How Is the Needle Moving On This Biodiesel Producer: Renewable Energy Group Inc (NASDAQ: REGI)

Renewable Energy Group Inc (NASDAQ: REGI) is leading the transformation of biofuel into something that helps improve the environment and grow customers’ profits by delivering cleaner fuels to meet growing global demand.

Company is a producer and refiner of biofuels in the oil and gas industry. The company’s operations include acquiring feedstock, operating biorefineries, and marketing and distributing renewable fuels. Its operating segments include Biomass-based Diesel, Services, and Corporate and other.

Most of the company’s revenue comes from the sale of biomass-based diesel. Geographically, it operates in the United States, Germany, and Other Foreign countries of which the United States derived maximum revenue. At its biorefineries, natural fats, oils, and greases are converted into biofuels and renewable chemicals.

Highlights:

- Recent Acquisition: January 4, 2022, company acquired Amber Resources- a leading Southern California full-service distributor of diesel, gasoline, lubricants, other transportation fuel components, industrial services, and additives.

The deal is a strategic move for REG that enables them to build upon their platform of direct sales, positioning them to capture full value chain margins and drive commercial optimization.

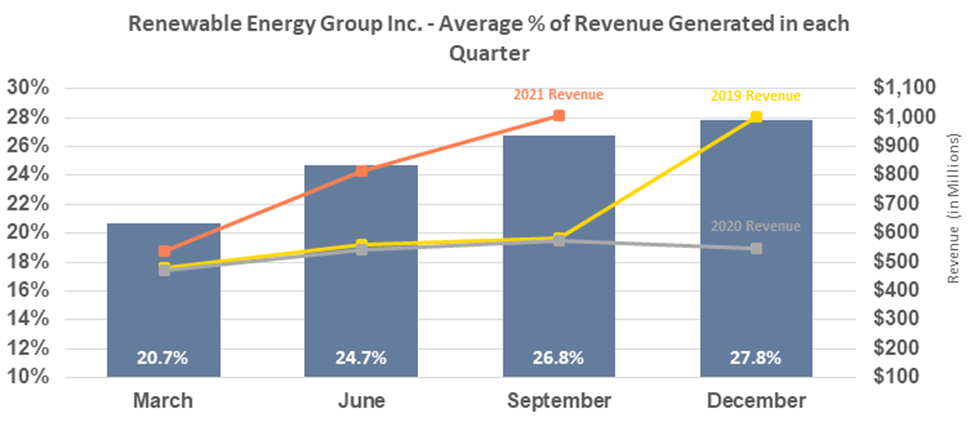

- Q4, 2022 & Annual Numbers Estimation: Analysts predict that Renewable Energy Group, Inc. will report sales of $830 million+ for the current fiscal quarter, with the lowest sales estimate coming in at $782.00 million and the highest estimate coming in at $891.40 million. Renewable Energy Group posted sales of $547.93 million in the same quarter last year, which would indicate a positive year-over-year growth rate of 52.1%. Renewable Energy Group may report full-year sales of $3.20 billion for the current year, with estimates ranging from $3.15 billion to $3.25 billion.

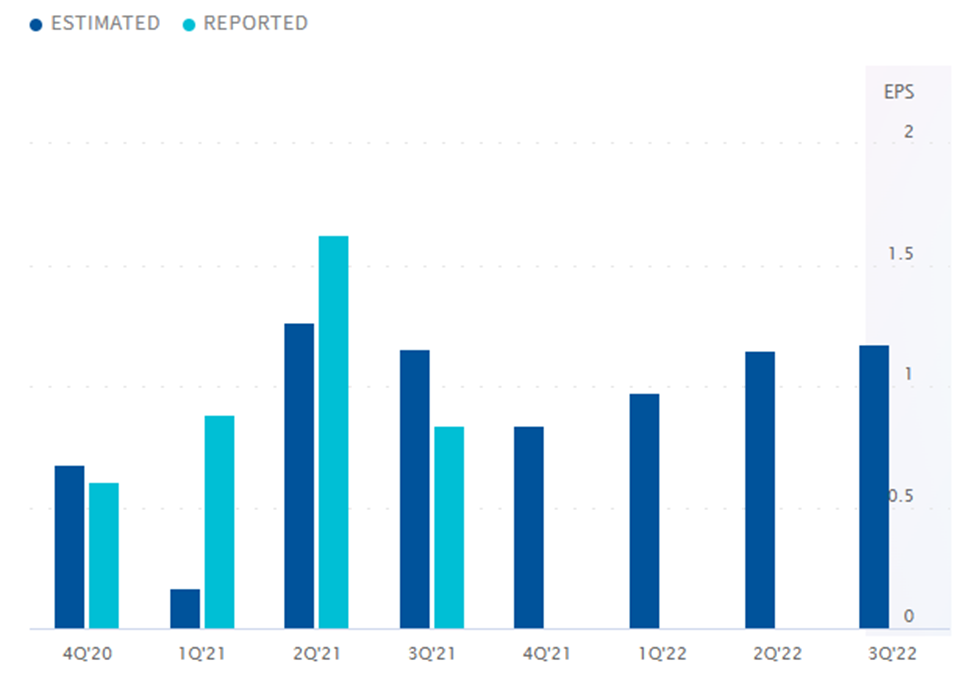

- Improved EPS: Renewable Energy Group is expected to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended December 2021. The earnings report might help the stock move higher if these key numbers are better than expectations. This biodiesel producer is expected to post quarterly earnings of $0.83 per share in its upcoming report, which represents a year-over-year change of +38.3%. The consensus EPS estimate for the quarter has been revised 17.99% higher over the last 30 days to the current level. This is essentially a reflection of how the covering analysts have collectively reassessed their initial estimates over this period.

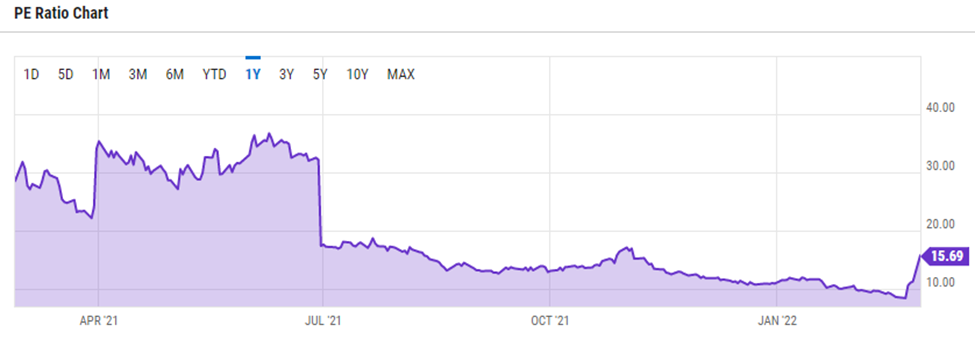

Current PE Ratio: Renewable Energy Group, Inc. has a trailing-twelve-months P/E of 11.15X compared to the Biofuels industry’s P/E of 15.91X. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. If the company can continue to grow earnings, then the current P/E may be unjustifiably low.

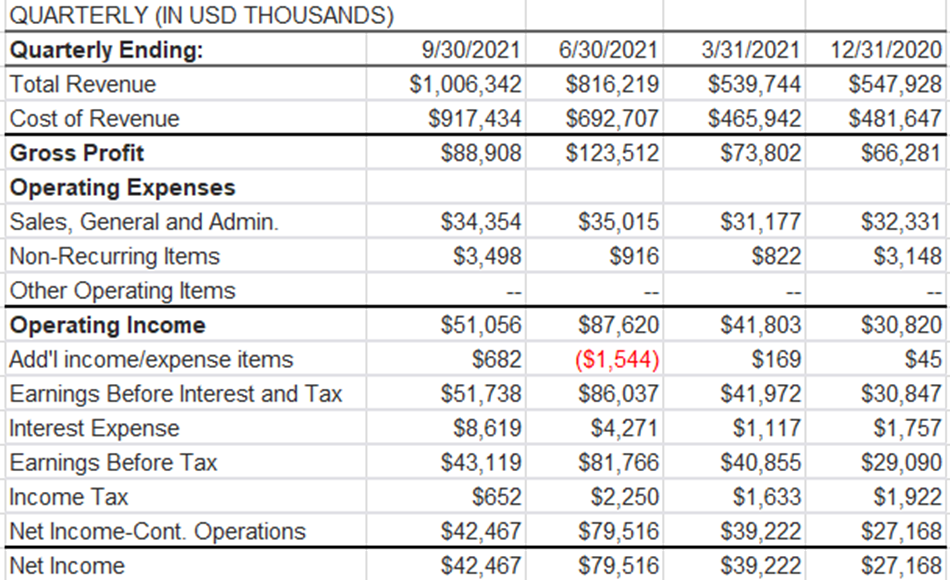

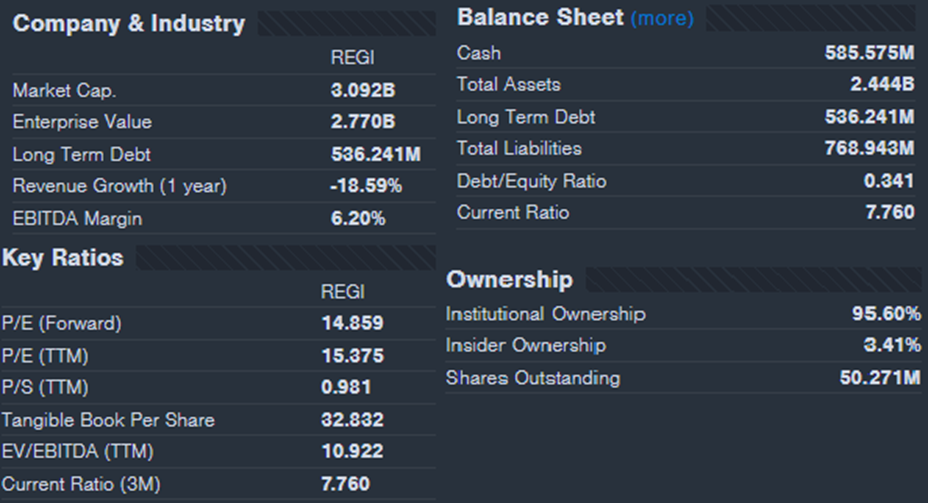

Quick Look at Company’s Key Data

Stock Recommendation: Its Value Score of A indicates it would be a good pick for value investors. The financial health and growth prospects of REGI, demonstrate its potential to outperform the market. According to analysts’ consensus price target of $74.01, Renewable Energy Group has a forecasted upside of 20.3% from its current price of $35.55.

MarketFacts gives a “Strong Buy” rating on the stock at the closing Price of $35.55 as of February 14th, 2022.

| CMP (USD) (14th Feb 2022) | $35.55 |

| Target Price (USD) | $74.01 |

| Recommendation | Strong Buy |