Exelon Corporation (NASDAQ: EXC): A Leading Energy Provider in the U.S. Power Sector

Exelon Corporation (NASDAQ: EXC) is one of the largest regulated electric utilities in the United States, headquartered in Chicago, Illinois. Originally formed in 2000 through the merger of PECO Energy Company and Unicom, Exelon provides electricity and natural gas to over 10 million customers across Illinois, Pennsylvania, Maryland, Delaware, New Jersey, and Washington, D.C. The company previously had a major power generation business, but in 2022, it spun off this segment into Constellation Energy, allowing Exelon to focus exclusively on its regulated utility operations. With subsidiaries like ComEd, PECO, BGE, Pepco, Delmarva Power, and Atlantic City Electric, the company plays a vital role in maintaining and modernizing the electrical grid. Exelon is committed to sustainability and clean energy investments, actively working on infrastructure improvements, grid resilience, and energy efficiency initiatives. Exelon continues to prioritize reliability, innovation, and customer service in the evolving energy sector.

Highlights and News Updates

- On December 3rd 2024, Exelon Corporation Announces Chief Legal Officer and Corporate Secretary Appointment.

- On November 14th 2024, ComEd Receives 2024 ReliabilityOne® Award for Outstanding Reliability Performance in the Midwest and Outstanding Climate Action Leader.

- On August 27th 2024, Empowering Innovation and Sustainability: Exelon’s Investments in Emerging Companies Are Driving Critical Clean Energy and Climate Solutions.

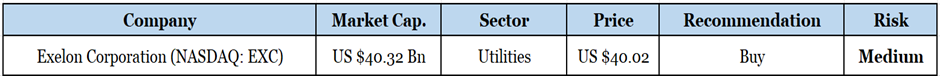

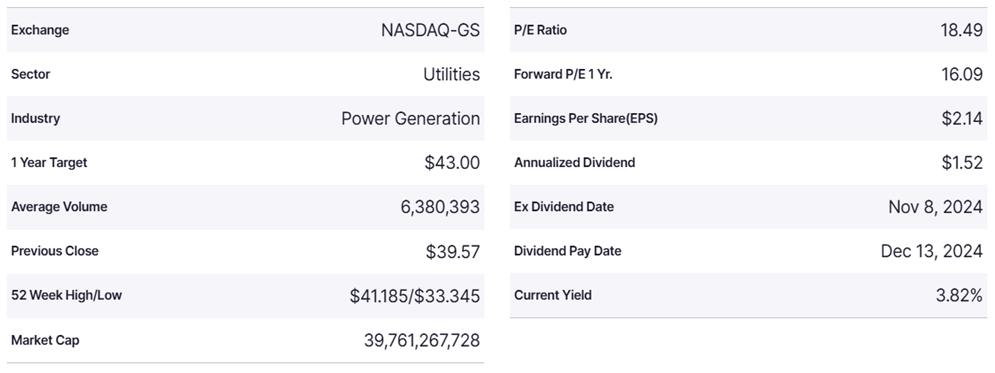

Key Data

First Quarter 2024 Highlights

- The company’s total revenue for the quarter was US $6.15 billion

- Financial Guidance reaffirmed full-year adjusted earnings forecast of US $2.40 to US $2.50 per share.

- Adjusted Operating Earnings US $0.71 per share beat estimates of US $0.67 per share.

Financials

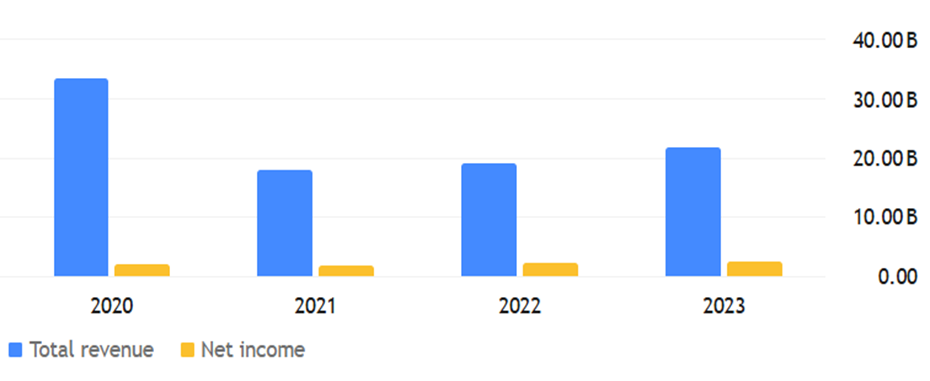

Exelon Corporation’s financial performance over the past four years shows consistent revenue growth, increasing from US $16.66 billion in 2020 to US $21.73 billion in 2023, reflecting a 30% increase. The company’s gross profit also improved significantly, rising from US $6.3 billion in 2020 to US $8.93 billion in 2023, demonstrating strong operational efficiency. Operating income grew 83% over the same period, reaching US $4.02 billion in 2023, despite rising costs. Net income applicable to common shareholders has remained stable, reaching US $2.33 billion in 2023, up from US $1.96 billion in 2020. However, interest expenses have increased alongside higher debt, which could impact future profitability. Exelon’s strong revenue growth, improving margins, and stable net income indicate solid financial health, making it an attractive investment for long-term stability and dividends.

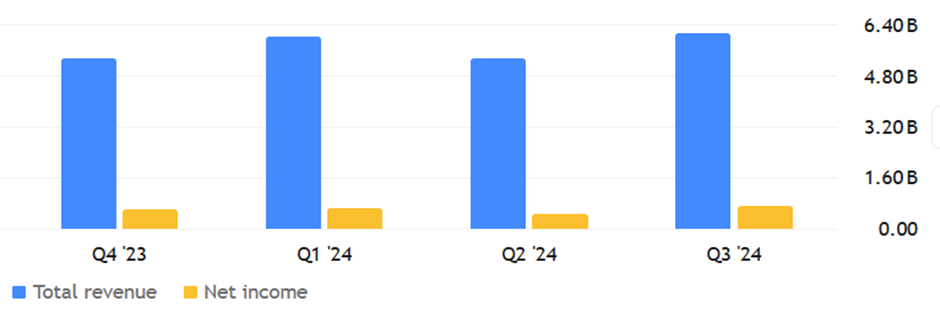

Exelon Corporation’s quarterly financials for 2024 demonstrate steady revenue growth and profitability, with total revenue reaching US $6.15 billion in Q3 2024, up from US $5.37 billion in Q4 2023. The gross profit margin remains strong, averaging 39%-41% across the quarters, reflecting operational efficiency.

Operating income peaked at US $1.2 billion in Q3 2024, a 9.4% increase from Q4 2023, while net income remained stable, exceeding US $600 million each quarter. However, interest expenses have risen, reaching US $496 million in Q3 2024, which could impact net earnings in the long run. Exelon continues to show consistent revenue growth, solid profitability, and stable earnings, making it a strong candidate for long-term investment, especially for dividend-focused and defensive investors.

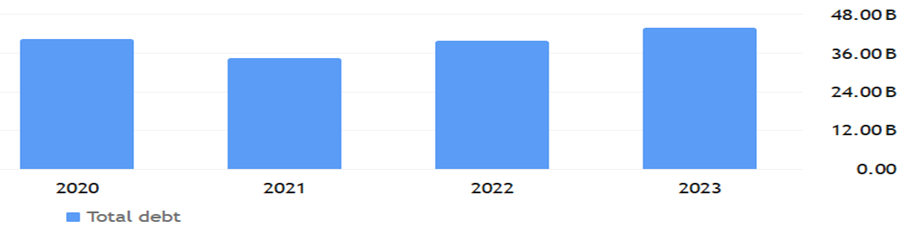

Exelon’s total debt has fluctuated over the past few years. In 2023, the company’s total debt was US $44.01 billion, showing an increase from US $40.05 billion in 2022. This marks a US $3.46 billion rise. In 2021, total debt was US $34.54 billion, indicating a significant increase from the previous year, while in 2020, the debt was US $40.63 billion, slightly higher than in 2022. The increase in debt in 2023 may be linked to ongoing investments and infrastructure projects

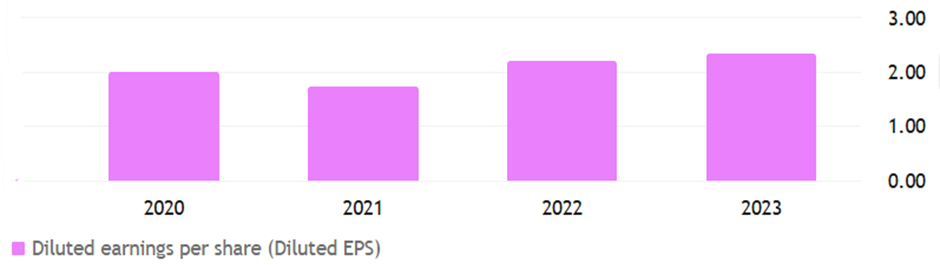

Exelon’s Earnings Per Share (EPS) has shown a positive recovery in recent years. In 2023, EPS increased to US $2.33, following a strong rise in 2022 to US $2.20. 2021 experienced a decline to US $1.74, while 2020 saw a more significant drop to US $2.01. Exelon’s EPS has been recovering since 2020, demonstrating improved earnings performance in the last few years.

Forecast

Right now, the company is trading at US $40.02 with a 1-year projected target of around US $50 and a low estimation of US $36; the average price target is US $45.

Technical Analysis

- The stock has corrected more than 17% and now it is taking support on its support level.

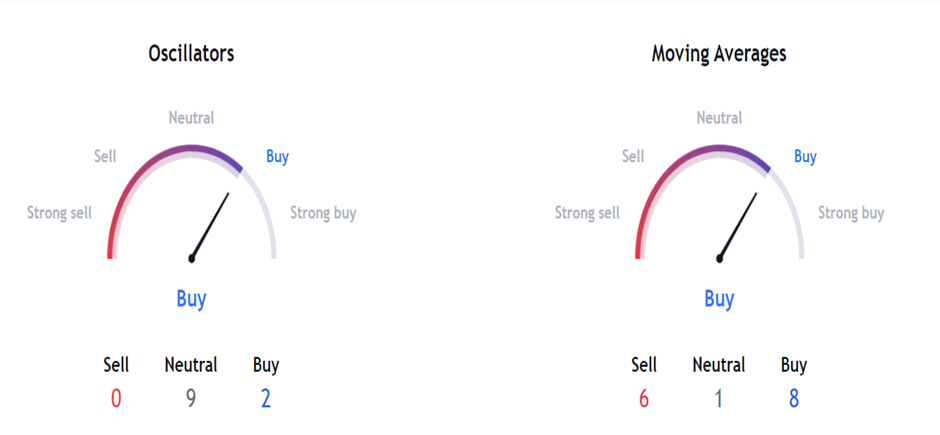

- Right now, the RSI (60.46) indicator is above 50, and it also gives us a bullish divergence.

- The stock has the potential to bounce back up to 15%-25% from the current market price. Analysts are bullish on this stock.

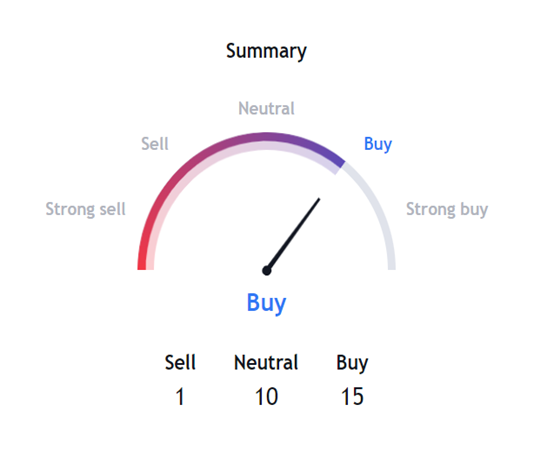

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock. Market sentiments are bullish.

- MACD (0.59) indicator is going to give a bullish signal.

- VWAP (38.82) indicator is also going to give us a bullish signal on the stock.

- The moving averages are also giving us a bullish signal.

Risk factors

Exelon Corporation, a major U.S. energy provider, faces several risk factors that could impact its operations, financial performance, and regulatory standing. These risks can be broadly categorized into regulatory, financial, operational, market, and environmental risks:

- Exelon operates in a highly regulated industry, with federal, state, and local laws affecting electricity generation, distribution, and pricing. Changes in regulations could impact profitability.

- Exelon’s nuclear plants are subject to strict oversight from agencies like the Nuclear Regulatory Commission (NRC). Non-compliance can result in fines, shutdowns, or increased operating costs.

- Policies favoring renewable energy, carbon taxes, or subsidies for competitors (e.g., wind and solar) could reduce demand for Exelon’s nuclear and fossil-fuel generation.

- State-level energy market changes, such as deregulation or subsidies for specific energy sources, could impact Exelon’s revenue and competitive position.

- Exelon has faced legal challenges related to market practices, political lobbying, and compliance issues. Ongoing or future litigation could result in financial penalties or reputational damage.

- Potential liabilities related to past pollution, hazardous waste disposal, or land use disputes could affect financial performance.

- While Exelon has a strong nuclear portfolio (which is carbon-free), its natural gas and other fossil-fuel assets could face carbon pricing, emissions regulations, or public opposition.

- Power plants, especially nuclear and fossil-fuel plants, rely on heavy water for cooling. Regulatory changes or heavy water scarcity issues could limit operations.

Stock Recommendation

Exelon Corporation is a strong investment choice due to its stable, regulated revenue stream, making it a low-volatility defensive stock with reliable cash flow and a solid dividend yield (~3-4%). As the largest U.S. nuclear power operator, Exelon benefits from the growing push for clean energy and government incentives supporting carbon-free electricity. Its focus on grid modernization, renewable energy expansion, and electrification trends positions it for long-term growth. Additionally, the company has a diverse customer base (10M+ customers) in economically strong regions, ensuring steady demand. While regulatory and policy risks exist, Exelon’s strong market position, ESG appeal, and consistent earnings make it a compelling buy for dividend, defensive, and long-term growth investors.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $40.02 as of January 30th, 2025.

| CMP (US) (January 30, 2025) | $40.02 |

| Target Price | $50 |

| Recommendation | Buy |

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.