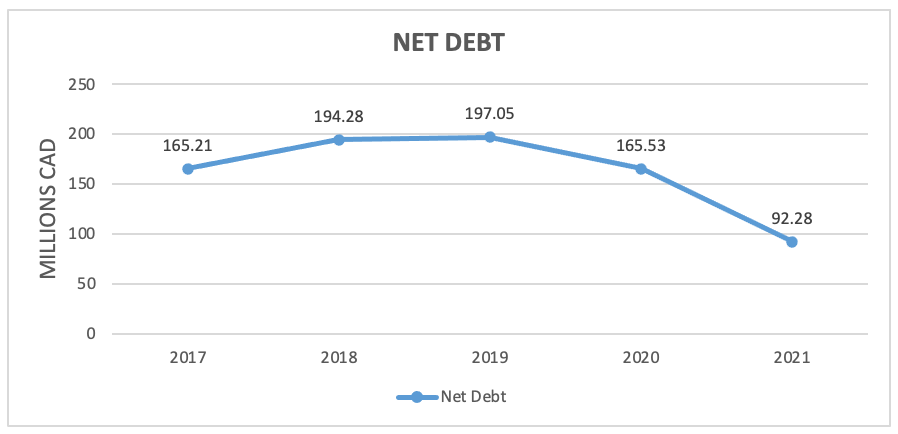

Is this the right time to invest in this undervalued renewable energy stock: Polaris Renewable Energy Inc. (TSE:PIF)?

Polaris Renewable Energy Inc. (TSE: PIF) is a Canadian American company, corporate office located in Toronto, and it comes under utility sector as independent power producer. The company operates, acquires and develops projects in the field of renewable energy. Such as solar power grid, hydroelectric dam and geothermal plants.

The company was established in 1984, with the name Polaris Infrastructure Inc and later in 2022 the company changed its name to Polaris Renewable Energy Inc. The company has presence majorly in South American countries like Dominican Republic, Ecuador, Nicaragua, Panama and Peru.

In 2022, the company added new subsidiaries and some new projects under its management. Let’s see the subsidiaries and projects, and the segment under which they operate, one by one.

First, “Emerald Solar Energy SRL ”. The new subsidiary operates the Canoa l Solar Park in Barahona Province, Dominican Republic with capacity of 50 MW. The subsidiary is also into a power purchase agreement with the local Dominican distributor. The Company will also start second phase of Canoa ll from this year i.e., 2023.

Second is “Hydroelectric San Jose De Minas S.A.”. This Subsidiary operates a river hydro project with capacity of 6 MWs, located along Cubi river, Ecuador. The subsidiary has 7 years of remaining power purchase agreement with wholly-owned Ecuadorian government entity. The company can increase the capacity of current hydro project from 6 MWs to 10 MWs in 10 months which will increase its load from 65% to 85%.

Third subsidiary is “Polaris Energy Nicaragua S.A (PENSA)” which operates “The San Jacinto-Tizate Geothermal Plant” located in north-western Nicaragua and is one of the largest generators of renewable energy in Nicaragua. It is contributing to the overall energy requirement of the country.

Fourth, in 2022 Polaris Renewable Energy cracked a deal with Panamanian Developer to build, own and operate two solar plants with capacity of 13.4 MWdc located in Village of Vista Hermosa, Corregimiento de pueblos Unidos, Aguadulce District, Cocle Province.

Fifth, in Peru, the company owned two subsidiaries “Empresa de Generacion Electrica SAC” and “Generacion Andina SAC”. Through both its subsidiaries company owns and operates three river-run hydroelectric projects. With “Empresa de Generacion Electrica SAC” the company owns ‘Canchayllo’, located in city of Juajo, Canchayllo District, which is operating since 2015. And with “Generacion Andina SAC” the company owns two project, the first is ‘El Carmen’, located in town of Maravillas, Monzon District of Huanuco. It has been operating since 2019 and production capacity is 138 kV. And second one is ‘8 de Agosto’, located in Aucantagua, Monzon District of Huanuco.

Highlights and News Updates

- On January 3rd, 2023, Company announced that it has completed the construction, testing and initial operation of 10.4 MW geothermal binary power plant at San Jacinto Geothermal Project in Telica, Leon, Republic of Nicaragua.

- On December 13th, 2022, Company announced that it is adding Catherine Fagnan as a consultant to the Board. She will work, and advise the Board, on a variety of initiatives including ESG matters. Before this, she used to work as an Associate General Counsel for Green Infrastructure Partners Inc.

- In the third quarter, company’s revenue stood at CA $19.44m, declined by 2% and net loss stood at CA $2m down by 169%.

- On November 3rd, 2022, company announced quarterly dividend of CA $0.15.

- On September 25th, 2022, due to company’s declining earning from last three years, stock price of the company fell significantly.

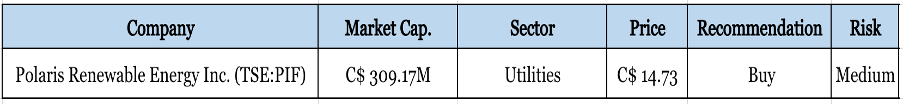

Key Data

Third Quarter 2023 Highlights

- Company produces 134,652 MWh of energy for the period ended September 30, 2022. 98,949 MWh was contributed by company’s geothermal facility in Nicaragua and 18,992 MWh was contributed by hydroelectric facilities in Peru, 14,262 MWh was contributed by solar facilities in Dominican Republic, and lastly 2,449 MWh was contributed by hydroelectric Facility in Ecuador.

- Company generated CA $19.48 million as revenue, which includes CAD $18.94 million from energy and CA $0.54 million from sale of carbon emission reduction (CER). For the same period in 2021 company had generated CA $19.88 million as revenue.

- Net loss borne by the owners of the company was CA $2.01 million or CA $0.094 per share compared to profit of CA $2.95 million or CA $0.15 per share in last year 2021 of same period.

- EBITDA stood at CA $13.43 million compared to CA $14.64 millions of last year 2021 in the same period.

- On the construction of the binary power plant at San Jacinto, an additional CA $4.43 million was spent in the third quarter, bringing the total investment to date to CA $30.76 millions.

- For the development of Panama solar projects which was acquired in March 2022, the company spent CA $4.70 million additional, to construct and an additional CA $5.64 million set aside as guarantees, to ensure delivery of the solar panels to Panama.

- On September 20, 2022, the Company completed the redemption of its unsecured convertible debentures, worth CA $20.55 million, of which CA $20.15 million were converted into common shares and CA $0.40 million were redeemed in cash.

Financials

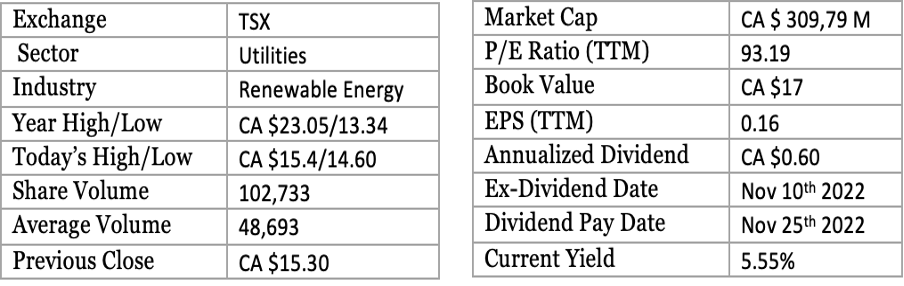

We can see in the graph of company, where revenue and profit was increasing but in 2021 it plunges. This is due to Covid-19 restriction, finance cost and currency fluctuation. Company has paid a good amount of interest in 2021. And the major decline in the revenue was seen in Nicaragua.

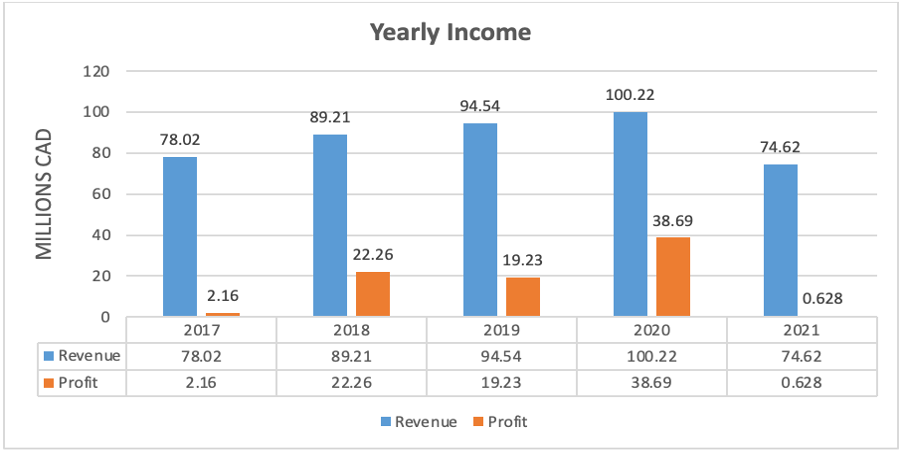

By looking at this graph above we can see that the company is also trying to reduce its debt burden. Reducing debt will help the company to preserve its profit and the profit can be used for future expansion.

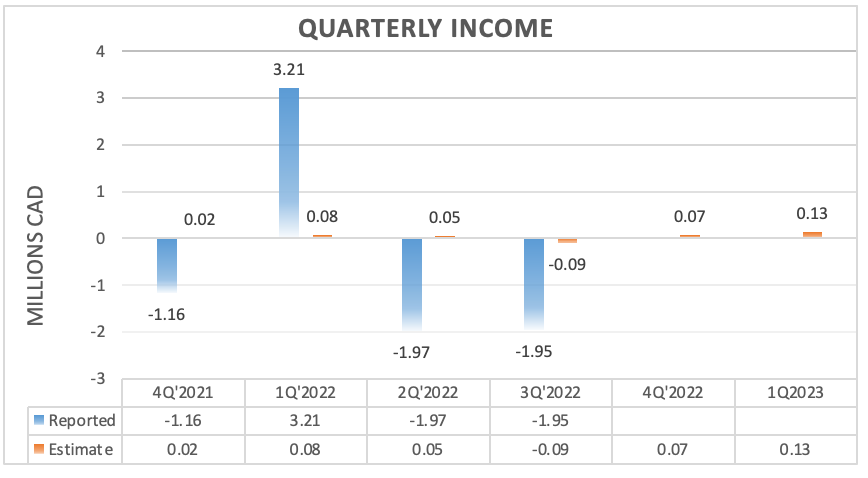

The Company has reported loss for the two consecutive quarters. Company has failed to achieve the market estimation and the next estimated target is set at CA $0.07 M.

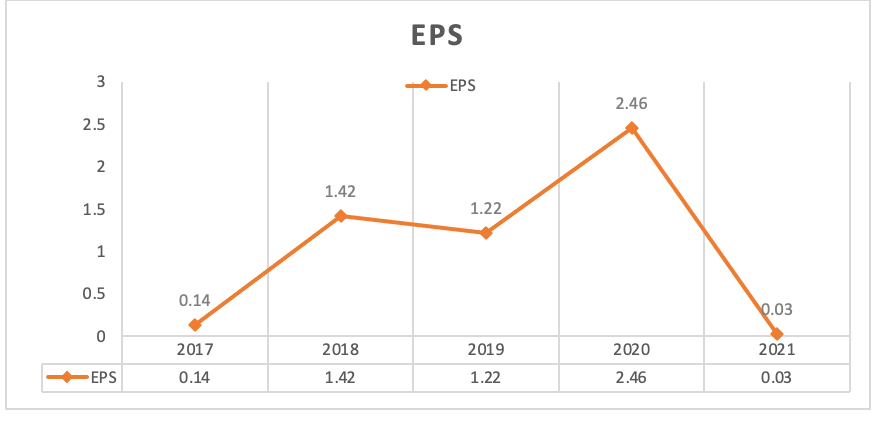

EPS of the company was in uptrend till 2020. But as said before, due to some global issues, revenue of the company fell but not the expense as energy sector is capital intensive sector.

Technical Analysis

- From the last 12 months stock price of the company has corrected more than 40%.

- Currently due to current global scenarios such as inflation, Russia-Ukraine war has given us an opportunity to invest in this stock for a short-term period.

- Currently there is a pullback happening, which may provide a good entry point.

- The stock has taken support from its long-term trend line and now it is going to take support of 50 Day EMA.

- The RSI (56.85) indicator is giving us a Short-term Buy Signal Opportunity.

- The volume is also increasing in this stock shown in the above key data table which indicates momentum.

- Currently the Stock has nice setup opportunity for investors to trade.

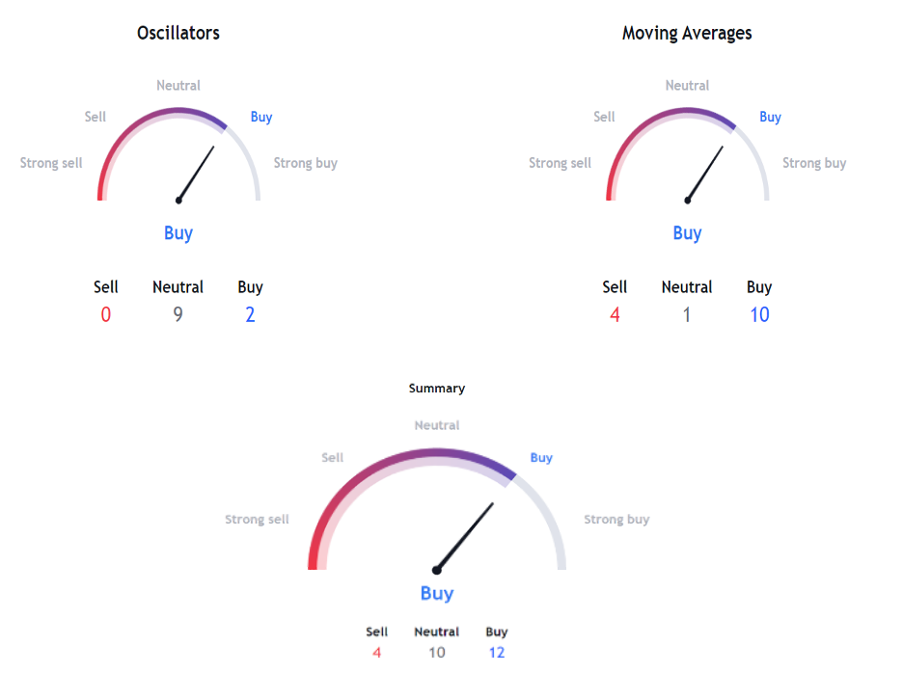

Indicators Summary – Buy

As we know that climate change is real. Governments all around the world are trying to contribute to control climate change by shifting their energy needs toward renewable sources. Laws all around the world are changing and they are concentrating on climate change, pollution and other environmental issues.

So, our research says that the company has expertise in producing renewable energy, which is the future. Companies cannot grow until governments support them with laws, regulations and taxation. And as we said above, the governments all around the world are trying to shift their energy needs towards renewable sources.

Right now, the company is trading at CA $14.91. The 12-month projected target will be around CA $28 and a low estimation will be CA $8; average price target will be CA $22.

Risk factors

As we know every coin has two sides and the same goes with this company. Sine the governments are now focused on renewable sources of energy and framing laws according to this. It is a big advantage for the companies operating in this sector. Polaris Renewable Energy is one of them and company as has paid off some amount of its debt. Now, let’s see the risks.

- Energy Sector is capital intensive sector, and we can see this on the income statement of the company where the revenue of company started declining after 2020 but operating expense kept on increasing. The maintenance cost of the projects are high which is eroding the profits of the company.

- Constant upgradation of technology is required keeping the environmental factor in mind.

- Book value of the company has reduced significantly due to issuance of equity, and this diluted the book value of the company.

Stock Recommendation

The capitalization of Company is around CA $313 million, placing it in the 8th position in the utility sector. The intrinsic value of the stock is approximately CA $34, but it is currently trading at CA $14.73 Polaris Renewable Energy is currently undervalued; hence, it is an excellent time to invest in the stock. With a positive outlook on the future, the future looks bright for PIF.

MarketFacts gives a “Buy” rating on the stock at the closing price of CA $14.73 as of February 9th, 2023

| CMP (CAD) (February 9, 2023) | C$ 14.73 |

| Target Price | C$ 20.50 |

| Recommendation | Buy |