport coal to customers. Disruptions in logistics, transportation strikes, or port issues could delay shipments, leading to financial losses and customer dissatisfaction.

Stock Recommendation

Ramaco Resources, Inc. presents an attractive investment opportunity due to its strategic focus on metallurgical coal, a critical component in steel production, which ties its success to global infrastructure and industrial growth. The company benefits from a low-cost production model, supported by access to high-quality coal reserves and efficient operations, allowing it to remain profitable even during downturns in coal prices.

As global demand for steel rises, particularly in emerging markets, Ramaco’s expanding production capacity positions it well to capitalize on these trends, enhancing its economies of scale and driving potential revenue growth. Furthermore, the company boasts strong financials with manageable debt, giving it stability and flexibility to navigate market volatility while pursuing new growth opportunities.

As a U.S.-based producer, Ramaco is also shielded from geopolitical disruptions that affect other coal-producing regions, providing a competitive edge in supply-constrained markets. Despite the environmental and cyclical risks inherent to the coal industry, Ramaco’s solid fundamentals, industry positioning, and potential for stock price appreciation make it a compelling investment choice for those seeking exposure to the metallurgical coal sector.

Market Facts gives a “Buy” rating on the stock at the closing price of US $11.51 as of September 27th, 2024.

| CMP (US) (September 27, 2024) | $11.51 |

| Target Price | $17.24 |

| Recommendation | Buy |

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.