Why Gold Is Gaining Momentum: Key Drivers Behind Its Growth

Gold has been a trusted store of value for centuries, but in recent years it has moved beyond a traditional safe‑haven asset to become a strategic part of many portfolios. With global markets shifting and investor preferences evolving, gold stocks and precious metals equities are showing renewed strength. Let’s explore the factors fueling this rise and why gold continues to shine.

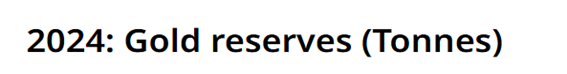

📈 Central Bank Accumulation and Global Demand

One major reason behind gold’s growth is the increasing demand from central banks and institutional investors. Nations looking to diversify away from over-reliance on the U.S. dollar have steadily increased their reserves, adding to upward pressure on gold prices. This trend supports natural resource investing and has put gold stocks gaining momentum back in the spotlight for global investors.

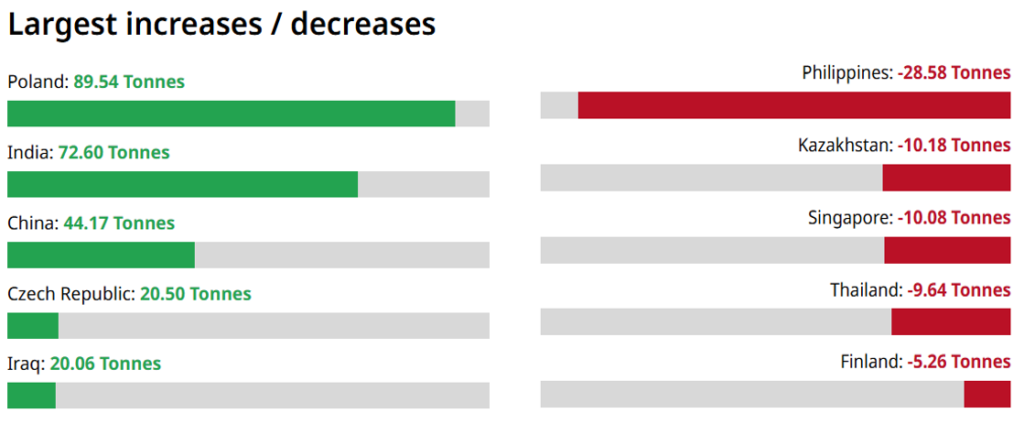

🌍 Geopolitical Uncertainty and Safe‑Haven Appeal

Geopolitical tensions and economic uncertainties often lead investors toward safer assets. Whether it’s trade issues, currency instability, or concerns about inflation, gold stands out as a hedge. For those exploring commodity investment insights, gold remains a preferred choice to protect capital, particularly when other asset classes like equities face volatility.

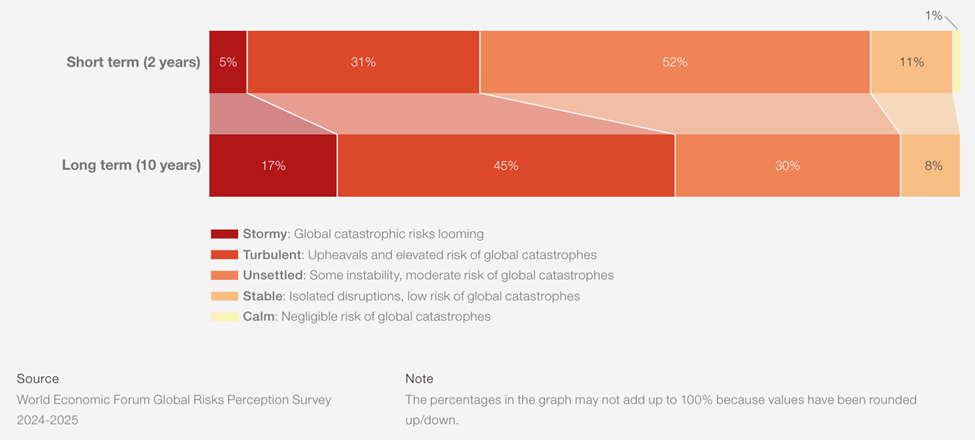

💡 Strong Performance in Natural Resources and Mining

A surge in exploration and development across Canadian mining stocks and global mining operations has also contributed to growth. Companies involved in precious metals equities are benefiting from rising prices and improved margins, making them attractive for investors seeking gold stocks to hedge against inflation or diversify portfolios with tangible assets.

🔋 Shift Toward Commodities in Portfolio Strategies

Portfolio managers are increasingly adopting strategies that include a mix of equities, bonds, and commodities. As part of natural resource investing, gold provides a counterbalance to traditional markets. This is particularly relevant when comparing gold stocks gaining momentum with sectors like energy or technology, allowing investors to benefit from multiple growth areas. Rising gold price shows the increasing demand of gold.

📊 Market Liquidity and Accessibility

With easier access through ETFs, futures, and US stock market research on gold miners, retail and institutional investors alike can now tap into the gold market without holding physical bullion. This liquidity supports a growing investor base, further amplifying demand for precious metals equities and commodity investment insights.

🌱 Sustainability and Long-Term Potential

Interestingly, gold mining companies are also improving operational efficiency and environmental practices. For investors focused on sustainability in their portfolios, natural resource investing in gold is increasingly seen as aligned with broader environmental, social, and governance (ESG) goals, making it appealing alongside renewable energy stocks or other green investments.

✅ Key Takeaways for Investors

- Central banks and institutions are buying more gold, boosting demand.

- Economic uncertainty drives flows into safe-haven assets.

- Canadian mining stocks and global gold producers are benefiting from high prices.

- Access to gold markets is easier than ever through modern platforms.

- Gold’s role in diversified portfolios continues to expand.

Gold’s ongoing momentum reflects deep structural factors—demand from central banks, portfolio diversification trends, and strong mining sector performance. For investors seeking commodity investment insights or exploring gold stocks gaining momentum, now is a good time to research opportunities in natural resource investing and watch how precious metals equities continue to perform in global markets.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions in an increasingly complex world.