Why NASDAQ Plunged Over 4500 Points This Year

The U.S. stock market is off to a brutal start in 2022. The Nasdaq composite, which is heavily weighted in technology stocks, has seen a more severe loss, plummeting over 25% so far this year. Nasdaq composite already lost over 4500 points.

According to Morningstar, the Nasdaq Composite Index produced an annualized return of 15.4% over the 10 years through April 28, 2022.

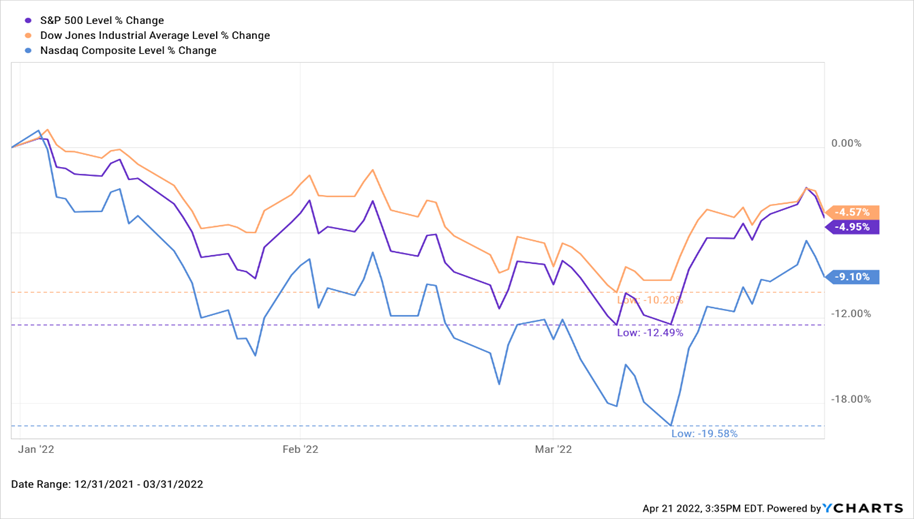

The Nasdaq Composite’s 9.1% drop in Q1 2022 was the worst since the 14.2% drop in Q1 2020 when the COVID-19 hit. The Nasdaq’s 12% decrease in April 2022 was its worst since a 17.4% plunge in October 2008, during the height of the global financial crisis.

Most of the damage has been the result of inflation, rising interest rates, and the war in Ukraine. Adding to the woes is China’s strict anti-COVID policies giving rise to more disruptions to worldwide trade and supply chains dragging down its economy, which for years was a main driver of global growth.

Fed raising interest rate to combat the rising inflation

The Federal Reserve’s sudden move from doing everything it could to prop up financial markets and the economy to trying to aggressively manage inflation has caused most of the damage. As the pandemic spread in 2020, the Federal Reserve implemented emergency policies to help stabilise the economy, which encouraged investors to buy equities and other riskier assets. However, the Fed said in early 2022 that it will shift to tighter monetary policy to combat rising inflation, signalling a substantial shift in the investing environment.

- Along with cutting its benchmark rate, the Fed lowered the reserve requirement to 0% in March 2020

- In March this year, The Federal Reserve hiked interest rates for the first time since 2018, increasing it by 25 basis points.

- The central bank hiked rates by another 50 basis points earlier in May, the largest increase in 22 years.

- Fed Chair Jerome Powell hinted that more hikes could be on the way as it begins to unwind assets it had stockpiled to fight the pandemic’s aftermath. Traders are anticipating another interest rate hike in Fed’s June meeting.

- As the borrowing becomes more expensive; it will automatically lead to slowing down the economy. The Fed faces the risk of causing a recession if it raises rates too much or too rapidly.

The rising rates will deter investors from investing in riskier expensive investments, when at the same time they can earn more by investing in fixed return Treasury bonds. Higher bond yields, in particular, dull the charm of technology and other high-growth sectors, which are valued for their projected cash flows and lose appeal as bond yields climb. So, there might be a paradigm shift of investments from the equity to bonds which may weaken the market further.

Russia- Ukraine war

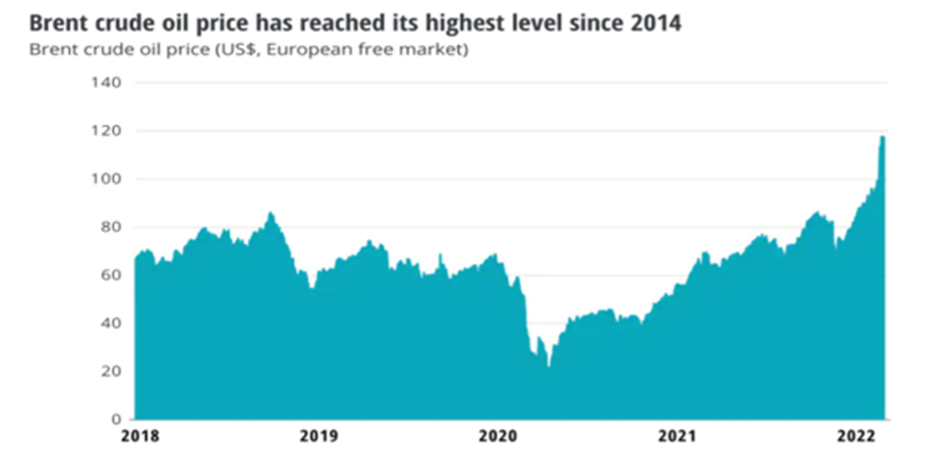

- The United States and its European allies responding to Russia’s military aggression through economic sanctions, including the cutting Russian financial institutions off the global financial system by removing them from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system led to interest rate hikes in Russia which in turn resulted in higher gas prices and pushed up oil and other commodity prices while simultaneously raising concerns about Europe’s economy.

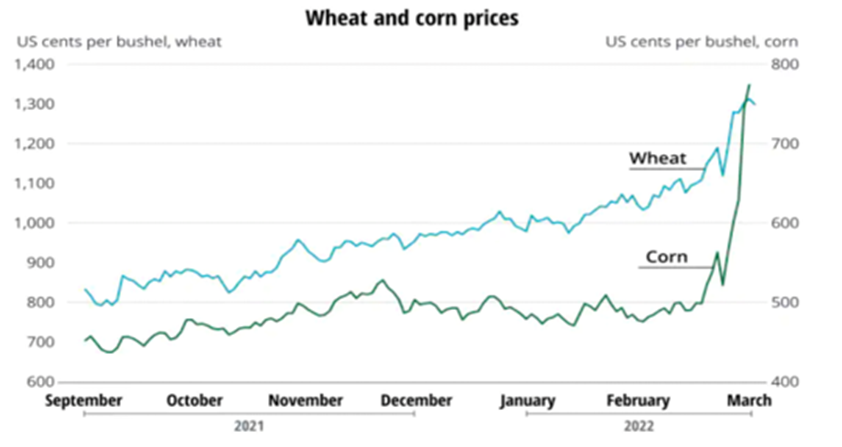

- If global commodity prices continue to rise, many nations, particularly in Europe, may see faster and extended high inflation. Global oil and natural gas prices climbed dramatically in the week following the commencement of the war, particularly in Europe.

- Furthermore, the prices of major mineral and food commodities such as nickel, palladium, neon, wheat, and corn have risen.

- Another significant danger to the global economy is the impact of the crisis on vital commodity supply chains. Major container shippers have halted all cargo bookings to and from Russia, with the exception of shipments of food and medical. This comes on top of the United Kingdom’s decision to bar all Russian ships from entering British ports. Meanwhile, European and Russian planes are prohibited from flying across each other’s airspace. As a result, flights between Europe and Asia must follow longer and more expensive routes.

- EU trade with Russia is strongly concentrated in energy. 40 percent of EU gas imports, 25 percent of oil imports, and 47 percent of imported solid fuels come from Russia. As the crisis has a significant negative impact on the European economy it could spill over into the United States because of the extensive trade between the United States and Europe.

- Furthermore, Russia and Ukraine are significant manufacturers of commodities used in the manufacture of semiconductors and batteries. If Russian and/or Ukrainian exports of these goods are restricted, global prices would rise, resulting in shortages, which will damage some US industries, increase inflation, and reduce potential output.

China’s rigid policies to combat COVID-19

- Just as the city was emerging from a month of rigorous lockdown following an outbreak, Shanghai authorities have tightened the restrictions again. China’s tough policies are feared to cause greater disruptions in global supply chains.

- For example, Tesla, having a factory in Shanghai and China being a major market for its electric vehicles, was one of the biggest laggards on the Nasdaq Composite.

In conclusion, as huge U.S. firms have been able to rake in significant profits during the pandemic, stock prices have remained strong amid economic turmoil. But this year’s earnings season has elicited less enthusiasm. While firms are reporting higher earnings than projected for the most recent quarter, there are plenty of signals that future development is stifled.

As people looked for new ways to work and occupy themselves while cooped up at home, several tech-oriented businesses saw profits rise as a result of the pandemic. However, after their stock prices soared on the assumption of future gains, slowing profit growth makes their equities vulnerable.

Thanks to the rapid growth of the most successful companies with Nasdaq-listed stocks, including Microsoft and more recently Apple and Alphabet Nasdaq rose to prominence. But the negative side of Nasdaq Composite being so top-heavy where 40% of the Nasdaq Composite’s index weight being relies on the top 6 companies makes it more volatile.

Furthermore, the index’s high-growth stocks tend to be more economically sensitive and volatile as a result. The Nasdaq Composite may be a standout when the market is performing well: despite a difficult March, it gained 43.6 percent in 2020, following a 35.2 percent gain in 2019. But when the things get rough the index suffers more than the other more stable indexes as can be seen from its 40.5 percent loss in 2008—or the first four months of 2022.