Gold, Oil, and Bitcoin: How They Are Reshaping Diversification

In today’s fast-moving financial markets, the definition of diversification is evolving rapidly. For decades, investors relied primarily on a blend of equities and bonds to manage risk and pursue returns. But shifting macroeconomic dynamics, persistent inflation, and geopolitical tensions have underscored the need to invest in safer and inflation hedging assets.

Commodities—once considered tactical tools—are increasingly becoming core components of modern portfolios. Gold, oil, and Bitcoin, each with unique characteristics, are at the forefront of this transformation.

The Enduring Appeal of Gold

Gold has always played a dual role: a store of value and a hedge against currency debasement. In times of economic uncertainty or geopolitical stress, it often benefits from a flight to safety and acts as an inflation hedge asset. Over the past few years, as central banks pursued aggressive monetary easing and geopolitical risks intensified, gold demand surged.

Beyond its defensive qualities, gold is also gaining traction among institutional investors as a strategic asset that can improve risk-adjusted returns over the long term. Allocations to gold often remain relatively modest—typically in the 3–10% range—but its low correlation to equities and bonds can provide meaningful diversification benefits, making it one of the best assets to invest.

Oil: The Barometer of Global Growth

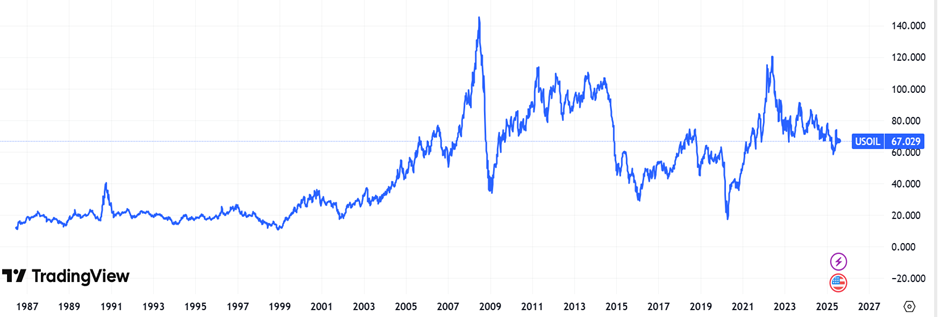

Oil is deeply entwined with economic activity, inflation expectations, and supply chain dynamics. Prices can be volatile, driven by geopolitical events, production decisions by OPEC+, and changes in global demand.

While many investors historically approached oil exposure via energy equities or futures, recent innovations—such as commodity-focused ETFs—have made direct participation more accessible. Oil can serve as both a cyclical play and an inflation hedge. Various emerging oil stocks offer potential upside when traditional assets struggle in commodity-led inflationary cycles.

However, it’s important to recognize that oil also carries higher volatility and geopolitical risk compared to other commodity exposures. As part of a broader diversification strategy, it can complement defensive assets like gold. It is also important to look for in-depth research and financial advice to invest in securities related to oil.

Bitcoin: Digital Commodity or Speculative Bet?

Bitcoin has emerged as a new and often controversial element of the diversification conversation. While some investors view it purely as a speculative instrument, others consider it “digital gold”—a decentralized store of value independent of fiat currencies and government policy. It is considered ideal to start your crypto currency investment journey.

Bitcoin’s volatility far exceeds that of gold or oil, but its limited supply and growing institutional adoption have encouraged some investors to carve out a small allocation. It is as a potential hedge against currency debasement making it an ideal asset to invest in 2025.

Incorporating Bitcoin requires careful consideration of portfolio objectives and risk tolerance. For many investors, a modest allocation—often less than 2%—strikes a balance between potential upside and significant drawdown risk.

Rethinking Diversification

In a world where traditional correlations can break down—especially during crisis periods—being a safer asset, commodities can play a vital role in strengthening portfolio resilience. The challenge lies in finding the right mix along with suitable investment advice.

- Gold for stability and long-term wealth preservation.

- Oil for cyclical exposure and potential inflation protection.

- Bitcoin for an uncorrelated (albeit volatile) growth opportunity.

The past few years have shown that relying solely on equities and bonds may leave portfolios exposed to unforeseen shocks. By incorporating a diversified basket of commodities along with expert investment guidance, investors can pursue a more robust strategy—one that adapts to the evolving economic landscape and provides them with good return investments.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.