Amidst all the chaos surrounding cryptos, is it a good time to invest in Ethereum?

Change is something that can be hard to accept, especially when it comes to something like cryptocurrencies. However, the Ethereum Merge has proven to be a great step in the cryptocurrency world. The Ethereum Merge has promised and still promises plenty of excitement for all cryptocurrency enthusiasts.

Ethereum, without a doubt, has a bright future ahead of it. Fundamentally, it’s a fantastic project that’s hit a lot of goals so far.

It’s no secret that Ethereum is the most well-known altcoin. For many investors and cryptocurrency fans, it represents much more than another cryptocurrency. Furthermore, analysts predict its market value might increase by as much as 400% in the coming years.

What is Ethereum?

Ether is a cryptocurrency introduced in 2015 by computer engineer Vitalik Buterin. Since its conception, the value of Ethereum’s native currency, Ether (ETH) has skyrocketed, reaching a peak of over $4,800 at its highest last year, although experiencing significant price swings along the way.

In terms of market capitalization, Ethereum is the second-largest cryptocurrency, behind Bitcoin. While Bitcoin is a “digital gold,” Ethereum is a software platform based on the Blockchain that creates value. If Bitcoin represents an investment in a new monetary asset, then Ethereum represents an investment in the infrastructure of Web 3.0. In addition to being a highly regarded currency, it is also a development platform that developers may use to produce Metaverses.

Ethereum is vastly different from other cryptocurrencies such as Bitcoin, Litecoin, or even Ripple. Ethereum is a blockchain protocol for smart contracts, and Ether is the native cryptocurrency that powers the Ethereum blockchain.

Ethereum runs smart contracts on what it calls the Ethereum Virtual Machine, which is essentially a supercomputer built on the blockchain. Because of its unique structure and its first of its kind, Ethereum price predictions can be extremely high, with so many investors and industry experts believing in Ethereum’s growth in the long term.

It’s possible that in the next few years, Ethereum could overtake Bitcoin in terms of popularity and will be used by major companies like Google and Facebook. ETH is mainly attributable to its more extensive spectrum of potential uses. Since Ethereum serves as a settlement and issuance layer for vast segments of current capital markets infrastructure, it will continue to be one of the most profitable investment options over the next decade.

MANA and SAND are two examples of ERC20 tokens that don’t use their blockchains. For verification of transactions, they leverage Ethereum’s network. The Ether contract allows investors to enter cryptocurrency markets and manage crypto-related risks.

How ETH is being used?

As a software network developers can use to create and power new tools, applications, and NFTs, Ethereum is distinct from existing cryptocurrencies. This blockchain-based software network has various uses and applications throughout the computer industry, notably for gaming, music, entertainment, and decentralized finance (DeFi). As a result, it has become one of the most popular and widely used cryptocurrencies over the last year.

Since the goods and services accessible on Ethereum are available to anybody with an internet connection, Ethereum was founded on the concepts of decentralized finance like many other prominent cryptos.

- Decentralized Apps– It is possible to create decentralized apps using smart contracts, which may be used for many reasons. These financial instruments are examples of decentralized financing systems and data services such as Matcha (which searches various cryptocurrency exchanges for the lowest rates). But there are also dApps for purchasing and selling digital artwork, games, and developer technologies.

- New Cryptocurrencies– Ethereum is, in layman’s terms, a decentralized engine that runs apps that are also decentralized. Developers may construct completely new cryptocurrencies on top of Ethereum, like Chainlink and XRP, known as tokens, because of their open-source approach. You may be familiar with some of these assets in the form of cryptocurrencies like Tether (USDT), Uniswap (UNI), or USD Coin (USDC).

- NFTs– Nonfungible tokens or NFTs are other digital assets that may be generated on Ethereum, in addition to cryptocurrencies. It has been stated on the Ethereum website that these digital tokens are used to represent the ownership of unique goods.

- Smart Contracts- Blockchain-based smart contracts, essentially written instructions that carry out financial transactions using algorithms, have made Ethereum famous.

Factors affecting the price of Ethereum?

There is a general feeling of confidence that the original, smart contract blockchain will make it through this testing period. Here are several factors that influence the price of Ethereum:

- High Usage and Traffic -Artists and makers were able to mint (create) and sell the digital artwork known as nonfungible tokens thanks to smart contracts. Since its popularity, both gift and curse for Ethereum led to what some term a “bottleneck” on the Blockchain, which was both good and bad for the cryptocurrency. Imagine the shopping mall parking lot on Black Friday and transposing it into the internet realm.

With so many users, Ethereum transactions are costly. The Ethereum team is responding by developing additional infrastructure updates.

If more individuals are utilizing the Ethereum network, then there is more significant support for the value of your investment; but, if rivals succeed in luring users away from Ethereum, Ethereum’s value might decrease over time.

- First-mover edge – Even if newer and more environmentally friendly technologies have been created, analysts believe Ethereum’s “first mover edge” has positioned it for long-term success despite the emergence of new competitors. However, given that the value of cryptocurrencies is entirely dependent on the participation of the community, it is more crucial to have a dedicated user base than to win the race to the top. Fortunately, Ethereum has both.

- Competition from ‘Ethereum Killers’ – Companies such as Ethereum and other blockchains with comparable functionality, such as Solana, Cardano, and Tezos, are trying to establish the infrastructure that will be used to build the future vision of Web3. The term “Web3” refers to an open-access Internet version based on blockchain technology. Investors compare these new advances to the dot-com boom, which occurred when Google, Facebook, and Apple first came to public attention.

The Future of Ethereum

Many of the most innovative businesspeople in the information technology and financial sectors see Ethereum as one of the most exciting developments in technology.

For OpenSea, the largest NFT platform in the world, Ethereum is the preferred payment method. Moreover, most NFTs may be acquired from a cryptocurrency wallet using ETH. Ethereum is also powering the emergence of new technologies like DeFi and dApps. So, one of the few Blockchains that makes it possible for Metaverses, NFTs, and cryptocurrencies to talk to each other. Ethereum controls over 90% of the NFT market. In a sense, this will be a make-or-break year for Ethereum.

Blockchain technology is spreading globally. According to research from Deloitte, 40% of questioned organizations intended to spend at least $5 million on blockchain projects in 2020, while 86% of U.S. companies have created or are establishing blockchain teams. 55% of those respondents indicated Blockchain was a top five strategic priority.

This adoption and investment indicate that blockchain technology is increasingly trusted by businesses wishing to enhance corporate operations or utilize it for transactions. As a result of Ethereum’s strong credentials in terms of both decentralization and scalability, it has become the most well-known cryptocurrency for these applications.

Second, more institutions are adopting the concept of crypto, which has a positive effect on demand. Some may regard crypto as a hedge against inflation in the present economic situation. Institutions with crypto assets require a trustworthy venue for pricing transparency and liquidity. The CME Ether futures contract gives institutional investors a regulated market to get price exposure without handling the digital asset or worrying about wallets, custodians, insurance, or other obstacles to entry.

How and Why Ethereum Is Going to Change Everything?

There are a few reasons why Ethereum and its open-source, decentralized Blockchain will bring about global change like Bitcoin did.

- Payments Made Using Ethereum Are Confidential and Safe -Ethereum’s real-world uses and value storage make it more promising than Bitcoin. It’s the future of programmable money and smart contracts, unlike Bitcoin.

While Bitcoin is the first original cryptocurrency, Ethereum was blockchain technology’s first mass-market application that global enterprises, SMEs, and consumers could utilize.

As the Ethereum network enables and facilitates the installation of new apps on its architecture, many individuals have utilized it to establish payment systems. In recent years, Ethereum’s use rate has surpassed that of Bitcoin, thanks to the exploding popularity of NFTs.

With Ethereum, anonymity is built into the system, and you are just a string of numbers where cash moves in and out safely, securely, and decentralized. With Ethereum, your data is safe. You don’t need to worry about anything.

- Using Ethereum’s Blockchain, anybody may create their programs -The Ethereum Foundation state their mission: “The Ethereum Foundation’s mission is to promote and support Ethereum platform and base-layer research, development, and education to bring decentralized protocols and tools to the world that empower developers to produce next-generation dApps and build a more globally accessible, free, and trustworthy Internet.”

According to State of the DApps, there are approximately 3,000 decentralized apps on the Ethereum blockchain. These developers may seek funds for their initiatives, like UniSwap did, the world’s biggest decentralized exchange.

Many Ethereum blockchain applications are already altering the world by providing new methods to transfer property, cash, debt, equity, and even construct multi universes safely and securely.

- Ethereum 2.0 will change everything– We’re in Ethereum 1.0, which was fantastic for its time but is now crowded, difficult to grow, and employs old technology in issuing new tokens and conducting transactions.

So, the Ethereum Foundation is releasing Ethereum 2.0. The improvement might be the game changer the world needs to make cryptocurrencies viable for daily payments and banking.

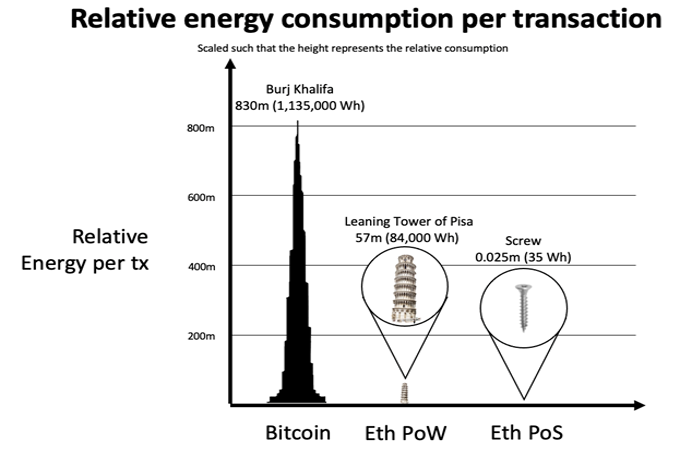

To begin, Ethereum 2.0 has a substantially lower effect on the environment than Ethereum 1.0. At the moment, an essential part of Ethereum’s Proof-of-Work mechanism is the need for electricity. Proof-of-Work uses more and more energy over time. Ethereum 2.0 will cut energy usage by 99.5% by switching to Proof-of-Stake. This is also known as ‘merge’ which is currently ongoing.

Ethereum’s improvement will undoubtedly decrease network congestion, resulting in lower gas prices.

For the first time, Ethereum 2.0 will be able to run thousands of dApps and other scalable applications for thousands of users.

Source: The Ethereum Foundation

Ethereum Price Predictions

We cannot make any price forecasts so far into the future. When dealing with something that is subject to so much uncertainty, it is just impossible to make an accurate price estimate.

A more interesting question is what the state of the crypto market will be in the 25 years, rather than trying to estimate its price. It would be easy to assume that it would get stronger in the future based on the way things are going, but there are just too many unknowns at play at this time to make such a prediction with any confidence.

This article is not financial advice and that the cryptocurrency market is very volatile. Before making any investment, you should perform your own research to ensure you understand the potential outcomes. The price of Ethereum in US dollars is $1,490.82 at the time of writing.

Ethereum Price Prediction 2023

Based on historical data, it is estimated that the lowest Ethereum price in 2023 will be about $2,785.91. The highest possible ETH price might reach $3,470.69. In 2023, the average price might reach $3,076.86. Potential ROI stands at 84%.

Ethereum Price Prediction 2025

Cryptocurrency specialists have studied Ethereum’s price history and volatility over the last several years. In 2025, it is predicted that the lowest price of ETH will be $6,318.83, while the highest price will be $7,282.72. The average price of the trade will be $6,601.48 with potential ROI of 288%

Conclusion

Ethereum is one of the oldest cryptocurrencies, and as such, it has established a solid reputation among large corporations.

With the Merge, Ethereum will switch from its current proof-of-work consensus mechanism to a proof-of-stake one, reducing its carbon footprint and setting the stage for future scalability improvements.

Despite the continued volatility of the cryptocurrency market, ETH is quickly becoming a must-have asset for traders and investors of all kinds. Ethereum is a promising investment since it is certain to attract more and more institutional money in the years to come.

Experts advise keeping crypto investments to no more than 5% of a diversified portfolio. The cryptocurrency market is very unpredictable, with price swings that may occur within a single day regardless of the sector’s wider acceptance.