Ameresco Inc.: At the Intersection of Sustainability, Infrastructure, and Cash Flows

Company Overview

- Ticker: AMRC(NYSE)

- Headquarters: Framingham, Massachusetts

- Founded: 2000

- CEO: Mr. George P. Sakellaris P.E.

- Industry: Engineering & Construction

Core Business

Ameresco, Inc. provides energy solutions in the United States, Canada and Europe. It operates through North America Regions, U.S. Federal, Renewable Fuels, Europe, and all other segments.

- Primary Product: The company offers energy efficiency, infrastructure upgrades, energy security & resilience, asset sustainability, and renewable energy solutions for businesses and organizations.

- Additional Services: The company offers renewable energy solutions and services, such as the development and construction of small-scale plants. It also develops for customers that produce electricity, gas, heat, or cooling from renewable sources of energy and O&M services and sells electricity, processed renewable gas fuel, heat or cooling produced from renewable sources of energy.

- Customer Base: AMRC’s customer base is comprised of organization public or private with complex facilities and a need for energy savings, infrastructure upgrades, and sustainable energy solutions.

- Distribution: Company’s service is direct, project-specific and built on financial innovation.

Industry Overview

- Valuation: The industry is characterized by strong growth projections, significant investment inflows, and evolving operational trends. While global figures for just the renewable sector segment are often embedded within broader market reports, the data points to a highly active and expanding market.

- Trends: The underlying demand and long-term order books remain exceptionally strong. Future valuation will heavily favour firms that demonstrate superior project execution, cost control, and expertise in complex, integrated technologies.

- Competition: Enphase Energy Inc, Sunrun Inc, Brookfield Renewable Partners LP, NextEra Energy Inc, Ormat Technologies Inc, AES Corp.

- Growth Drivers: The industry in the renewable sector is experiencing a period of unparalleled growth, driven by a powerful confluence of policy mandates, technological advancements, and shifting corporate priorities.

Key Growth Drivers

- High Profitability: AMRC is exhibiting strong operational performance and growth. However, the high interest expense associated with its capital-intensive assets is a significant factor impacting its reported net income.

- Market Share Expansion: AMRC is actively expanding its market share through a multi-faceted strategy focused on geographic diversification, securing high-value contracts in new sectors, and substantially growing its recurring revenue streams.

- Financial Strength: AMRC is driven by its dominant market position and exceptional long-term revenue visibility, but its continued reliance on debt to fund its growing asset portfolio.

- Undervaluation: AMRC is generally considered undervalued by growth investors, despite having a P/E ratio that appears high based on past earnings.

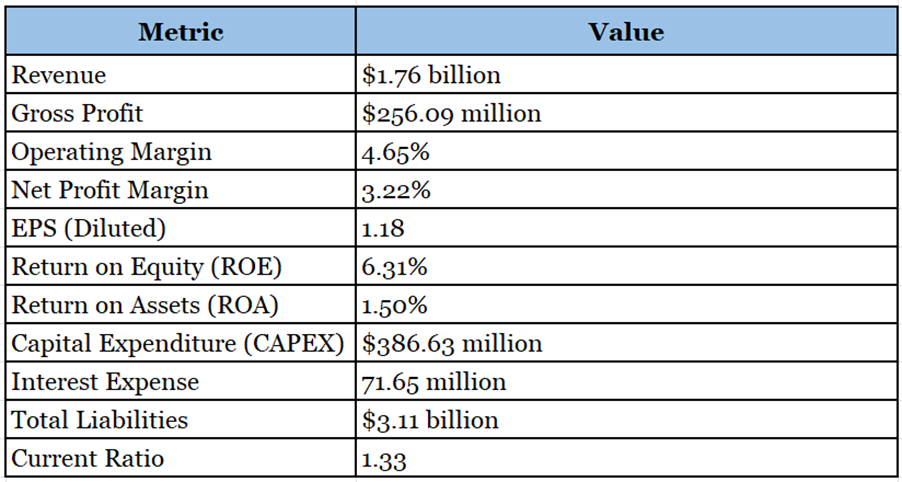

Financial Overview (FY 2024)

- Revenue: $1.76 billion

- Net Income: $56.75 million

- Operating Income: $81.99 million

- Total Assets: $4.15 billion

- Total Debt: $1.70 billion

- P/E Ratio (Current): 29.12

Key Financials

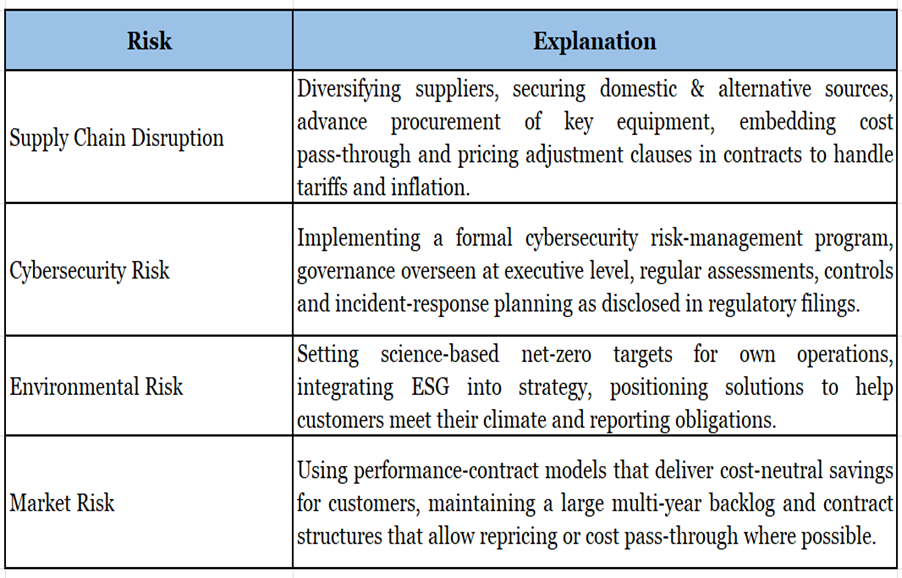

Risks

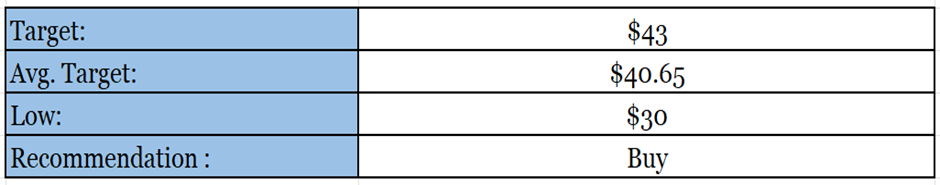

Target

Right now, the company is trading at US $34.65, with a 1-year projected target of around US $43 and a low estimation of US $30; the average price target will be US $40.65

MarketFacts gives a “Buy” rating on the stock at the closing price of US $34.65 as of November 26th, 2025.

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.