The Weaponisation of Finance: Power, Sanctions, and Global Resilience

The “weaponisation of finance” refers to the strategic use of financial mechanisms such as sanctions, asset freezes, and exclusion from global payment systems to achieve geopolitical objectives. While these tools can be effective in compelling compliance or punishing adversaries, their increasing deployment raises significant questions about global economic resilience and the future of the international financial order.

The Mechanisms of Financial Weaponisation

Financial weaponisation operates through several key channels:

- Sanctions: These are the most common form of financial weaponisation, imposing restrictions on economic activities with targeted individuals, entities, or entire countries.

- Exclusion from Global Payment Systems: Blocking a country’s access to SWIFT can effectively cut it off from the majority of global finance, making it incredibly difficult to conduct cross-border business.

- Asset Freezes and Seizures: Governments can freeze or even seize the assets of foreign central banks, state-owned enterprises, or individuals held within their jurisdiction. This can deprive a target country of critical financial resources and leverage.

- Export Controls on Critical Technologies: While not purely financial, restrictions on the export of essential technologies can severely cripple a country’s economic and military capabilities, impacting its long-term financial health and competitiveness.

Consider the example of sanctions against Russia following its actions in Ukraine. These sanctions have targeted various sectors, including finance, energy, and technology. The freezing of central bank assets and the partial exclusion of Russian banks from SWIFT were unprecedented in scale, demonstrating the willingness of major powers to deploy extreme financial measures.

Impact on Global Economic Resilience

The weaponisation of finance has profound implications for global economic resilience:

- Disruption of Supply Chains

- Increased Financial Volatility

- Search for Alternatives and De-dollarisation

- Erosion of Trust in the International Financial System

- Humanitarian Consequences

Data and Trends

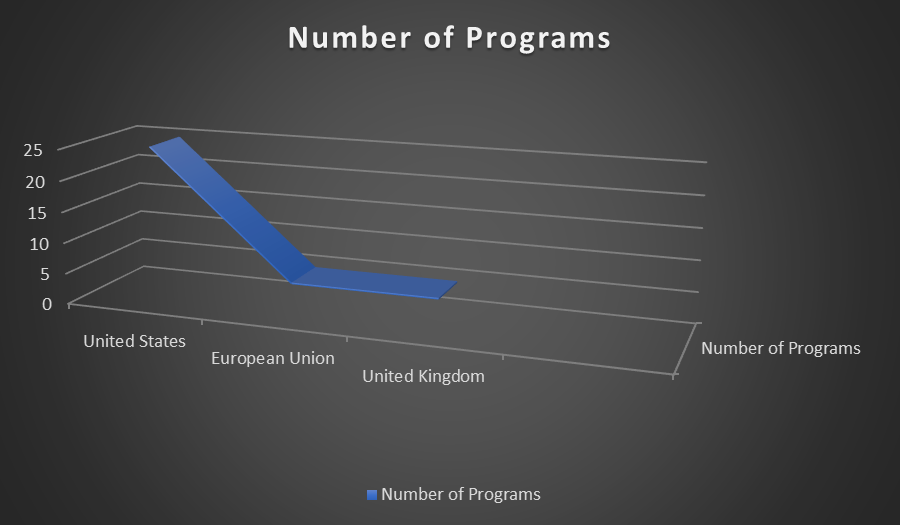

This chart demonstrates a clear upward trajectory in the number of active US sanctions programs, particularly in the last decade, highlighting the increasing reliance on this tool.

Addressing these challenges requires a multi-pronged approach, focusing on diversification, multilateral cooperation, and the development of robust, resilient economic systems capable of weathering the storms of financial statecraft. The ongoing evolution of this phenomenon demands continuous scrutiny and adaptive policy responses to ensure a stable and equitable global economy.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.