DBA Sempra (NYSE: SRE) – Leading energy infrastructure company

DBA Sempra (NYSE: SRE), headquartered in San Diego, California, is a leading energy infrastructure company operating both domestically and internationally. Originally incorporated in 1996 and formerly known as Sempra Energy until its name change in May 2023, the company operates through three main segments: Sempra California, Sempra Texas Utilities, and Sempra Infrastructure. Sempra California provides electric services to approximately 3.6 million people and natural gas services to around 3.3 million people in San Diego County, covering a significant area of 4,100 square miles. Additionally, this segment’s infrastructure supports a broader service area of 21 million people over 24,000 square miles. In Texas, Sempra Texas Utilities engages in regulated electricity transmission and distribution, operating an extensive network that includes 18,298 circuit miles of transmission lines and 125,116 miles of overhead and underground distribution lines. Sempra Infrastructure focuses on developing, building, operating, and investing in energy infrastructure projects that facilitate the energy transition across North America and globally. With its substantial investment in critical infrastructure and commitment to sustainable energy solutions, Sempra plays a pivotal role in meeting the evolving energy needs of diverse markets.

Highlights and News Updates

- On June 13th, 2024, Sempra’s Southern California Gas Adds 21 Ford Electric Vans to Fleet.

- On June 5th, 2024, Entergy Texas proposes natural gas power plants as electricity needs surges.

- On June 4th, 2024, Sempra Energy (SRE) Rides on Investments and Strong Demand.

- On May 28th, 2024, Over 268,000 are still without power in Texas, and other states because of storms. Texas power company Oncor, a unit of California-based Sempra Energy had the most outages with over 135,000 customers without power in the Dallas-Fort Worth area. Oncor said it had already restored power to over 500,000 customers.

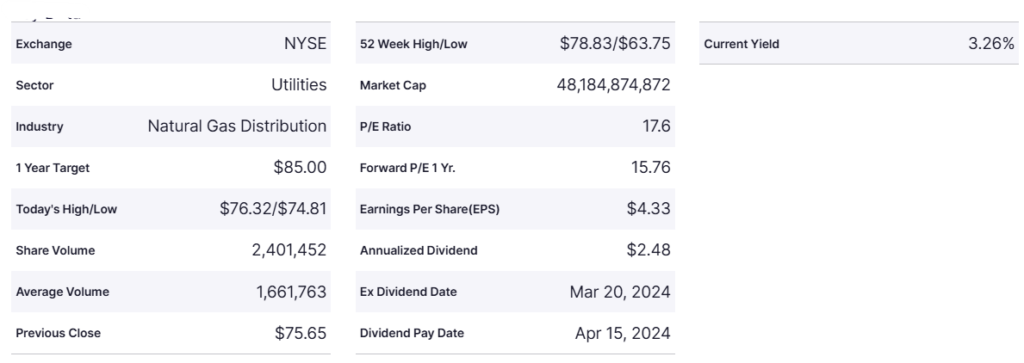

Key Data

First Quarter 2024 Highlights

- Sempra reported US $3.64 billion in revenue, down 44.5% over the same period last year.

- EPS came in at US $1.34, compared to US $1.46 in the year-ago quarter.

- The company booked a net profit of US $801 million compared to US $969 million down by 17.33%.

Financials

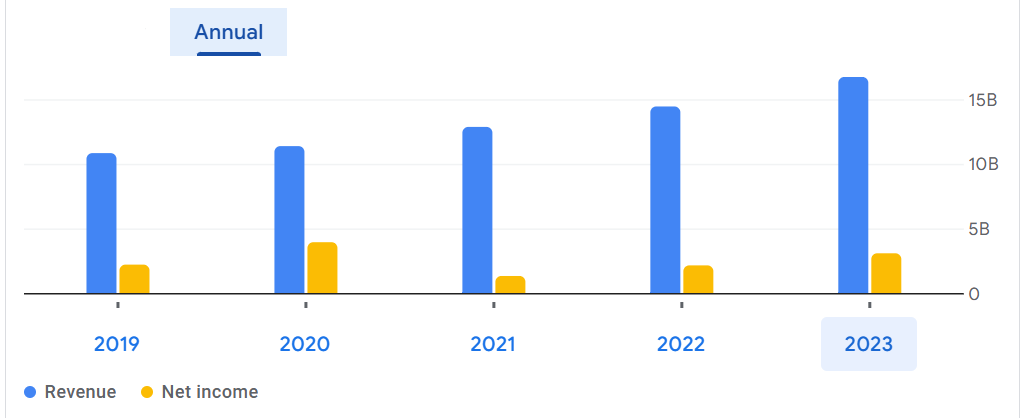

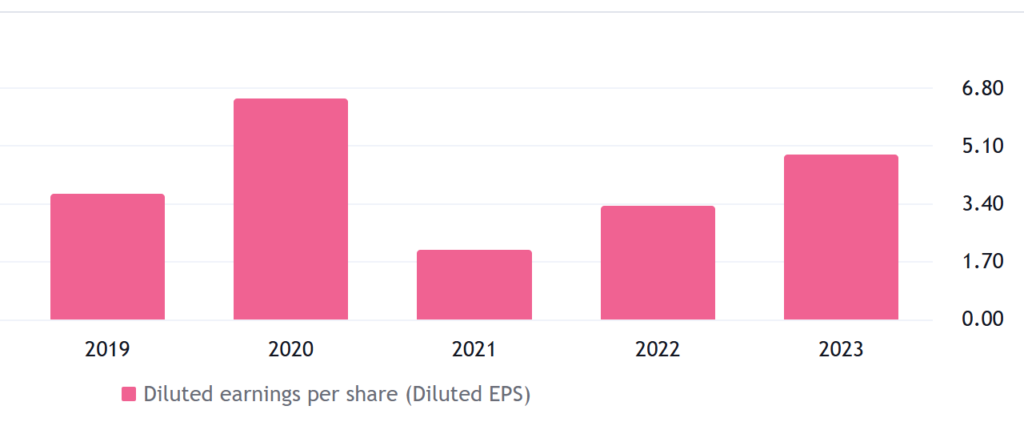

Sempra has exhibited a robust growth trajectory, increased revenues, and improved profitability. Total revenue steadily rose from US $11.37 billion in 2020 to US $16.72 billion in 2023, demonstrating a consistent annual growth trend. This increase is accompanied by a rise in the cost of revenue, which reflects the expanding scale of operations, yet gross profit also improved significantly, reaching US $6.62 billion in 2023.

Operating income and EBIT have shown similar upward trends, with operating income increasing from US $2.30 billion in 2022 to US $3.72 billion in 2023, indicating effective cost management and operational efficiency. Despite higher interest expenses, earnings before tax have more than doubled from US $1.34 billion in 2022 to US $2.63 billion in 2023. Net income from continuing operations also saw a notable rise to US $3.08 billion in 2023, underscoring the company’s resilience and ability to generate higher profitability.

However, net income applicable to common shareholders in 2023, while improved from the previous years, is still lower than the peak in 2020, suggesting some variability in financial performance. Overall, Sempra’s financial trend indicates strong growth, operational effectiveness, and a positive outlook for continued expansion and profitability in the energy infrastructure sector.

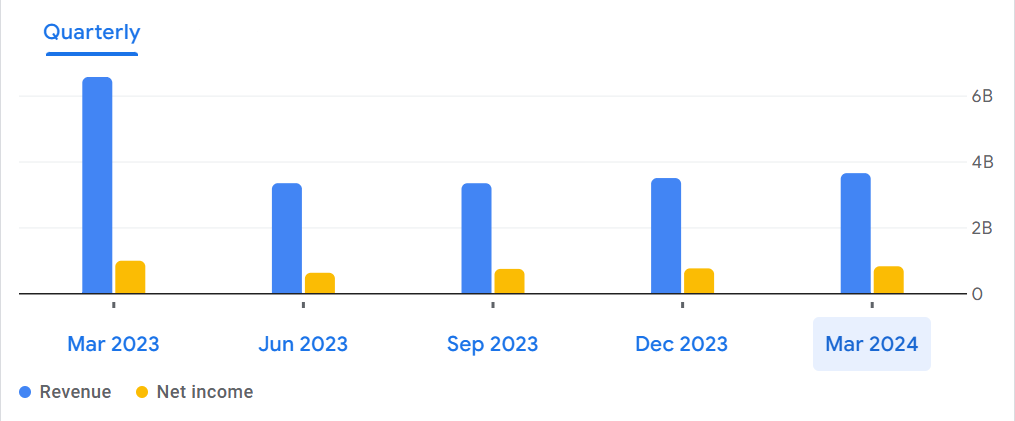

Sempra’s quarterly financial performance for the fiscal year 2023-2024 shows consistent revenue generation and profitability. Total revenue increased to US $3.64 billion in the first quarter of 2024 from US $3.49 billion in the fourth quarter of 2023, US $3.33 billion in the third quarter of 2023, and US $3.34 billion in the second quarter of 2023. The cost of revenue fluctuated, peaking at US $2.07 billion in the fourth quarter of 2023 before dropping to US $1.96 billion in the first quarter of 2024. Despite these variations, gross profit increased to US $1.68 billion in the first quarter of 2024 from US $1.42 billion in the fourth quarter of 2023.

Operating expenses remained relatively stable, with Sales, General, and administrative expenses slightly increasing from US $148 million in the second quarter of 2023 to US $184 million in the first quarter of 2024. Other operating items also showed a steady rise, reaching US $594 million in the first quarter of 2024. Consequently, operating income saw growth, hitting US $898 million in the first quarter of 2024 from US $680 million in the previous quarter.

Earnings before interest and tax (EBIT) rose to US $1.01 billion in the first quarter of 2024 from US $766 million in the fourth quarter of 2023. Despite consistent interest expenses, earnings before tax (EBT) improved to US $705 million in the first quarter of 2024, up from US $452 million in the previous quarter. Notably, the income tax expense showed significant variability, with a negative US $9 million in the fourth quarter of 2023 compared to US $172 million in the first quarter of 2024.

Minority interest remained substantial, with a slight decline from US $395 million in the fourth quarter of 2023 to US $348 million in the first quarter of 2024. Equity losses from unconsolidated subsidiaries continued, with a loss of US $69 million in the first quarter of 2024. Despite these factors, net income from continuing operations increased to US $812 million in the first quarter of 2024 from US $748 million in the previous quarter.

Net income applicable to common shareholders followed this positive trend, rising to US $801 million in the first quarter of 2024 from US $737 million in the fourth quarter of 2023. These quarterly results highlight Sempra’s ability to maintain revenue growth and profitability despite fluctuations in costs and expenses, indicating a strong and resilient operational performance.

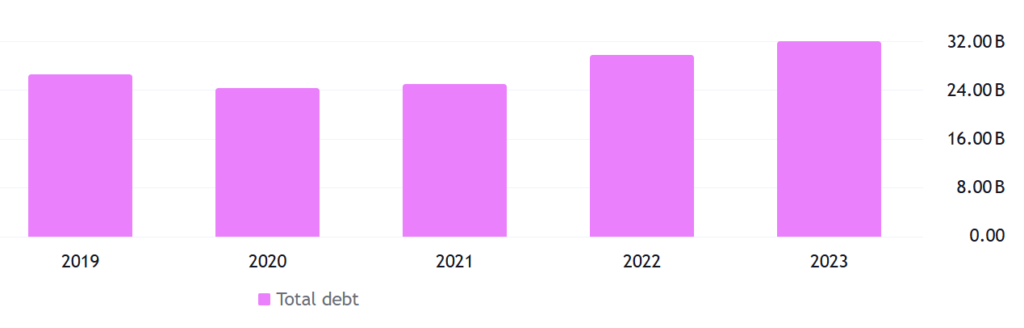

The company has a total debt of US $32.07 billion. The company also has assets worth US $87.18 billion including cash of US $285 million. The company also has a capital surplus of US $15.732 billion. The debt of the company is high, and it is common for the company in the energy sector.

Currently, the EPS of the company is US $4.79 compared to last year’s EPS of US $3.31.

Forecast

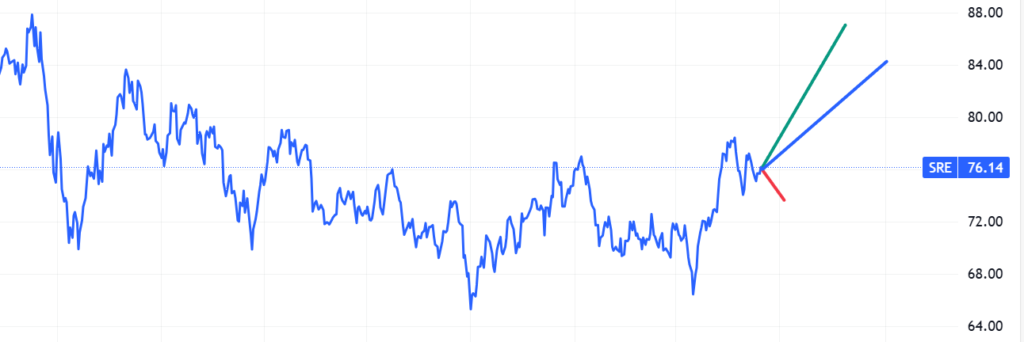

Right now, the company is trading at US $76.14 with a 1-year projected target of around US $87 and a low estimation of US $73.53; the average price target is US $84.26.

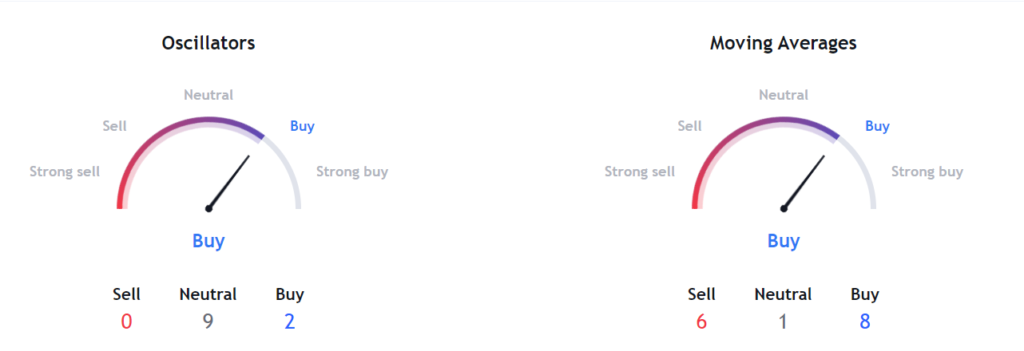

Technical Analysis

- The stock has corrected more than 12% and now it is taking support on its support level.

- Right now, the RSI (54.16) indicator is above 50, and it also gives us a bullish divergence.

- The stock has the potential to bounce back up to 10%-14% from the current market price. Analysts are bullish on this stock.

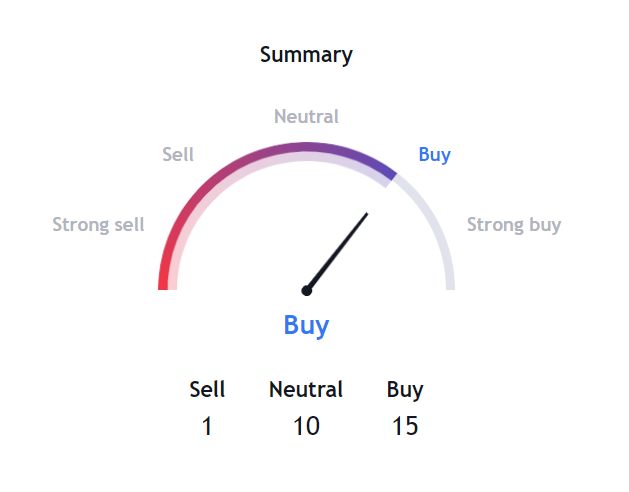

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock. Market sentiments are bullish.

- MACD (0.39) indicator is going to give a bullish signal.

- The momentum (1.72) indicator is also going to give us a bullish signal on the stock.

- The moving averages are also giving us a bullish signal.

Risk factors

Here are specific risk factors related to Sempra Energy:

- Sempra Energy operates in a heavily regulated industry, and changes in regulations, policies, or compliance requirements could impact operations and financial performance. Regulatory decisions related to rates, environmental standards, and energy market reforms could affect revenue streams and operational costs.

- Fluctuations in energy prices, supply, and demand can impact Sempra Energy’s financial results. Changes in commodity prices, such as natural gas and electricity, affect revenue from its utility subsidiaries, including Southern California Gas Company (SoCalGas) and San Diego Gas & Electric (SDG&E).

- Sempra Energy faces risks related to environmental regulations and climate change policies. Increased focus on reducing carbon emissions and transitioning to renewable energy sources may require significant investments in infrastructure and technology, potentially impacting profitability.

- Operational disruptions, including natural disasters, cyberattacks, and infrastructure failures, pose risks to Sempra Energy’s ability to deliver reliable energy services. Maintenance of aging infrastructure and integration of new technologies also present operational challenges.

- Sempra Energy’s financial performance is sensitive to interest rate fluctuations, credit rating changes, and access to capital markets. High levels of debt and financial leverage increase vulnerability to economic downturns and market volatility.

- Intense competition within the energy sector, particularly in renewable energy development and energy efficiency solutions, could pressure Sempra Energy’s market share and profitability. Rapid technological advancements and shifts in consumer preferences for sustainable energy sources add complexity to competitive dynamics.

Stock Recommendation

Sempra Energy (SRE) is a compelling investment due to its consistent revenue growth, diversified operations, and strategic infrastructure investments. Operating through segments in California, Texas, and infrastructure development, Sempra benefits from stable, regulated income streams and a strong presence in key markets. Its focus on sustainability and technological innovation aligns with global energy trends, enhancing long-term growth prospects. Strong financial performance and operational efficiency demonstrate the company’s resilience, while experienced leadership provides confidence in its strategic direction. Overall, Sempra’s solid financial health and forward-thinking approach make it an attractive option for investors seeking stability and growth in the energy sector.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $76.14 as of June 13th, 2023.

| CMP (US) (June 13, 2024) | $76.14 |

| Target Price | $87 |

| Recommendation | Buy |

The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.