Is STEM a hallmark for clean energy solutions: Stem, Inc. (XNYS:STEM)?

Stem, Inc. (XNYS:STEM) provides clean energy solutions and services designed to maximize the economic, environmental, and resiliency value of energy assets and portfolios. It operates as a digitally connected and intelligent energy storage network provider in the United States and internationally. It offers energy storage systems sourced from original equipment manufacturers (OEMs).

The company also provides Athena, an artificial intelligence platform, which offers battery hardware and software-enabled services to operate the energy storage systems. It serves commercial and industrial enterprises, independent power producers, renewable project developers, and utilities and grid operators. Stem, Inc. was incorporated in 2009 and is headquartered in San Francisco, California.

Highlights And News Updates

- On the 15th of November, William Bush sold around 30k shares on-market at roughly US$14.67 per share. This transaction amounted to 11% of their direct individual holding at the time of the trade

- On November 3,2022 company announced that Frost & Sullivan ranked Stem as the Leader in Innovation in the Frost Radar: Digital Platforms for Renewable Energy and Battery Storage Optimization and Trading report

- Stem’s fiscal 2022 third quarter earnings saw revenue growth come in at nearly 150% to reach its highest quarterly record.

- Stem contracted storage assets under management (AUM) of 2.4 gigawatt hours (GWh) at end of Q3 2022, up from 2.1 GWh (+14%) at end of Q2 2022.

- On September 21,2022 Stem announced the appointment of Michael Carlson as its Chief Operating Officer. Prior to joining Stem, Michael served as Vice President at Koch Engineered Solutions.

- On September 20,2022 Stem announced its newly unified clean energy management platform, Athena, to help make storage, solar, and EV charging asset ownership simpler and more valuable for businesses.

- The Inflation Reduction Act subsidizes U.S. clean energy manufacturing. More importantly, for Stem, there is also a production tax credit for wind, solar, and battery storage. The battery storage tax credit is new and could create significantly more demand.

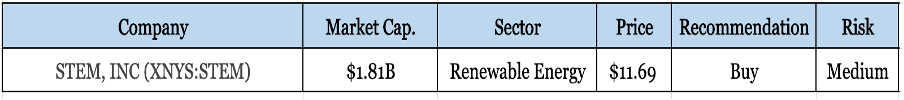

Key Data

Third Quarter 2022 Highlights

- Record Revenue of $100 million, up from $40 million (+150%) in Q3 2021 and sequentially up 49% from Q2 of $67 million

- Net Loss of $34 million versus Net Income of $116 million in Q3 2021

- 12-month Pipeline of $7.2 billion at end of Q3 2022, up from $5.6 billion (+29%) at end of Q2 2022

- Record contracted backlog of $817 million at end of Q3 2022, up from $312 million (+162%) at end of Q3 2021

- Solar monitoring AUM of 25 gigawatts (GW), down 7 GW sequentially primarily due to a one-time reduction of unprofitable platforms and customers.

- Ended Q3 2022 with $294 million in cash, cash equivalents, and short-term investments.

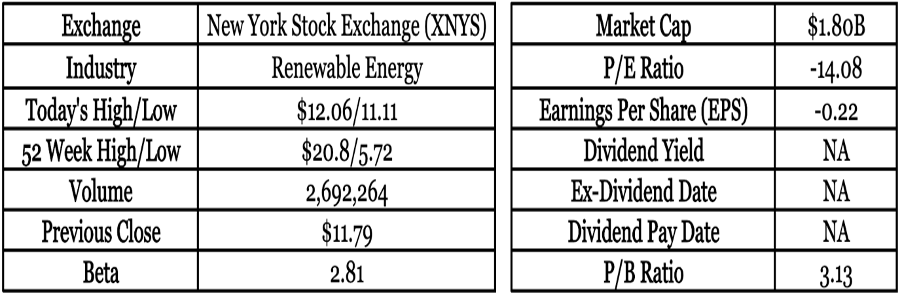

Earnings

The company reported earnings of $(0.22) for the third quarter of 2022, less than the estimate of $(0.17). Analysts estimate profits for the fourth quarter of 2022 to be $(0.71).

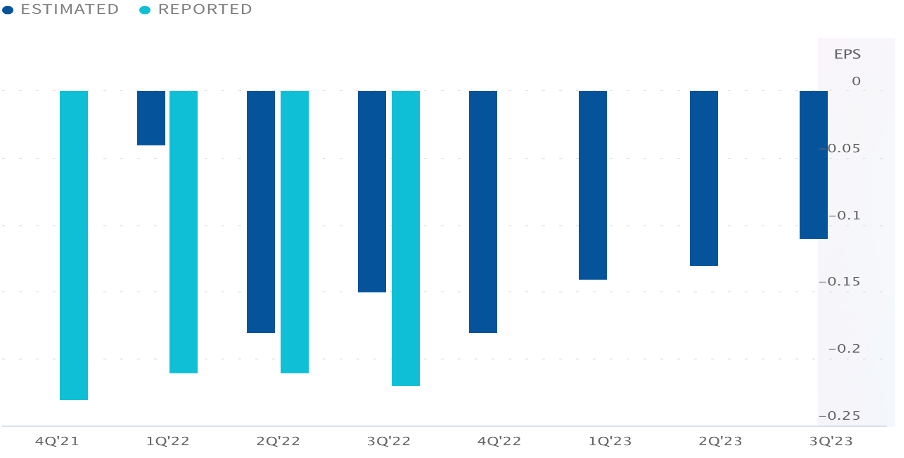

Past Earnings and Growth Analysis

In the past 5 years the profit has declined at 2.5% per year. But in last one year the company has outperformed the industry and the market by growing at 26.9%

Forecast

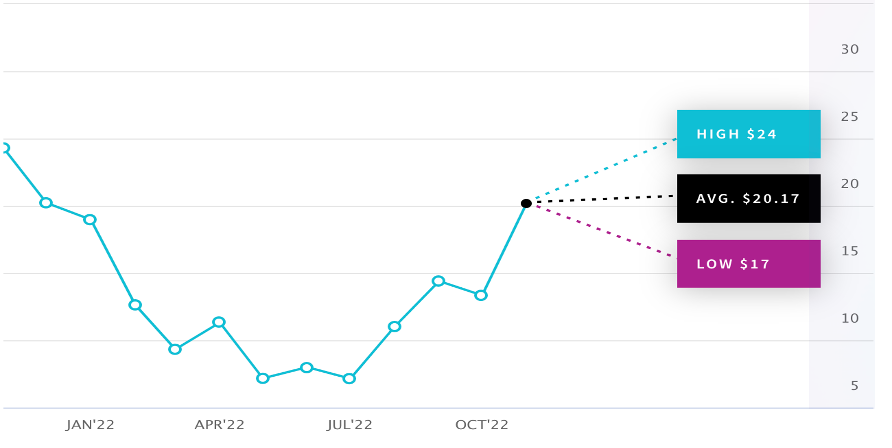

Based on 6 Wall Street analysts offering 12 month price targets for Stem Inc in the last 3 months. The average price target is $20.17 with a high forecast of $24.00 and a low forecast of $17.00. The average price target represents a 72.54% change from the last price of $11.69.

Risk factors

- There are financial risks with Stem having a 92% debt-to-equity ratio and not being cash flow positive.

- STEM has been unprofitable, and losses have increased over the past 5 years at a rate of 2.5% per year.

- In the last 12 months insiders have sold shares worth $18.62M with no insiders buying in the period.

Stock Recommendation

The Inflation Reduction Act has a large package for climate change, including solar, wind, and energy storage tax credits which will benefit Stem. It just delivered an excellent set of results. Stem has outperformed in recent quarters and increased its guidance. As per the analysts STEM is undervalued and is trading below Fair value. The rise of energy storage is accelerating at an increasing rate and Stem, a pioneer in software solutions is expected to reap benefits in a few years.

MarketFacts gives a “Buy” rating on the stock at the closing price of $11.69 as of December 2nd, 2022

| CMP (USD) (December 2, 2022) | $11.69 |

| Target Price | $17.50 |

| Recommendation | Buy |