Invest in this leading sustainable transportation vehicles manufacturer : NFI Group Inc. (XTSE:NFI)

NFI Group Inc. (TSX: NIF) is a Canadian multinational bus manufacturer, based in Winnipeg, Manitoba. NFI Group owns Alexander Dennis, ARBOC Specialty Vehicles, Motor Coach Industries, New Flyer, Plaxton, NFI Parts, and Carfair Composites. The company was founded by John Coval in 1930, NFI Group was created on June 16, 2005, as the holding company of New Flyer Industries so it could be publicly traded on the Toronto Stock Exchange.

Leveraging 450 years of combined experience NFI is leading the electrification of mass mobility around the world. With zero-emission buses and coaches’ infrastructure and technology, NFI meets today’s urban demands for scalable smart mobility solutions. Together NFI is enabling more liveable cities through connected clean and sustainable transportation.

NFI currently offers the widest range of sustainable drive systems available including zero-emission electric trolley battery and fuel cell natural gas electric hybrid and clean diesel. In total NFI supports its installed base of over 105,000 buses and coaches around the world.

Highlights and News Updates

- On April 28th, 2023, NFI Group Inc. announced that the Regional Transportation Commission of Southern Nevada has awarded its subsidiary New Flyer of America Inc. a new contract for zero-emission vehicles. This is RTC’s third zero-emission contract with NFI.

- On April 24th, 2023, NFI Group Inc. announced that it has delivered the first next-generation Enviro500EV zero-emission double deck buses to The Kowloon Motor Bus Company (1933) Limited in time for the operator’s celebration of its 90th birthday.

- On April 13th, 2023, Alexander Dennis Limited, subsidiary of NFI Group Inc. with BYD UK jointly announced that their electric vehicle partnership, the UK’s leading electric bus producer, has taken a firm order from National Express West Midlands for a further 170 double deck electric buses, to be delivered by the end of 2024.

- On April 11th, 2023, NFI Group Inc. announced proposed changes to its Board of Directors. After 17 years the Honourable Brian Tobin, O.C. P.C. will retire as Chair of NFI’s Board. Ms. Wendy Kei, who joined NFI’s Board in 2022, will replace Mr. Tobin as Chair of the Board.

- On April 5th, 2023, Alexander Dennis Limited, subsidiary of NFI Group Inc. announced plans to expand its UK Larbert head office and facility into a manufacturing site for the future.

- On April 4th, 2023, Alexander Dennis Limited subsidiary of NFI Group Inc. announced that the CAVForth autonomous bus service in East Scotland will begin on May 15, 2023, using five Alexander Dennis Enviro200AV buses.

- On January 31st, 2023, NFI’s subsidiary Alexander Dennis receives launch order for 55 of its next-generation Enviro400EV battery-electric buses from Stagecoach.

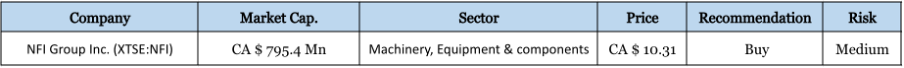

Key Data

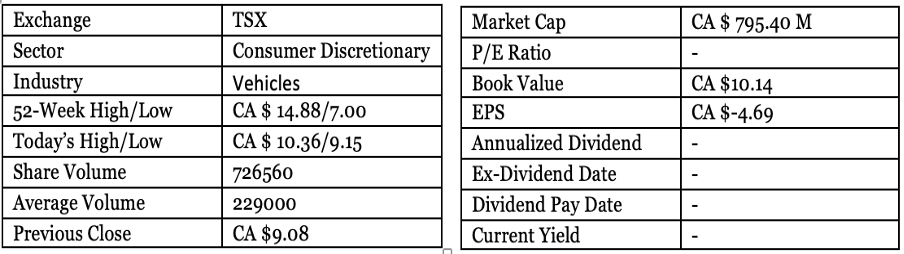

Fourth Quarter 2022 Highlights

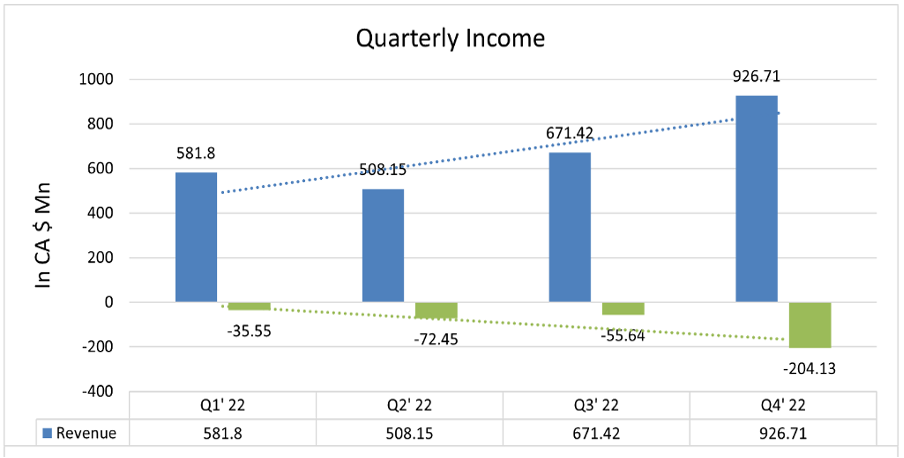

- Revenue stood at CA $926.71 Mn up by 5.8% compared to last year’s fourth quarter.

- Net loss stood at CA $204.13 Mn down by 1763% compared to last year’s fourth quarter.

- Net Margin in fourth quarter stood at -22% which was -1.25% in last year’s fourth quarter.

- Yearly revenue stood at CA $2.67Bn down by 9.18% compared to the FY2021.

- Net loss stood at CA $361.61 Mn up by 2091% compared to the FY2021.

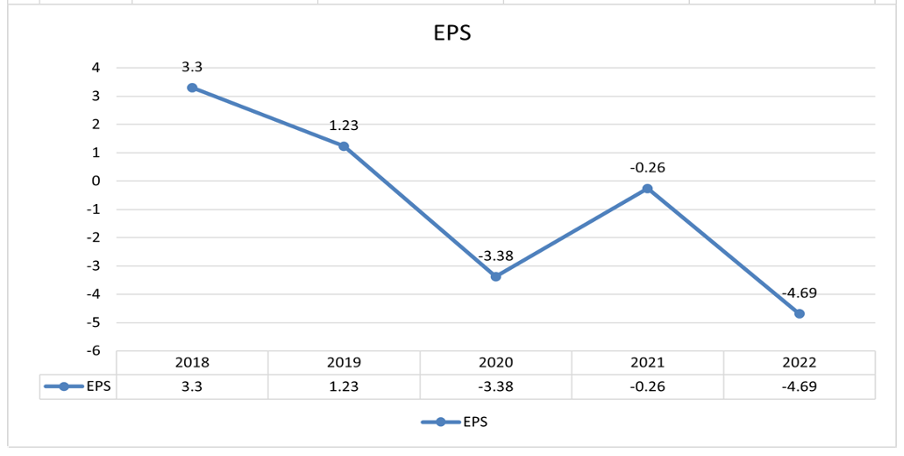

- Basic and diluted EPS stood at CA $-2.65, and yearly it was CA $-4.69.

- Active North American public bid universe up 17% year-over-year; ZEBs now represent 51% of the Total Bid Universe.

- Amended credit agreements in December 2022 and now focused on completing a new multi-year, credit agreement prior to June 30, 2023.

Financials

The negative profit for three consequent years since FY2020 is due to supply chain disruption, inflation, currency fluctuation, and goodwill impairment in ARBOC, ADL Manufacturing and in NFI’s private motor coach business, non-recurring restructuring change, less government support, Covid-19 impact, and less new vehicle deliveries.

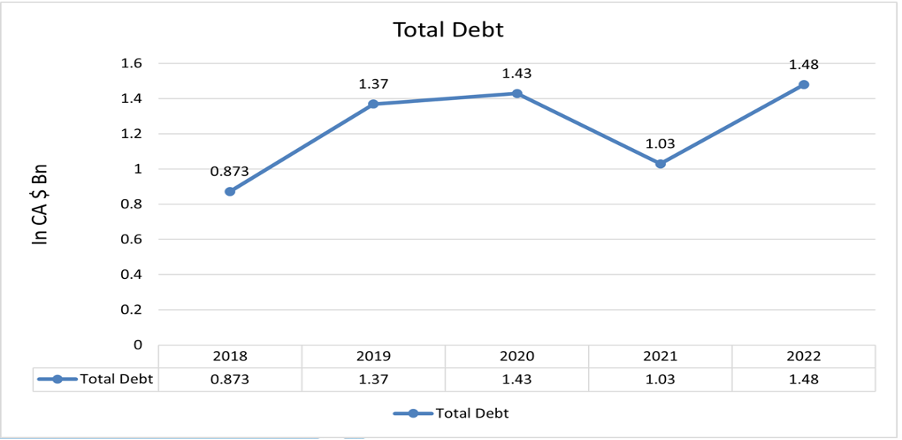

Debt has grown at CAGR of 11.13%. Although company has asset worth CA $3.51Bn, still debt is a concerning factor here.

Quarterly revenue was in uptrend in FY2022 but the yearly revenue was still down compared to FY2021. And loss of the company also widened.

Currently EPS of the company is CA $-4.69 down by 1707% compared to last year’s EPS. EPS of the company is also negative and in downtrend due to continuous loss.

Forecast

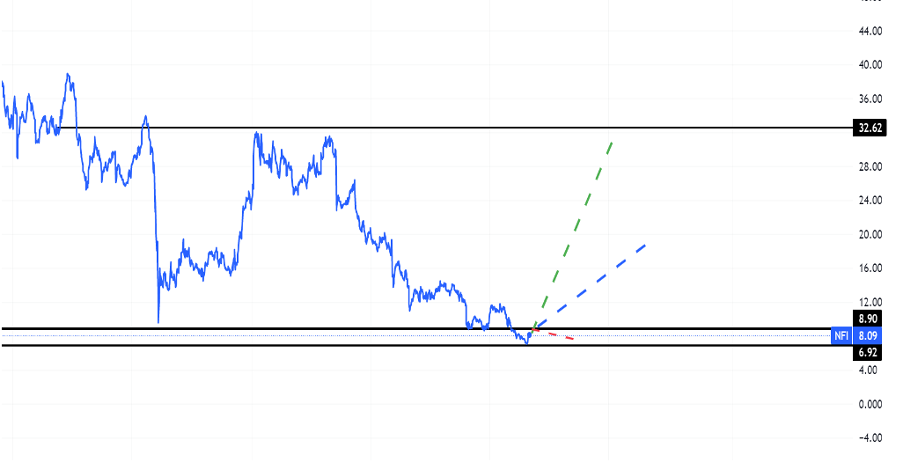

Currently, the company is trading at CA $10.31 with 1-year projected target around CA $32 and a low estimation of CA $6.90; average price target is CA $20.

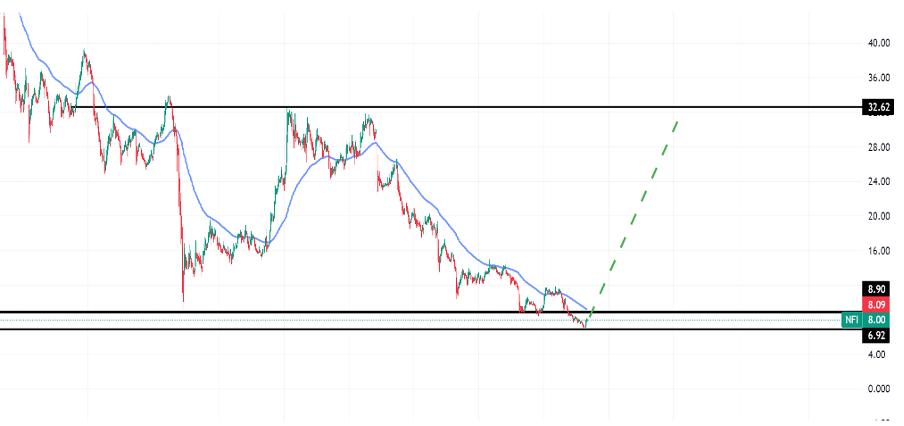

Technical Analysis

- Stock has made double bottom pattern and now it is making W like bullish pattern.

- Currently, RSI (53.95) indicator is above 50 which show it is a good time to invest in the stock as it is getting bullish.

- The stock has potential to bounce back up to 283% from current market price. Analysts are bullish on this stock.

- The stock is also going to go above 50-day EMA.

- It has also made a green bullish marubozu candle which shows stock is turning bullish.

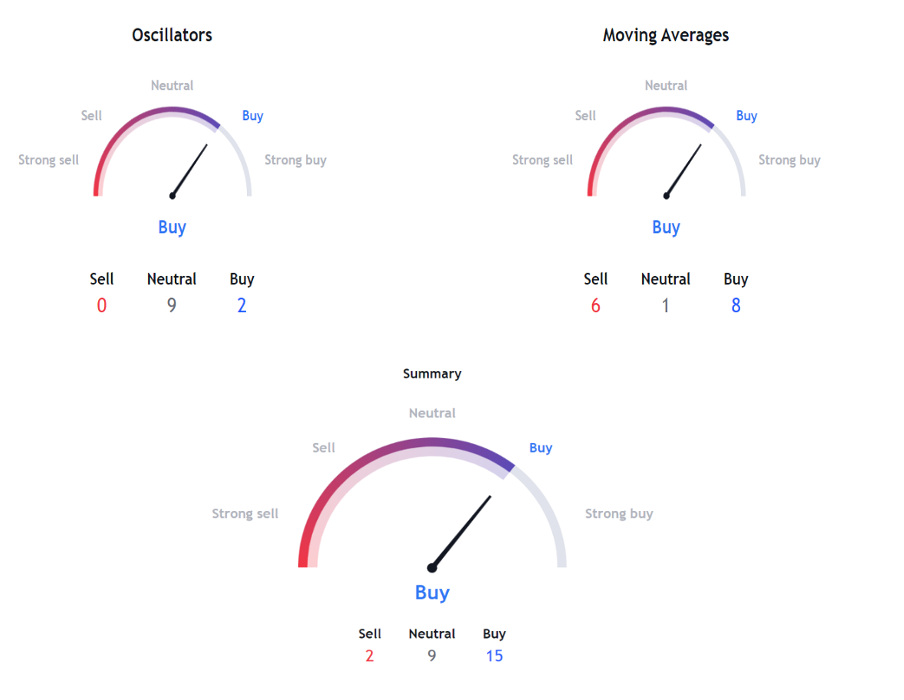

Indicators Summary – Buy

- The price action analysis of the stock is indicating a positive trend in the stock. Market sentiments are bullish.

- MACD (-0.16) indicator is giving bullish signal.

- VWAP (7.60) indicator is bullish on the stock.

Risk factors

- Due to supply chain disruption the company is not able to deliver the existing orders and there is a backlog. Because of this the revenue of the is declining.

- Debt is concerning here as the company is not able to book profit. Due to high interest rate it will be tough for them to pay back the debt which will stress out the assets.

- In the past Company was not getting support from the government but this can change in FY2023 as the current Canadian budget has allocated nice chunk of its share for the promotion of EV’s.

- Inflation has caused the price of parts to go up which in turn have decreased the profit margin of the company. The hike in production cost has impacted the company negatively.

- Currency fluctuation is also an issue as the company has booked losses due to currency fluctuation because of unstable global scenarios.

- EV businesses are very regulated business and rules regulation all around the world can impact the company.

Stock Recommendation

Although we saw company has multiple risk factors, the importance of EV cannot be denied. With the growing climate and environmental concerns all around the globe, EV is the future.. All around the world governments are pushing EV and are coming out with rules and regulations to promote EVs to reduce pollution, global warming, and decreas3 Co2 emissions.

Although company has booked consecutive losses, but things are looking up for the future of the company. Unstable global scenarios are forcing the countries to shift from traditional energy sources to EV’s, to reduce their dependency for energy on other countries. As the Russia- Ukraine war has led to EU is trying to reduce its dependency on Russia.

Company has scope to expand itself. And due to the experience it has in the field, it gives it an edge over its competitors.

MarketFacts gives a “Buy” rating on the stock at the closing price of CA $10.31 as of May 5th, 2023.

| CMP (CAD) (May 5, 2023) | CA $10.31 |

| Target Price | CA $14.25 |

| Recommendation | Buy |