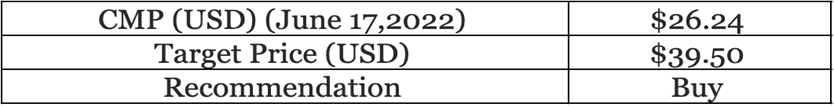

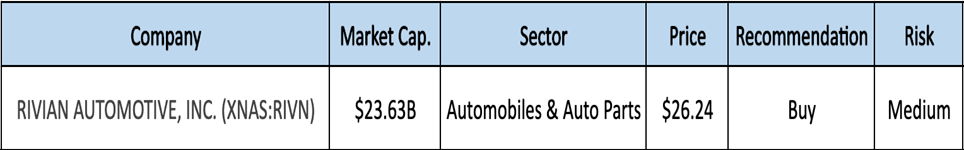

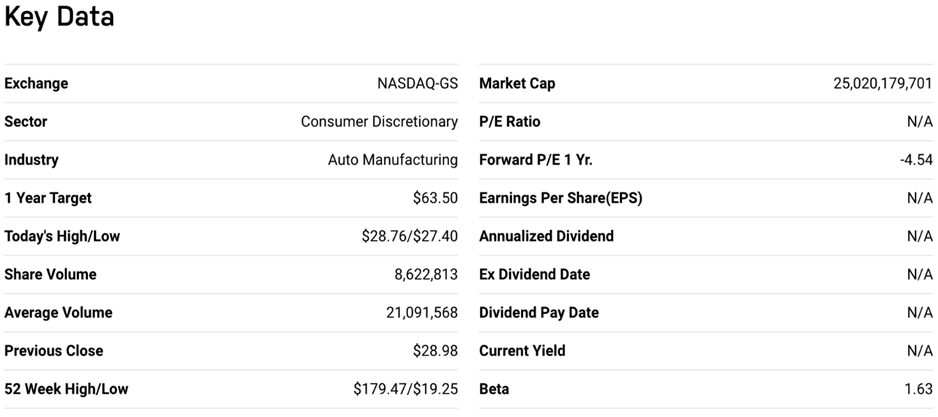

After An 80% Correction, IS Rivian Automotive Inc (NASDAQ: RIVN) a buy ?

Rivian Automotive, Inc. (NASDAQ: RIVN) designs, develops and manufactures category-defining electric vehicles and accessories. Rivian is developing an electric SUV and pickup truck based on a “skateboard” that can support future vehicles or be adopted by other companies. The company is also building an electric delivery Van as part of a partnership with Amazon. It plans to build an exclusive Charging Network in the United States and Canada by the end of 2023.

Highlights & News Update

- On June 17,2022, the company issued a statement that it intends to have a wind turbine of at least 2.8 MW installed at its R1 vehicle factory in Normal, Illinois if the project gets approved by the town’s planning commission later this summer.

- The Company has pledged to reach net-zero carbon emissions by 2040 and installed a 783-kW solar canopy at the plant’s outbound charging yard earlier this year. It is scheduled to start power generation late this summer.

- As per the company’s SEC filing on June 6th, 2022, the company continue to grow demand with a backlog of over 90,000 R1 pre-orders and Amazon’s initial order of 100,000 EDVs which is the largest commercial order ever for EVs.

- On May 9th, 2022, Rivian’s IPO lockup ended and closed at $22.78, down more than 60% from the IPO price.

- Amazon, which owns almost 160 million shares responded to IPO Lockup ending by saying: “Rivian is an important partner for Amazon, and we are excited about the future. Putting 100,000 electric delivery vehicles on the road by 2030 is no small feat, and we remain committed to working with Rivian to make it a reality.”

- As of March 8, 2022, the company had built over 100 pre-production units of its new drive units on the pilot manufacturing line and executed validation testing for both consumer and commercial vehicle applications.

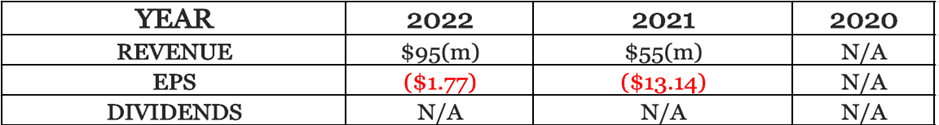

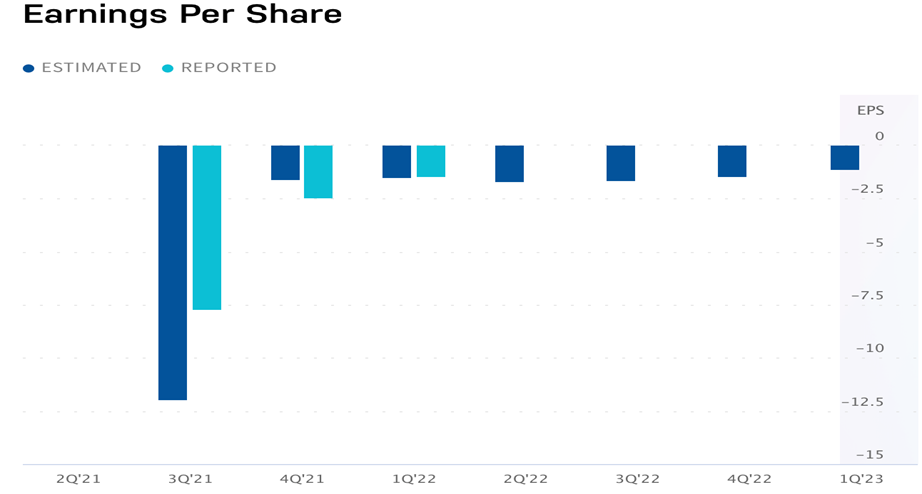

- Total revenues for Q4 2021 were $54 million, driven by the delivery of 909 vehicles. For fiscal year 2021, total revenues were $55 million, supported by 920 total vehicle deliveries.

- The company raised $13.7 billion of gross proceeds from its IPO in November 2021 when it went public on Nasdaq at an IPO price of $78 making it as the most successful offering in the U.S. since 2014.

RIVN Revenue EPS

First Quarter 2022 Highlights

- The company declared its total planned annual capacity between Normal and Georgia plants to be approximately 600,000 units.

- Approximately 5000 vehicles produced since the start of production, as of May 9, 2022, with total production for Q1 2022 of 2,553 vehicles and delivered vehicles being 1,227.

- $17 billions of cash, cash equivalents, and restricted cash as of March 31, 2022, which, Scaringe highlighted on June 6th, 2022, can support the 2025 launch.

- 2022 annual production target reaffirmed at 25000 units.

- In May 2022, the company finalized and signed an Economic Development Agreement to move forward on to its second domestic manufacturing facility, which will be located in Georgia.

- The said agreement represents the largest economic development deal in Georgia’s history and offers Rivian a total incentive package of $1.5B.

- In Q1 company generated $95 million in revenue and net loss of $(1,593) million.

- The company is focusing on increasing its vertical integration for key aspects of production process and has also built up its direct-to-customers sales approach.

Risk Factors

- Supply chain continues to be the bottleneck in production. This challenge has continued across a small handful of technical components such as semiconductors, as well as a few non-semiconductor components. Since March 31, 2022, the company has been forced to stop production for longer periods than anticipated, resulting in approximately a quarter of the planned production time being lost due to supplier constraints.

- Rivian is relatively a new company and faces fierce competition from Ford. Ford appears to be winning in pre-orders, with 200,000 reservations for the F-150 Lightning. Ford’s truck starts at less than $40,000 versus Rivian’s starting price tag of $67,500. There are also other manufacturers entering the truck EV pool. General Motor‘s Silverado 1500 is slated for a 2023 delivery and Stellantis‘ Ram 1500 will hit the markets in 2024. Additionally, Tesla’s Cybertruck should be launching within the next two years.

- It is spending heavily to bring its factory to full speed to meet its 2022 production goal of 25,000 vehicles. It lost $1.6 billion on revenue of $95 million during Q1, but this loss should narrow once Rivian reaches full capacity.

Stock Recommendation

As the rapidly shifting consumer mindset supported by increasingly supporting government policies towards shift to a carbon neutral global economy will enable the industry transformation in coming years, MarketFacts gives a “Buy” rating on the stock at the closing Price of $ 26.24 USD as of June 17th, 2022.