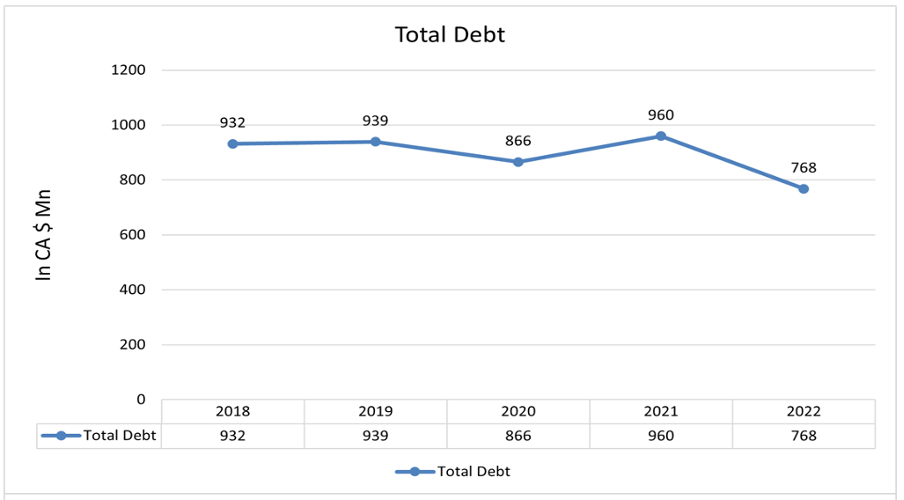

Make your portfolio sustainable by investing in TransAlta Renewables Inc : (TSX:RNW)

TransAlta Renewables, Inc.(TSX: RNW) is a leading renewable energy company based in Canada. Established in 2013, it is focused on the development, operation, and ownership of renewable power generation facilities. The company’s mission is to provide clean, sustainable, and reliable energy solutions while contributing to the global transition to a low-carbon future.

TransAlta Renewables operates a diversified portfolio of renewable energy assets, including wind, hydro, and solar power facilities. The company’s assets are spread across various regions in Canada, the United States, and Australia, allowing it to benefit from geographic and technology diversity.

The company’s wind power segment is a significant contributor to its renewable energy portfolio. The company also operates hydroelectric power facilities. Furthermore, it has expanded its portfolio to include solar power. The company owns and operates solar farms, harnessing the power of the sun to generate clean electricity. Solar power is a rapidly growing sector within the renewable energy industry, and TransAlta Renewables is well-positioned to leverage this market opportunity.

Highlights and News Updates

- On May 15th, 2023, TransAlta Renewables upgraded to outperform by Credit Suisse.

- On August 24th, 2022, TransAlta Renewables announced Ieso contracts at Sarnia and Melancthon 1 have been extended till April 30th, 2031.

- On June 2nd, 2022, TransAlta Renewables announced a rehabilitation plan for Kent Hills and executed a 10-year contract extension with New Brunswick Power, and received a waiver from project bondholders.

- On December 3rd, 2022, TransAlta Renewables has put its Windrise Wind Farm into commercial service, and the company has also planned to raise CA $173 million through a green bond issue.

- On September 2nd, 2021, TransAlta Renewables acquired a 122 MW solar facility portfolio in North Carolina for over US $96 Mn.

- On July 30th, 2021, BHP Group Ltd., and Canada’s TransAlta came together to build solar farms at the Western Australia nickel site.

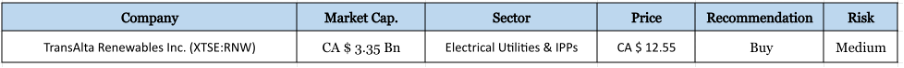

Key Data

First Quarter 2023 Highlights

- Revenue stood at CA $119 Mn, down by 16.78% compared to last year’s first quarter.

- Profit stood at CA $45 Mn, up by 9.76% compared to last year’s first quarter.

- Cash flow from operating activities was $67 million. Cash available for distribution was CA $71 million or $0.27 per share.

- Free cash flow of CA $93 million. Adjusted EBITDA was $128 million.

Financials

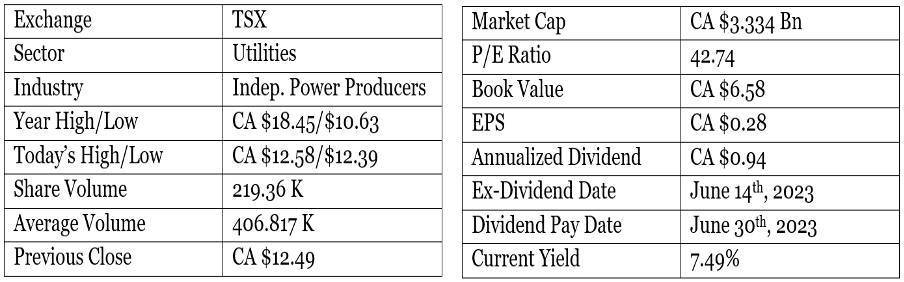

The revenue of the company has grown significantly however, revenue had fallen in FY2019, and FY2020 due to lower production because of changes in customer demand. But post FY2020 revenue started to grow. In FY2022 revenue grew by 19.15% due to an increase in production by 326 GWH.

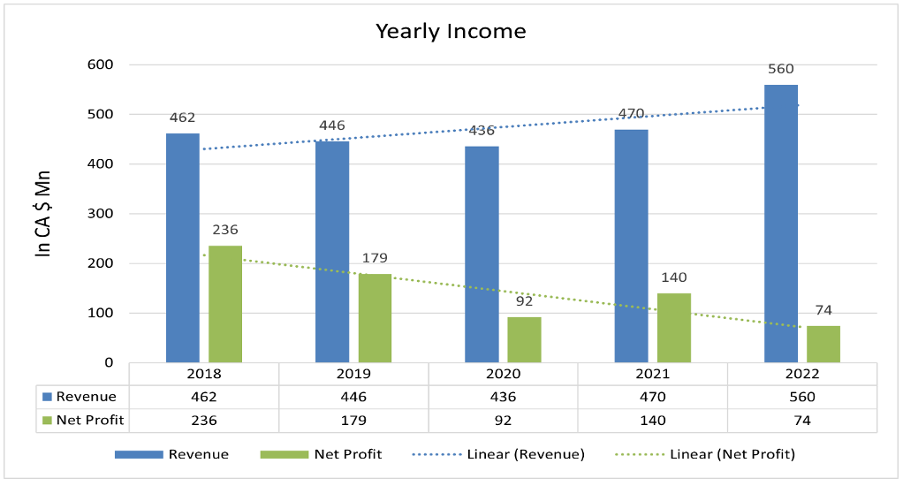

As of now, the debt of the company is at CA $768 Mn decreased by 20% from FY2021, the company has assets worth CA $3.229 Bn including cash of CA $89 Mn but by looking at the declining profit, the debt seems a bit problematic here.

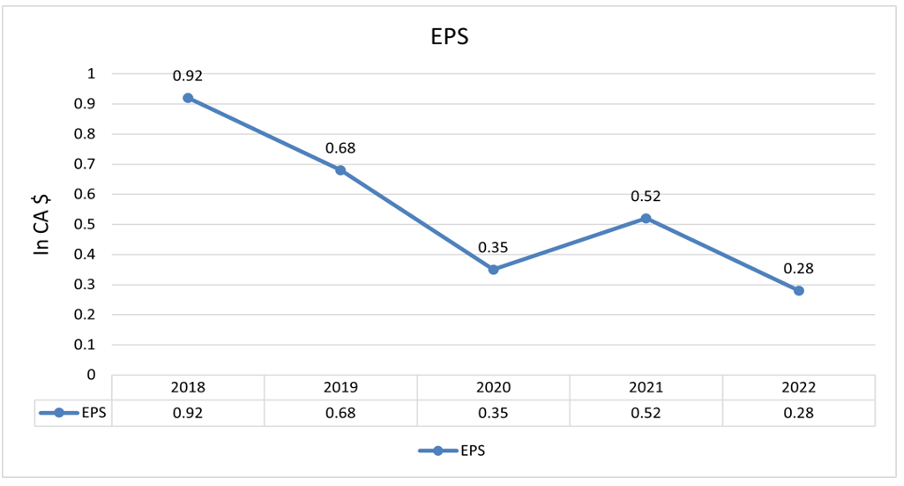

Currently, the EPS of the company is at CA $0.28 down by 46.15% compared to last year.

Forecast

Currently, the company is trading at CA $12.55 with a 1-year projected target of around CA $14.80 and low estimation of CA $10.70; the average price target is CA $13.76.

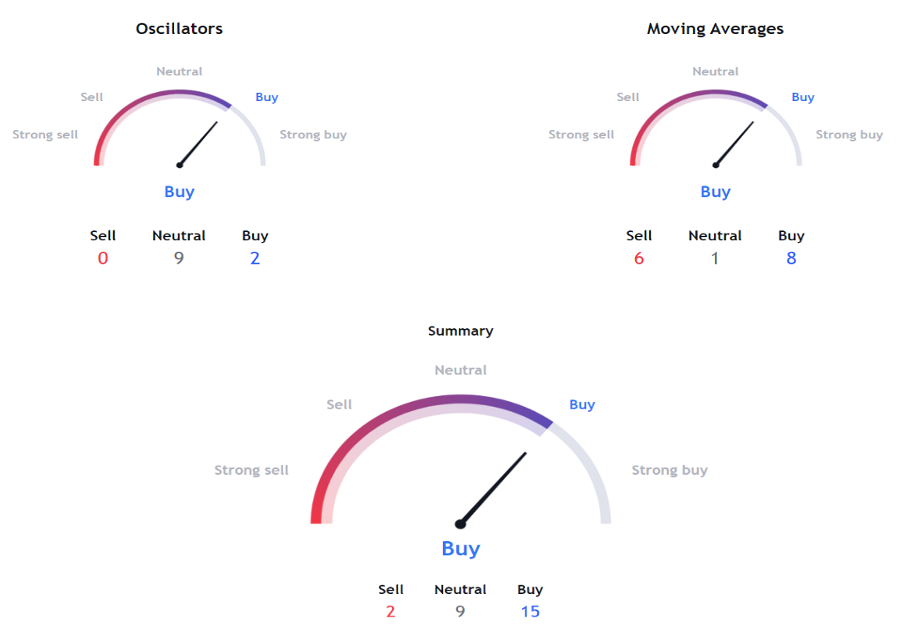

Technical Analysis

- Stock of the company has corrected more than 35.67% and has taken support on its short-term trendline.

- Right now, RSI (47.30) indicator is above 50 which shows it is a good time to invest in this stock.

- The stock has the potential to bounce back up to 17.7% from the current market price. Analysts are bullish on this stock.

Indicators Summary – Buy

- The price action analysis of the stock is indicating a positive uptrend in the stock. Market sentiments are bullish.

- Hull moving average (12.40) is also giving a buy signal.

- 100-day SMA is also giving a buy signal to us.

ESG Factor

TransAlta Renewables’ commitment to sustainability goes beyond generating renewable energy. The company actively seeks opportunities to enhance environmental, social, and governance (ESG) practices. This includes reducing greenhouse gas emissions, promoting biodiversity conservation, engaging with local communities, and maintaining strong corporate governance standards. The company has lots of clean power generation areas such as wind, hydro, and solar. However, the company also uses gas to generate electricity which is bit of a problem here as it releases a small amount of emissions. The company should limit the use of natural gas to control the emissions.

Risk factors

- The company operates in multiple countries which exposes it to foreign currency fluctuations.

- The price of energy, including electricity, can be volatile and dependent on various factors such as supply and demand dynamics, fuel costs, and market conditions. Fluctuations in energy prices can impact TransAlta Renewables’ revenue and profitability.

- Renewable energy projects require significant upfront investments. TransAlta Renewables may face challenges in securing favourable financing terms or accessing capital markets at reasonable costs, which could affect its ability to fund new projects and expand its portfolio.

- TransAlta Renewables engages in project development activities, including the construction and commissioning of new renewable energy facilities. Delays or cost overruns in these projects can impact the company’s financial performance and cash flow.

- The company also has high debt, which has led net profit to fall.

Stock Recommendation

As the world continues to transition towards cleaner and more sustainable energy solutions, companies operating in the renewable energy sector may benefit from increased demand and government support.. The Canadian government has declared numerous incentives and subsidies in the recent budget to support companies that are into producing clean energy.

The company often enters into long-term power purchase agreements (PPAs) with utility customers. These contracts provide revenue stability and predictable cash flows, which can be attractive to investors.

TransAlta Renewables has a diversified portfolio of renewable energy assets across multiple regions, including Canada, the United States, and Australia. Diversification can help mitigate risks associated with specific geographic locations or regulatory changes.. Moreover, the company has a history of paying dividends to its shareholders.

The intrinsic value of the stock is approximately CA $28.50, but it is currently trading at CA $12.55, TransAlta Renewables, Inc. is currently undervalued.

MarketFacts gives a “Buy” rating on the stock at the closing price of CA $12.55 as of June 6th,2023.

| CMP (CAD) (June 6, 2023) | CA $ 12.55 |

| Target Price | CA $ 15.75 |

| Recommendation | Buy |