Blockchain and Crypto Integration: The 2025 Regulatory Revolution

The global blockchain and crypto landscape in 2025 is undergoing a historic transformation. Policymakers, regulators, and financial institutions are no longer treating digital assets as fringe instruments — instead, they’re integrating them into mainstream finance through structured regulation, institutional adoption, and cross-border innovation.

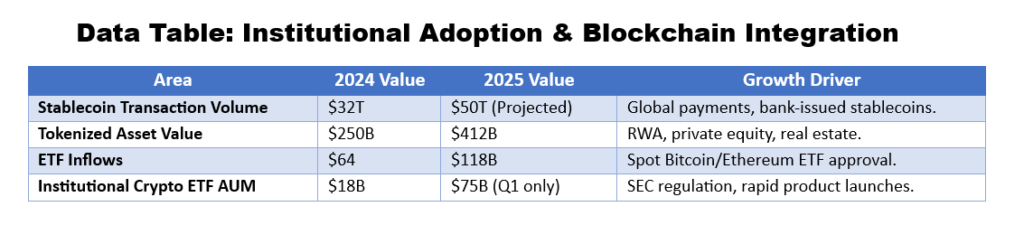

This year marks a turning point for blockchain’s maturity — with the approval of Bitcoin and Ethereum ETFs, institutional inflows into crypto products, and the rise of tokenized real-world assets (RWA) reshaping how value moves across markets.

Blockchain Regulation: From Caution to Compliance

Recent U.S. and international policy shifts are paving the way for regulated crypto adoption:

United States Policy Momentum

- The new federal administration has introduced crypto-friendly regulations, repealing restrictive executive orders and clarifying tax and custody frameworks.

- The SEC’s approval of Bitcoin and Ethereum spot ETFs has legitimized institutional participation, driving inflows exceeding $75 billion in Q1 2024.

- BlackRock’s IBIT ETF crossed $50 billion in AUM, setting a record for digital asset products.

Global Stablecoin and ETF Expansion

- Stablecoin legislation now allows bank-issued, insured stablecoins, accelerating adoption in cross-border settlements and Treasury operations.

- 62% of FSB (Financial Stability Board) members plan new frameworks for crypto-assets, and 60% for stablecoins, aiming for global harmonization and enhanced consumer protection.

These initiatives signal a mainstreaming of crypto, embedding it within the global regulatory and financial system.

Cross-Border Blockchain Integration

Blockchain is transforming global payments by making them instant, traceable, and low-cost.

Key Highlights:

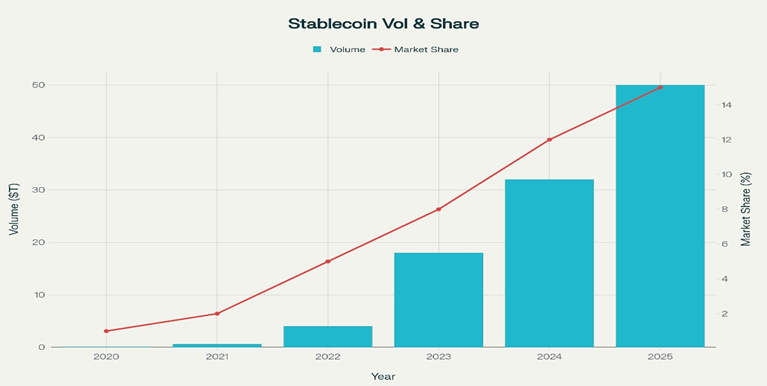

- Stablecoin transaction volume surged from $100B in 2020 to $32T in 2024, with projections hitting $50T in 2025, capturing nearly 15% of global cross-border payments.

- Blockchain settlement times are now measured in minutes, not days, removing intermediaries and reducing chargeback risks.

- Financial giants like Visa, JPMorgan, and Fidelity are partnering with fintech innovators to develop tokenized payment rails and TradFi–crypto interoperability tools.

The result: a unified ecosystem where traditional finance (TradFi) and digital finance (DeFi) seamlessly interact through secure, API-based systems.

Key Regulatory Trends

- EU MiCA Framework: Introduces harmonized crypto rules across 27 EU member states, improving investor confidence and compliance clarity.

- UK FCA & Dubai VARA: Define digital asset standards, emphasizing risk management and transparency.

- U.S. Regulatory Updates:

- Repeal of SAB 121, allowing more banks and brokers to hold crypto.

- Expansion of broker-dealer custody rights for tokenized assets.

- DeFi oversight reforms enabling institutional DeFi participation.

Emerging tools such as AI-powered smart contracts, programmable compliance, and tokenized collateral systems are now bridging DeFi with traditional finance.

Conclusion

2025 marks the mainstream integration of blockchain and crypto into the global financial system.

With clear regulatory frameworks, institutional backing, and cross-border functionality, digital assets are evolving from speculative tools into essential financial infrastructure.

As adoption accelerates, blockchain is poised to redefine capital markets, payment systems, and asset management — ushering in a new era of programmable, transparent, and borderless finance.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.