Algonquin Power & Utilities Corp. (TSX: AQN): A Sustainable Investment for a Greener Future

Algonquin Power & Utilities Corp. (TSX: AQN) is a prominent Canadian company specializing in both renewable energy generation and regulated utility services. Founded in 1988 and headquartered in Oakville, Ontario, Algonquin operates across North America, providing essential services in electricity, natural gas, and water distribution.

Algonquin’s core operations are divided into two main segments: renewable energy and regulated utilities. In its renewable energy segment, Algonquin develops and operates a portfolio of wind, solar, and hydroelectric power projects. This focus aligns with the company’s commitment to sustainability and reducing its carbon footprint. The regulated utilities segment provides essential services through its subsidiaries, which manage infrastructure for electricity, water, and natural gas distribution.

Algonquin is dedicated to advancing environmental stewardship and supporting the transition to a greener energy landscape, all while ensuring stable returns for its investors and high-quality service for its customers.

Highlights and News Update

- On June 14th, 2024, Algonquin Power & Utilities announced the settlement rate for the share purchase contracts that are part of its outstanding corporate units issued in June 2021.

- On May 28th, 2024, Algonquin Power & Utilities said that it backs Energy Capital Partners’ proposed CA $2.56 billion acquisition of Atlantica Sustainable Infrastructure.

- On May 3rd, 2024, Algonquin Power & Utilities retained its “sector perform” rating and CA $7 price target by Analysts amid reports of the potential sale of subsidiary Atlantica Sustainable Infrastructure.

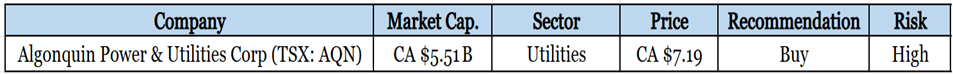

Key Data

Second Quarter 2024 Highlights

- Algonquin Power & Utilities Corp reported quarterly adjusted earnings of 9 cents per share for the quarter ending in June, higher than last year, when the company reported EPS of 8 cents.

- The company’s Revenue fell 4.7% to US $598.60 million from a year ago; analysts expected US $625.00 million.

- The company reported quarterly net income of US $200.8 million.

- Algonquin Power & Utilities Corp shares had risen by 5.6% this quarter and lost 2.1% so far this year.

Financials

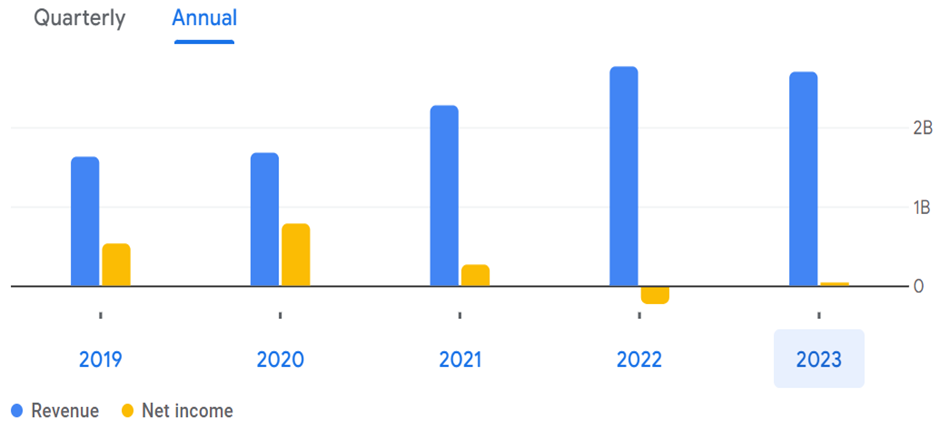

The financial analysis reveals several key insights about the company’s performance over the past four years. The company has shown consistent growth in total revenue, increasing from US $1.68 billion in 2020 to US $2.69 billion in 2023. Operating revenue trends align closely with total revenue, suggesting stable core business performance. Gross profit has also improved significantly, rising from US $1.28 billion to US $1.96 billion, though there is some fluctuation in gross profit margins, particularly a decrease from 2022 to 2023.

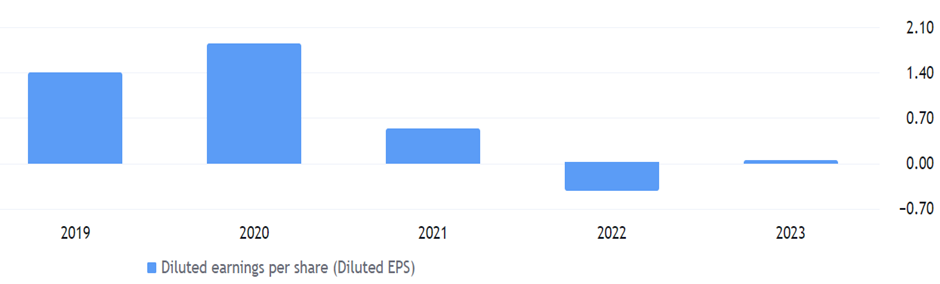

Selling, general, and administrative expenses have remained relatively stable, which is a positive sign of controlled operational costs. Depreciation and amortization expenses have increased, reflecting a larger asset base and possibly higher capital expenditures. Operating income has improved from US $343 million in 2020 to US $477 million in 2023, indicating better operational efficiency. However, net income shows significant volatility, peaking at US $782 million in 2019 but turning negative in 2022 before recovering to US $28 million in 2023.

Despite these challenges, the company’s EBITDA, although declining from a peak of US $1.29 billion in 2020, has shown some recovery to US $718 million in 2023. The company has demonstrated revenue growth and operational efficiency, but it faces challenges related to high expenses and interest costs, impacting net income and EPS stability.

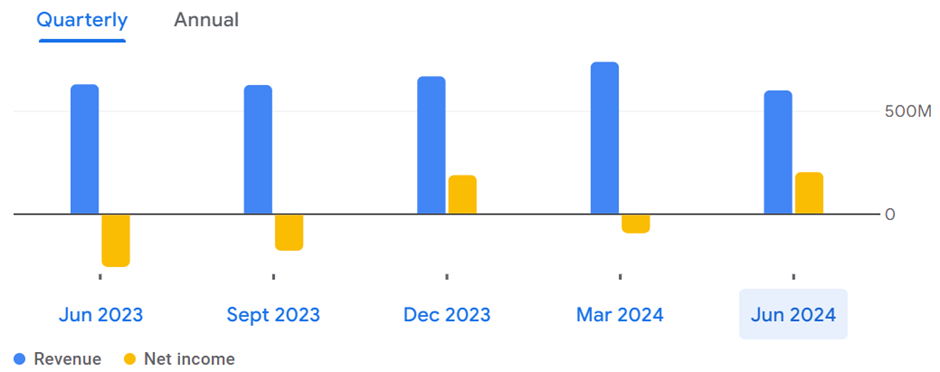

The company’s financial performance has shown significant variability across the observed periods. While total revenue has fluctuated, ranging from approximately US $598.6 million in June 2024 to US $737.1 million in March 2024, the gross profit has remained relatively stable, indicating consistent profit margins despite revenue changes. Operating expenses have gradually increased, reaching US $406.8 million in June 2024, which could be due to higher operational costs or strategic investments. Despite these rising expenses, the company has generally maintained positive operating income, though it saw a decrease from US $141 million in March 2024 to US $82.2 million in June 2024.

Net income has been highly volatile, with periods of both profit and loss. For instance, net income was US $200.8 million in June 2024, but there was a significant loss of US $89.1 million in March 2024. Interest expenses have consistently been high, impacting net non-operating income, although interest income has provided some relief.

The company has also experienced fluctuations in other income and expenses, particularly with gains and losses on the sale of securities. Special charges related to restructuring, mergers, and acquisitions have also contributed to financial instability. Consequently, the company’s EBIT and EBITDA have been inconsistent, with some quarters showing positive results while others have been negative, which reflects operational challenges.

The company is facing financial instability marked by fluctuating revenues, inconsistent net income, and varying profitability. The combination of rising operating expenses, high-interest burdens, and special charges has led to financial volatility, highlighting the need for stabilization in its operations and financial management to achieve sustained growth and profitability.

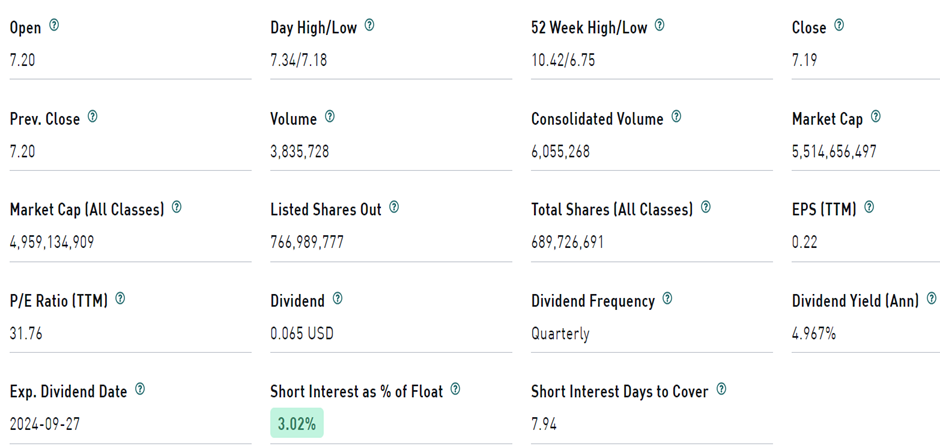

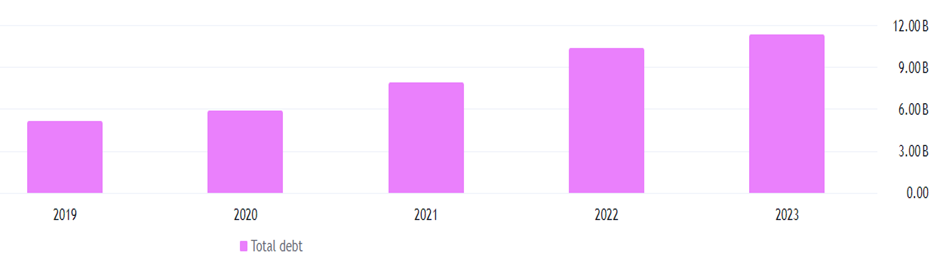

The company has a total debt of US $8.52 billion. The company also has assets worth US $18.37 billion including cash of US $56.14 million. The debt is problematic here it can pressure the liquidity of the company.

Right now, the EPS of the company is at US $0.03 compared to last year’s EPS of -US $0.33.

Forecast

Right now, the company is trading at CA $7.19, with a 1-year projected target of around CA $8.76 and a low estimation of CA $6.87; the average price target will be CA $8.09.

Technical Analysis

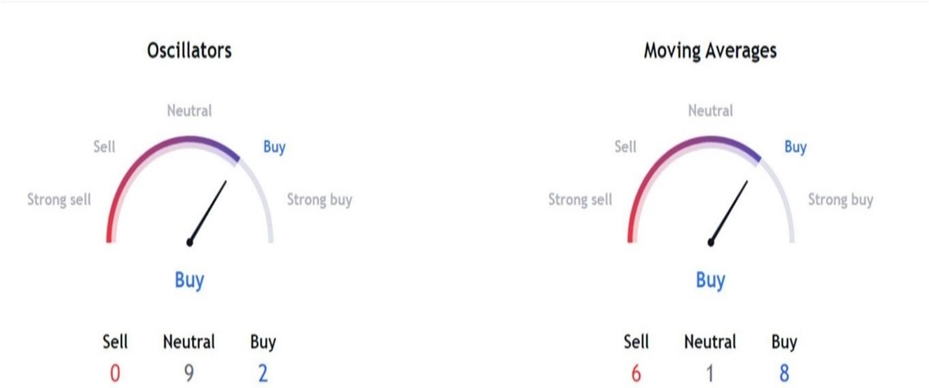

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Right now, the RSI (38.07) indicator gives a positive sign, which shows it is a good time to invest in this stock. It is also giving a bullish divergence.

- The stock has the potential to bounce back up to 12%-22% from the current market price.

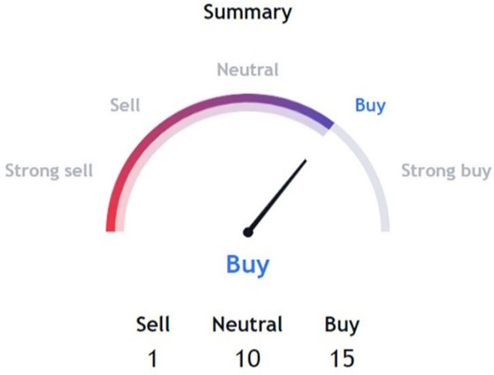

Indicators Summary- BUY

- Market sentiment is bullish, and stocks can go up further.

- 100 days EMA and 50 days EMA also give a positive sign pushing the price upwards.

- VWAP is also giving us a buy signal.

Risk factors

There are some risks involved with Algonquin Power & Utilities Corp.

- As a utility company, Algonquin is heavily regulated. Changes in government policies, regulations, or tariffs can significantly affect the company’s operations and profitability.

- Algonquin operates a diverse portfolio of utility and renewable energy assets, which can be subject to operational challenges such as equipment failures, natural disasters, or other disruptions.

- Algonquin’s business relies on its ability to secure financing for its projects. If the company’s credit rating were to be downgraded, it could face higher borrowing costs or difficulty in accessing capital, which could hinder growth and expansion plans.

- The company carries a substantial amount of debt, making it sensitive to fluctuations in interest rates.

- Algonquin undertakes large-scale renewable energy and utility infrastructure projects that can face delays, cost overruns, or failure to achieve expected returns.

Stock Recommendation

Algonquin Power & Utilities Corp. offers a compelling investment opportunity due to its diversified business model. The company operates in both regulated utilities and renewable energy, providing a balance of stable, predictable revenues and growth potential in the expanding renewable energy sector. Its strong presence in wind, solar, and hydroelectric power positions it well to benefit from the global shift towards cleaner energy sources. This focus on renewables is expected to drive long-term growth, making it an attractive choice for investors seeking exposure to sustainable energy.

Additionally, Algonquin’s ongoing investments in renewable projects and strategic acquisitions enhance its growth prospects and shareholder value. Algonquin’s commitment to environmental, social, and governance (ESG) practices aligns with the increasing interest in sustainable investing. The company’s strategic acquisitions have expanded its asset base and diversified its revenue streams. With favorable industry trends and an experienced management team, Algonquin is well-positioned to deliver long-term value to its shareholders.

Market Facts gives a “Buy” rating on the stock at the closing price of CA $7.19 as of September 4th, 2024.

| CMP (CA) (September 4, 2024) | $7.19 |

| Target Price | $8.76 |

| Recommendation | Buy |

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.