Retail Investors vs Wall Street: Who’s Winning the Battle for Small-Cap Dominance in 2025?

In 2025, financial markets are witnessing a fascinating tug-of-war: retail investors—empowered by mobile platforms and social media—are increasingly challenging Wall Street’s dominance, especially in the realm of penny stocks, micro-cap companies, and small-cap investment ideas.

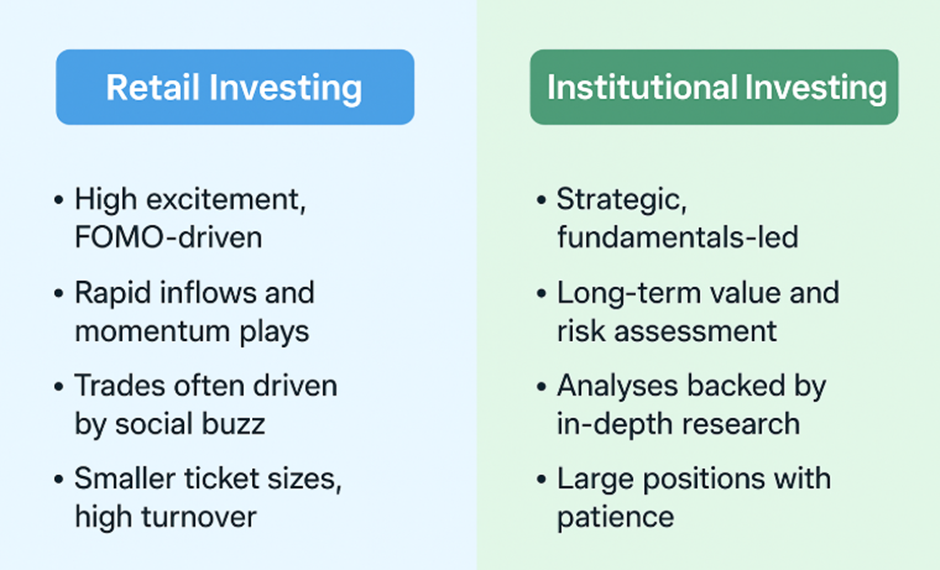

The Rise of Retail Momentum

- Social media and online communities (like X/Twitter forums, Reddit boards, and Discord groups) have made small-cap and penny stocks more accessible and hyped than ever before.

- Driven by narratives like “10x growth micro-cap winners”, many retail investors are pushing obscure Canadian penny stocks and U.S. small-cap stocks into the spotlight.

- Mobile brokers with zero trading fees and fractional shares allow these investors to engage with emerging growth stocks and make swift trades.

Wall Street’s Strategic Edge

- Institutional investors, including hedge funds and mutual funds, bring rigorous equity research, data analytics, and deep due diligence when targeting emerging technology stocks, EV plays, or dividend growth stocks.

- These investors often focus on sustainable fundamentals—not hype—when evaluating undervalued micro-cap companies or TSXV and OTC market opportunities.

- Institutions generally look to build positions in companies with scalable business models, solid earnings growth, and manageable risk.

When Retail Trends Meet Institutional Strategy

The interplay between these two forces creates volatility—and sometimes, opportunity—for small-cap and speculative sectors: from AI stocks analysis to green energy equities and penny/micro-cap sectors.

Why This Matters for Investors

- Retail momentum can ignite short squeezes, spike trading volume, and drive sharp price moves—especially in low-liquidity small-cap names.

- Institutional capital often arrives on the heels, providing validation and driving sustained value appreciation—especially if supported by strong fundamentals.

- Savvy investors blend both: tracking stock alerts for small-cap opportunities and pairing retail-led price surges with rational equity research for small-cap investors.

Final Takeaway

The confluence of social media-driven retail trading and strategic institutional analysis is reshaping how small-cap markets perform in 2025. Retail buzz may launch the rocket—but it’s fundamental research that keeps it flying.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.