Shutdown Looms: Market Caution and Fed Uncertainty Ahead

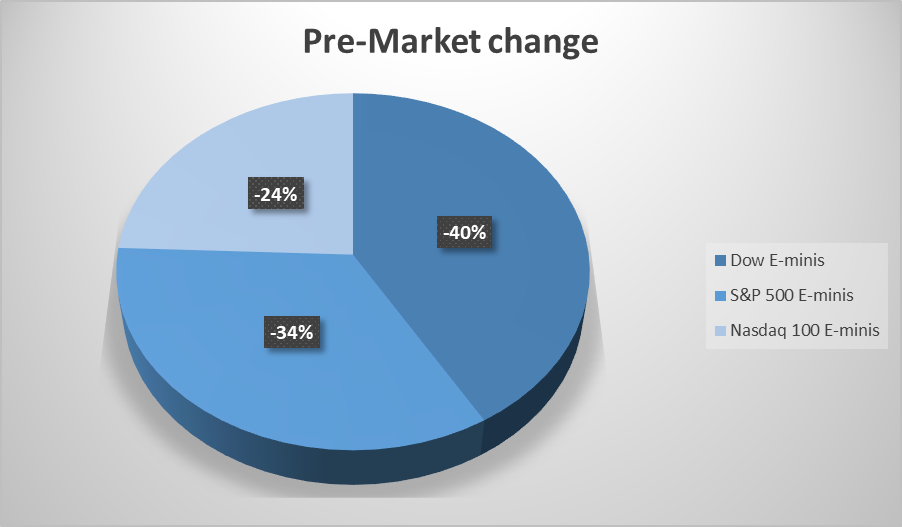

U.S. stock futures indicated a lower open on Wall Street on the final trading day of the quarter, as investor caution intensified over the high probability of a U.S. government shutdown. The political gridlock in Washington, which threatens to halt non-essential federal operations, is injecting uncertainty into markets already sensitive to economic indicators and the Federal Reserve’s policy path.

The Shutdown Impact on Investor Sentiment

The primary concern driving the risk-off sentiment is not the shutdown’s typical short-term economic impact, which history suggests is often minimal and quickly recovered. Instead, the immediate anxiety centers on the potential delay in the release of key economic data.

- Data Dependent Fed:- The Federal Reserve maintains a data-dependent stance, making upcoming economic reports crucial for investors hoping to solidify expectations for the central bank’s rate trajectory.

- Delayed Reports:- A shutdown would likely postpone the release of significant data from agencies like the Bureau of Labor Statistics, including the all-important Nonfarm Payrolls report due on Friday. This data blackout clouds the outlook for monetary policy and makes Tuesday’s economic releases, such as the JOLTS report on job openings and the Conference Board’s consumer confidence index, subject to heightened scrutiny.

End of Quarter Dynamics.

Despite the recent wobble, the major U.S. indices—the S&P 500, Nasdaq, and Dow Jones Industrial Average are still positioned to notch gains for the quarter, marking the second consecutive quarterly rise. However, the looming shutdown is an untimely disruption to what has been a period of solid performance.

Beyond the immediate market reaction, the potential shutdown arrives at a delicate point in the U.S. economic cycle. Inflation remains above the Federal Reserve’s comfort zone, while labor markets show early signs of cooling. Any disruption in government operations or data flow could blur the real-time economic picture, complicating policy decisions ahead of the next FOMC meeting. Moreover, with global markets already on edge from slowing growth in Europe and persistent geopolitical risks, investors are viewing the U.S. standoff as another layer of uncertainty in an increasingly fragile macro environment.

The uncertainty, nonetheless, is prompting a flight to safety in some corners, with the U.S. dollar facing downward pressure and the Japanese yen strengthening as a safe-haven currency.

The immediate reaction to the shutdown threat, as seen in the slipping futures, reflects caution over data disruption, but many long-term investors are historically inclined to view any weakness spurred by government-shutdown anxiety as a potential buying opportunity.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.