Edison International: Powering Returns Through Clean Energy Transformation

Company Overview

- Ticker: EIX (NYSE)

- Headquarters: Rosemead, California, USA

- Founded: 1886

- CEO: Pedro J. Pizarro (as of 2025)

- Industry: Regulated Electric Utilities

Core Business

Edison International is a public utility holding company and the parent of Southern California Edison (SCE) — one of the largest electric utilities in the United States.

The company:

- Delivers electricity to ~15 million people across Central, Coastal, and Southern California.

- Operates, maintains, and upgrades high-voltage transmission lines, substations, and distribution systems.

- Through its subsidiaries, it also focuses on clean energy transition, grid modernization, and energy advisory services (via Edison Energy and Trio).

Industry Overview: U.S. Electric Utilities

U.S. Utility Sector (2024)

- A regulated industry with stable cash flows and dividend reliability

- Focus shifting toward: Renewable integration, Grid resilience, and Electrification (EVs, heat pumps).

California Focus

- One of the most aggressive states in decarbonization

- Requires large-scale infrastructure investment and regulatory coordination

Key Growth Drivers

1. Grid Modernization & Decarbonization

- Upgrading infrastructure to support distributed energy and renewables.

- SCE is investing heavily in fire-resistant equipment and system hardening.

2. Electrification Trends

- Supporting state-wide moves to electrify buildings and transport.

- Benefitting from California’s push toward carbon neutrality by 2045.

3. Renewable Integration

- Large-scale solar, wind, and battery projects are being connected to SCE’s grid.

- Regulatory support for “green capital” programs.

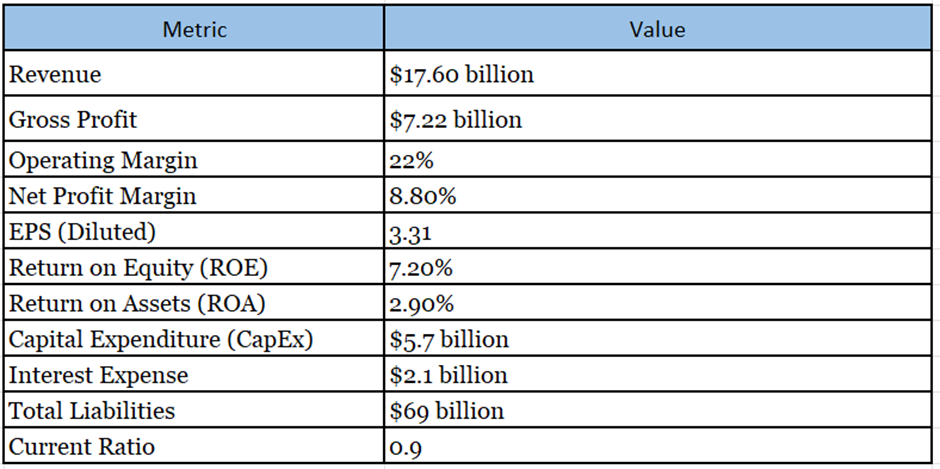

Financial Overview (Fy 2024)

- Revenue: $17.60 billion

- Net Income: $1.3 billion

- Operating Income: $2.93 billion

- Total Assets: $85 billion

- Total Debt: $36.6 billion

- P/E Ratio (Current): 15x

Key Financials

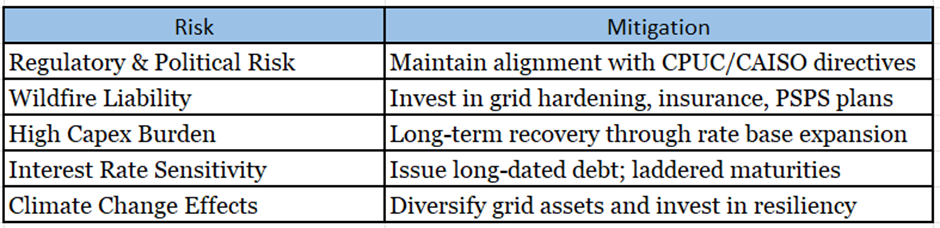

Risks

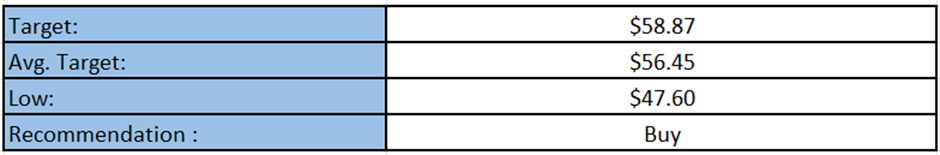

Target

Right now, the company is trading at US $50.81, with a 1-year projected target of around US $58.87 and a low estimation of US $47.60; the average price target will be US $56.45.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $50.81 as of May 26th, 2025.

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.