With the demand for Lithium skyrocketing, give your portfolio a boost by investing in Lithium Americas Corp: (NYSE:LAC)

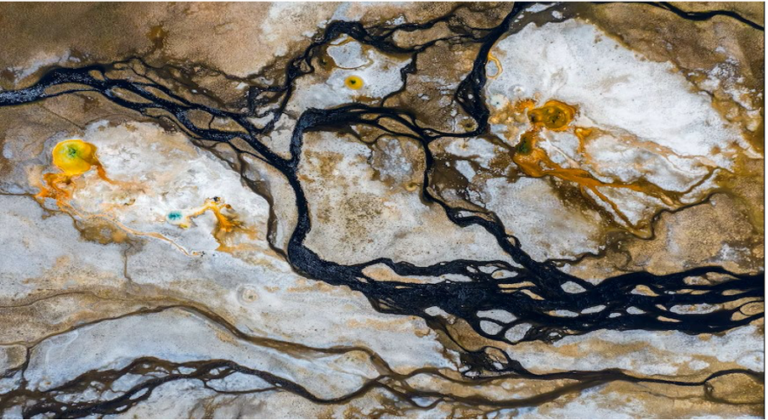

Lithium Americas Corp. (TSX: LAC) is dedicated to driving forward lithium projects in Argentina and the United States with a clear focus on achieving production. In the northern region of Argentina, the Caucharí-Olaroz project is making remarkable progress towards its first production milestone. Notably, it stands as the largest new brine operation to emerge in over two decades. Moreover, the Pastos Grandes basin, situated near Caucharí-Olaroz, holds immense potential for regional growth and development.

On another front, Thacker Pass in northern Nevada takes centre stage as the largest known measured and indicated resource of lithium in the United States. Construction has recently commenced at Thacker Pass, following the receipt of a notice to proceed from the Bureau of Land Management. This exciting development solidifies the company’s commitment to expanding its presence in the U.S. market.