Fed Chairman vs. President Trump: How Their Clash Shapes Markets and Investment Strategies

When analyzing the US stock market research landscape, investors often focus on corporate earnings and sector trends. However, one of the most important forces shaping market sentiment is the dynamic between the Federal Reserve Chairman and the President of the United States. In recent years, the relationship between the Fed’s monetary policy leadership and President Trump’s pro-growth agenda has captured the attention of traders, from US mid-cap stocks to emerging growth stocks enthusiasts.

📊 The Fed’s Role in US Equities

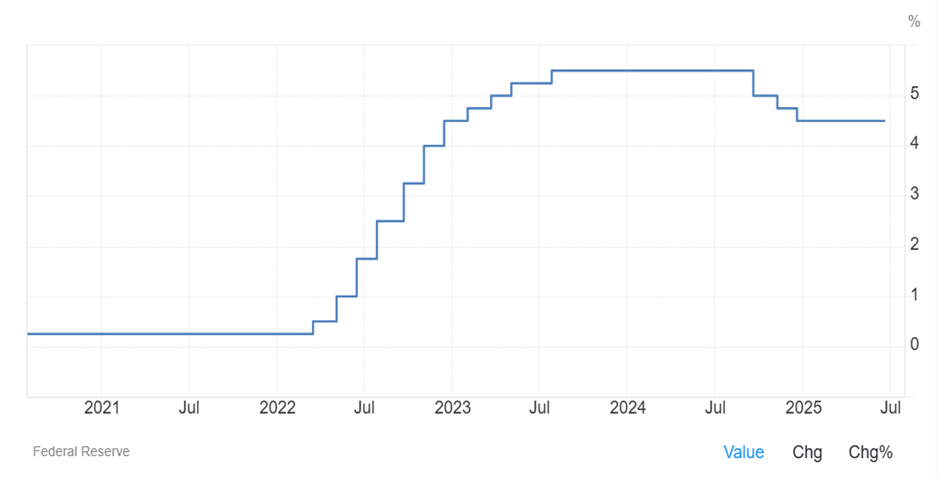

The Fed Chairman, currently Jerome Powell, oversees interest rates and liquidity—key drivers for US equities analysis. A lower interest rate environment often supports risk-on investing, leading to higher valuations in NASDAQ stock research and Dow Jones investing strategies. On the other hand, a tightening cycle can weigh on speculative stock picks and even slow momentum in penny stock analysis. The Fed has been increasing the interest rate after the COVID pandemic and started reducing it in August 2024. Currently, the interest rate stands at 4.5%.

⚖️ Trump’s Fiscal Push and Market Goals

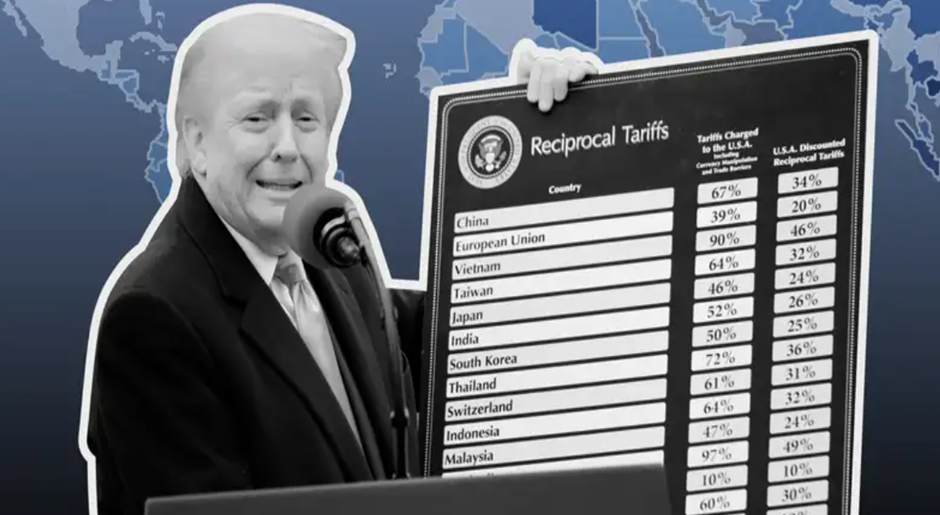

President Trump has consistently pushed for lower interest rates and aggressive fiscal stimulus. This aligns with policies that can benefit small-cap investment ideas and high-potential TSX-V stocks, as cheaper borrowing costs fuel innovation and expansion. For investors tracking emerging technology stocks and AI stocks analysis, such policies often create a favorable backdrop.

🔥 Where They Collide

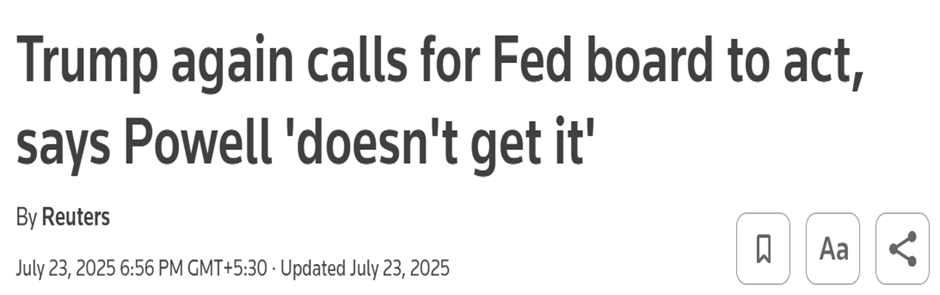

- Trump’s Position: Advocates for rapid growth, trade policies, and sometimes public pressure on the Fed to cut rates faster.

- Fed Chairman’s Position: Focused on long‑term stability, inflation control, and independent decision-making.

This tug‑of‑war affects sectors from renewable energy stocks to natural resource investing, and it’s closely watched by independent equity research firms that produce custom investment reports.

Source: Reuters

💡 Impact on Investment Strategies

Investors monitoring breakout technology stocks or hidden gems on NASDAQ and TSX often respond quickly to policy signals. A Fed pivot to lower rates could support growth stocks and undervalued micro-cap companies, while aggressive fiscal measures from the White House might boost penny stock research or micro-cap stock insights in sectors like EVs or green energy.

✅ Key Takeaways

- Fed policy drives liquidity and shapes US stock market research outlooks.

- Presidential influence, like Trump’s, can create short‑term rallies in small-cap stock research or speculative investing ideas.

- Balancing both views is essential for investors seeking stock alerts for small-cap opportunities and long-term equity insights.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.