Magna International Inc (NYSE:MGA): A stock with strong growth prospects

Magna International, Inc. (NYSE: MGA) is a Canadian global automotive supplier and one of the largest companies in the world specializing in automobile components and technology. Founded in 1957, the company has grown to become a leading player in the automotive industry, providing a wide range of innovative products and solutions to automakers worldwide. With its headquarters in Aurora, Canada, Magna operates in multiple continents and has a strong presence in key automotive markets.

Magna International operates under a decentralized corporate structure, which allows each of its operating units to function autonomously and cater to the specific needs of its customers. This approach has contributed significantly to Magna’s success over the years, as it enables the company to be flexible, responsive, and innovative in its product offerings.

Magna is known for its diverse portfolio of automotive solutions, catering to both traditional internal combustion engine vehicles and the growing electric vehicle market. Some of its primary product offerings include Body Exteriors, Body Structures, Power and Vision, Seating Systems, and Complete Vehicles.

Highlights and News Updates

- On August 4th, 2023,Canada’s Magna International raised its full-year profit and sales outlook after its quarterly results beat estimates on solid demand for parts, as automakers ramp up production.

- On August 1st,2023, the company announced the start of production of a first-to-market, modular eDecoupling unit to support multiple battery electric vehicle (BEV) programs for a German premium OEM. Magna to Launch Industry-First Award with Modular eDecoupling unit for BEVS

- On July 28th, 2023, Zacks was bullish on Magna International. EPS can grow 20.43% in the next 3-5 years. The company delivered an earnings surprise of 16.8% in the last reported quarter.

- On July 27th, 2023, Onsemi, a leader in intelligent power and sensing technologies, and Magna announced a long-term supply agreement (LTSA) for Magna to integrate Onsemi’s EliteSiC intelligent power solutions into its eDrive systems.

- On June 29th, 2023, DBRS confirmed the issuer rating and senior debt rating of Magna International at ‘A’ (low) and its short-term Debt rating at ‘R-1’ (low).

- On July 21st, 2023, Magna International decided to invest US $790 Million in Ford’s EV complex which is the BlueOval City EV assembly complex. The investment will create about 1,300 new jobs in the state. Ford’s BlueOval City will be capable of producing 500,000 electric trucks a year at full production.

- On May 5th, 2023, Magna International Inc slightly raised its full-year sales forecast a as the Canadian auto parts maker expects light vehicle production to improve in its two biggest markets

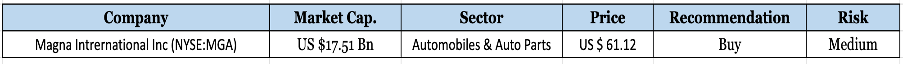

Key Data

Second Quarter 2023 Highlights

- Sales increased 17% or $1.62 billion to $10.98 billion for the second quarter of 2023 compared to $9.36 billion for the second quarter of 2022.

- Global light vehicle production increased 15%, including 14%, 13% and 21% higher production in North America, Europe and China, respectively.

- Diluted earnings per share were $1.18 and Adjusted diluted earnings per share(1) increased $0.67 or 81% to $1.50 primarily due to earnings on higher sales including higher margins as a result of a focus on operational excellence and cost initiatives.

- Cash from operating activities increased $126 million to $547 million.

- It completed the acquisition of the Veoneer Active Safety Business. The transaction broadens the Active Safety portfolio with complementary products, customers, geographies, engineering and software resources.

- Equity income increased $11 million to $36 million for the second quarter of 2023 compared to $25 million for the second quarter of 2022.

Financials

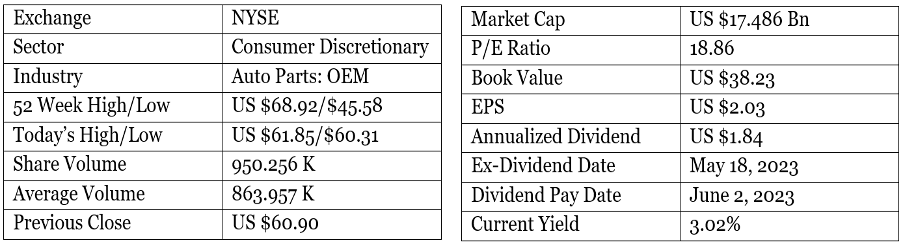

Since FY2018, the company has experienced a decline in its revenue primarily attributed to the economic slowdown, the impact of the covid-19 pandemic, and several other factors. However, there are signs of recovery evident in the FY2022 results.

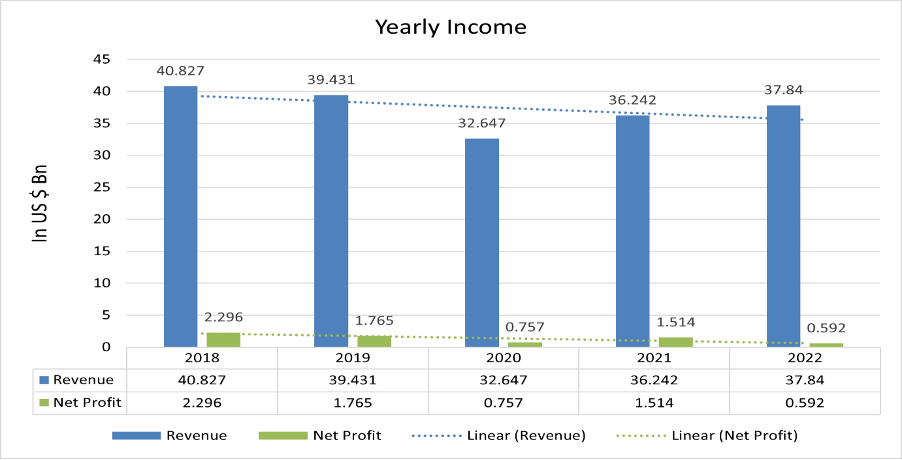

With assets totalling US $27.789 billion, which includes a cash reserve of US $1.234 billion, the company exhibits sufficient capability to effectively manage its debt obligations.

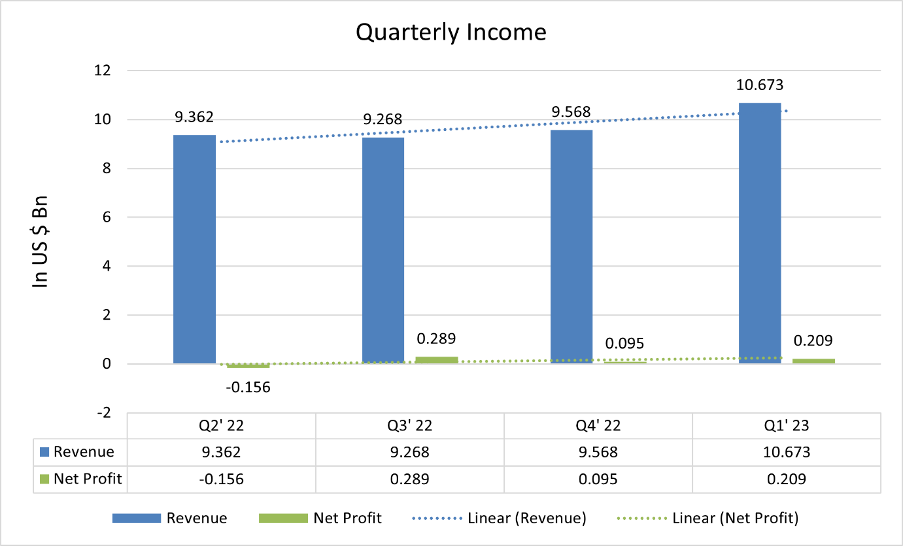

The company’s quarterly revenue has been showing positive progress. However, the net profits have been trailing behind due to elevated expenses related to the cost of goods sold and operating costs.

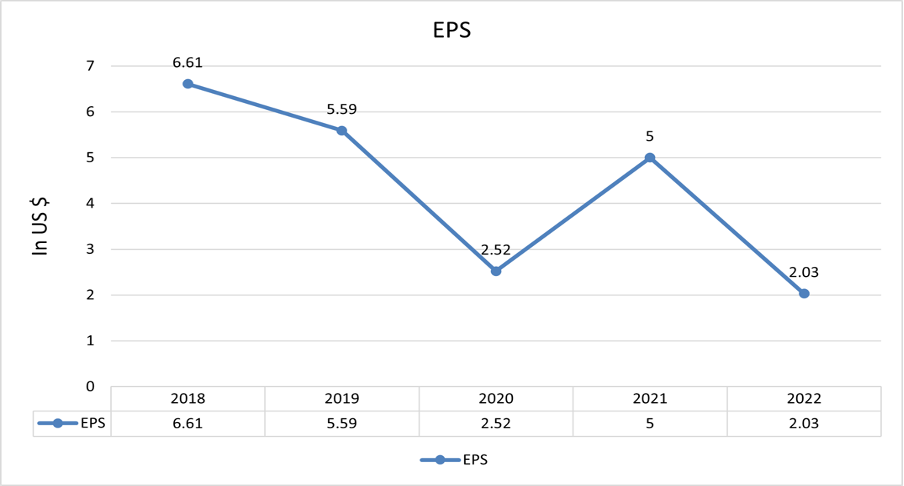

Currently, the EPS of the company is US $1.52 down by more than 59.4% compared to last year’s EPS.

Forecast

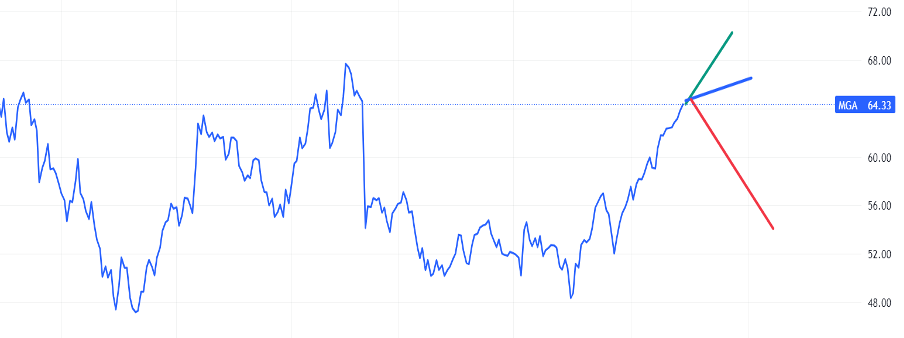

Currently, the company is trading at US $61.12 with a 1-year projected target of around US $70.13 and a low estimation of US $53.95; the average price target is US $66.65.

Technical Analysis

- The stock has the potential to bounce up to 9% from the current market price. Analysts are bullish on this stock.

- Right now, RSI (76.27) indicator is above 50 which shows it is a good time to invest in this stock.

- The stock is also above 100-day EMA.

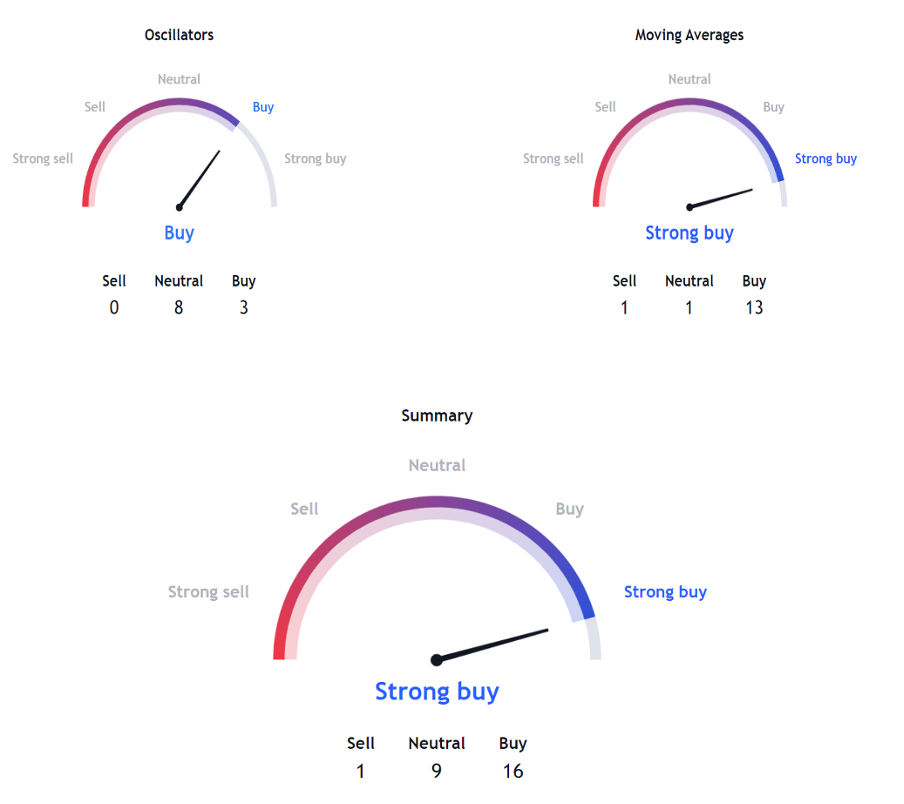

Indicators Summary – Buy

- The price action analysis of the stock is indicating a positive uptrend in the stock. Market sentiments are bullish.

- MACD (2.21) indicator is giving a bullish signal.

- VWAP (60.86) indicator is bullish on the stock.

ESG

As the company continues to progress in its endeavours to safeguard and conserve the planet, it sets its sights on achieving carbon neutrality in its European operations by 2025 and extending the same goal to its global operations by 2030. The technologies, systems, and concepts under development are poised to promote cleaner and safer mobility for all individuals and entities alike.

In 2020, Magna witnessed 12% of its global energy procurement originating from renewable energy sources, while having laid out comprehensive strategies to shift all operations worldwide towards renewable energy usage. Simultaneously, the company exhibited an impressive environmental commitment, as over 91% of total waste outputs generated from operations in the previous year were recycled or diverted away from landfills.

Moreover, the company continues to prioritize the development of products that empower customers to attain their sustainability objectives, such as advancing towards a zero-emissions future and enhancing fuel economy. This product portfolio encompasses a range of e-powertrain solutions, active aerodynamics, as well as lightweight structures and exterior components.

Risk factors

- The company is in the automotive industry which means it is subject to fluctuations in demand and economic conditions. Economic downturns, changes in consumer preferences, or global trade disruptions can impact sales and profitability. And Automotive companies rely on complex global supply chains for raw materials and components. Any disruptions, such as natural disasters, trade disputes, or transportation issues, can affect production and lead to increased costs as happened due to Covid-19, Russia-Ukraine war, Inflation.

- The company deals in a highly competitive market, with numerous players competing for market share. Increased competition may put pressure on pricing, innovation, and profitability.

Stock Recommendation

Magna International is the fourth largest leading global automotive supplier with a strong track record of success. With over 60+ years of industry experience, the company has established itself as a reliable and trusted partner in the automotive sector.

As a major player in the automotive industry, investing in Magna provides exposure to the growth potential of this sector. The company’s products and technologies are used by numerous automobile manufacturers worldwide, giving it a wide market reach. It has a presence in 29 countries.

Magna has established a strong relationship with many major automakers. These relationships can provide a competitive advantage and stable revenue streams. As of today, it has more than 50+ brand as customers.

Their focus on e-powertrain systems, lightweight structures, and other innovative products positions them well to capitalize on the growing demand for electric and sustainable mobility solutions.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $61.12 as of August 7th, 2023.

| CMP (USD) (August 7, 2023) | US $61.12 |

| Target Price | US $70.50 |

| Recommendation | Buy |