Korea Electric Power Corporation: Powering Growth Through Innovation & Renewables

Company Overview

- Ticker: KEP(NYSE)

- Headquarters: Naju-Si, South Korea

- Founded: 1898

- CEO: Kim Dong-Cheol (as of 2025)

- Industry: Regulated Electric

Core Business

Korea Electric Power Corporation, an integrated electric utility company, engages in the generation, Transmission and Distribution of electricity in South Korea and internationally.

- Primary Product: The company provides electricity to residential, commercial, educational, industrial, agricultural, street lighting and overnight power usage.

- Additional Services: It provides engineering and construction services for utility plant maintenance, electric power information technology, resources development, facility maintenance, electric meter reading and security services.

- Customer Base: The company serves to residential customers, commercial and industrial customers, government and public institutions, overseas and specialized projects.

- Distribution: Company uses transmission network, local decentralized distribution, smart grid and advanced distribution management.

Industry Overview

- Valuation: The sector is currently valued attractively relative to historical averages and continues to receive investor attention for its earnings and dividend stability, supported by growth in electricity demand and infrastructure investment.

- Trends: Sector is experiencing major transformation driven by surging electricity demand, increased renewable energy integration, rapid grid modernization, and advanced technology adoption.

- Competition: NextEra Energy Inc, Southern Company, Duke Energy Inc, American Electric Power Company Inc, Dominion Energy Inc.

- Growth Drivers: The industry’s growth is fuelled by the surging electricity demand, large-scale capital investment, the rapid expansion of data centres and AI-related loads, a continued policy push towards renewables and the need for modernization and resilience in grid infrastructure.

Key Growth Drivers

- High Profitability: Company shows strong profitability in the first half of the year, a significant rise from the previous year. The company maintained healthy profit and operating margins, reflecting improved cost efficiency and operational performance.

- Market Share Expansion: The company’s current market expansion focuses on cutting-edge technology integration like superconducting grids, substantial growth in renewable and nuclear power and a strong international presence in diverse power projects. Their strategy balances innovation, sustainability, and global asset growth.

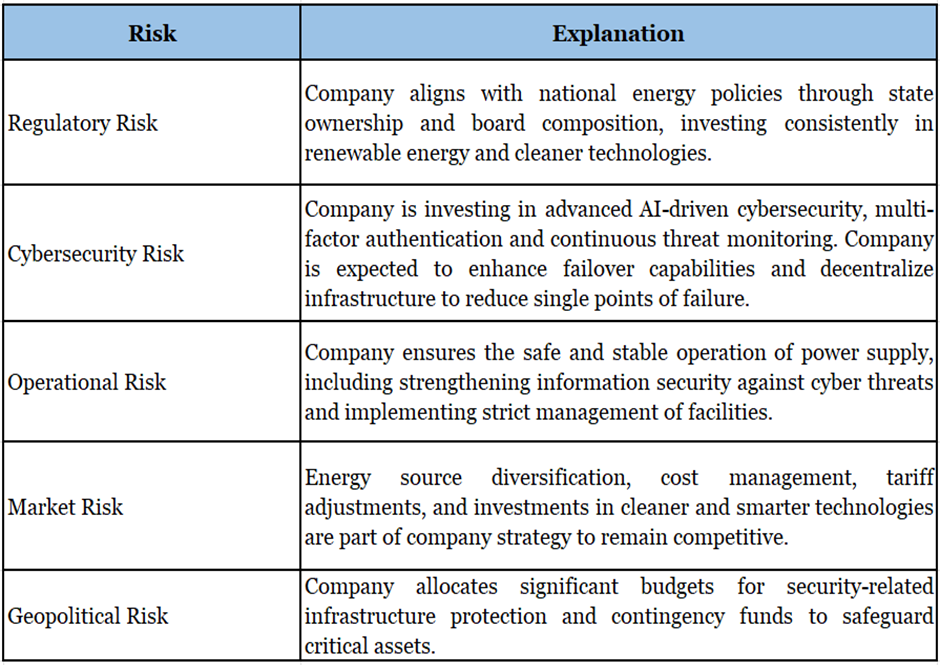

- Financial Strength: Company’s financial strength is characterized by strong government support. Company manages stable cash flows and cost controls. Its credit risk is mitigated by the government’s quasi-sovereign backing and its monopoly position in South Korea’s power market.

- Undervaluation: Company is currently undervalued, with intrinsic valuations and P/E multiples. Despite strong profitability and growth prospects. The company’s solid fundamentals and government backing combined with its undervalued market standing.

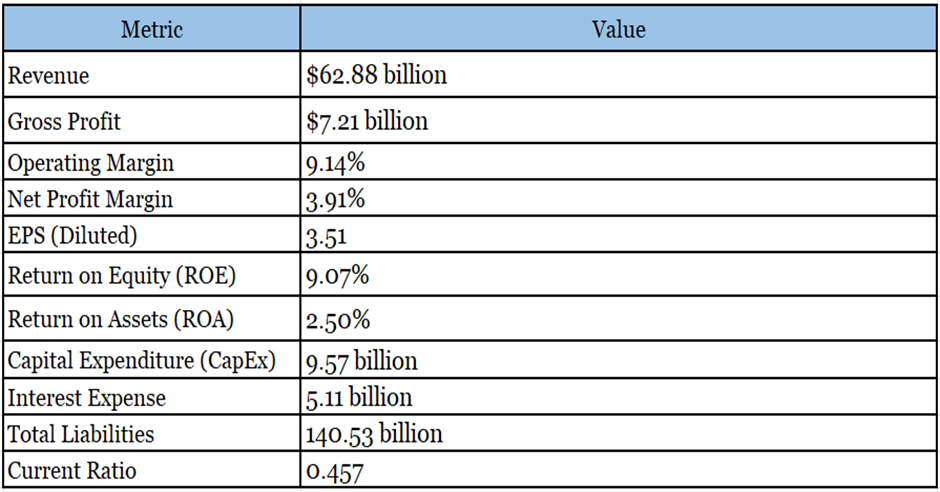

Financial Overview (FY 2024)

- Revenue: $62.88 billion

- Net Income: $2.46 billion

- Operating Income: $5.74 billion

- Total Assets: $167.65 billion

- Total Debt: $3.13 billion

- P/E Ratio (Current): 3.70

Key Financials

Risks

Target

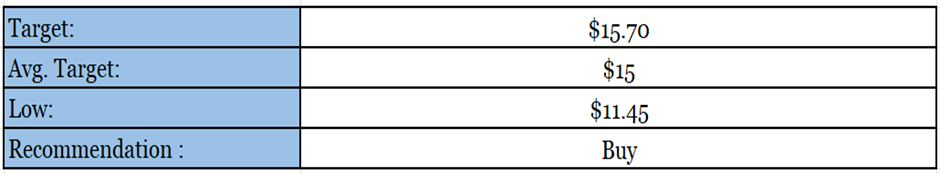

Right now, the company is trading at US $13.05, with a 1-year projected target of around US $15.70 and a low estimation of US $11.45; the average price target will be US $15.

Marketfacts gives a “Buy” rating on the stock at the closing price of US $13.05 as of September 30th, 2025.

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.