SABESP (NYSE: SBS): Essential Water Services for Brazil’s Economic Core

Company Overview

- Ticker: SBS (NYSE ADR)

- Headquarters: Brazil

- Founded: 1973

- CEO: Carlos Augusto Leone Piani

- Industry: Water & Sanitation Utilities

Core Business

SABESP is Brazil’s largest water and wastewater utility, providing essential services to residential, commercial, and industrial customers across São Paulo.

- Water Supply Services: Treatment and distribution of potable water to millions of customers, generating stable, regulated revenue.

- Wastewater Collection & Treatment: Sewerage services including collection, treatment, and environmental compliance—key long-term growth driver.

- Regulated Utility Model: Revenue governed by state regulator with tariff adjustments tied to inflation, investment needs, and efficiency targets.

- Infrastructure-Heavy Operations: Manages extensive reservoirs, pipelines, and treatment facilities requiring continuous capex.

- Environmental & Public Health Role: Central to sanitation expansion goals, especially under Brazil’s national sanitation framework.

Industry Overview

- Water utilities offer defensive, low-volatility cash flows due to non-discretionary demand.

- Growth driven by urbanization, sanitation mandates, and infrastructure upgrades.

- Returns are regulated, limiting upside but protecting downside.

- ESG relevance is structurally high, attracting long-term capital.

- Water utilities require decades-long infrastructure investment and regulatory approvals, making new competition economically and legally impractical.

- Water scarcity, drought cycles, and climate volatility elevate the importance of efficient water management, strengthening the strategic and political relevance of incumbent operators.

Key Growth Drivers

- Privatization Tailwind: Shift toward private ownership improves governance, capital discipline, and operational efficiency.

- Tariff Revisions & Inflation Protection: Regulated price adjustments support revenue visibility and real returns.

- Sanitation Expansion: Brazil’s push toward universal sanitation drives multi-year capex and volume growth.

- Operational Leverage: Efficiency gains post-privatization can materially expand margins.

- Defensive Profile: Stable demand regardless of economic cycles.

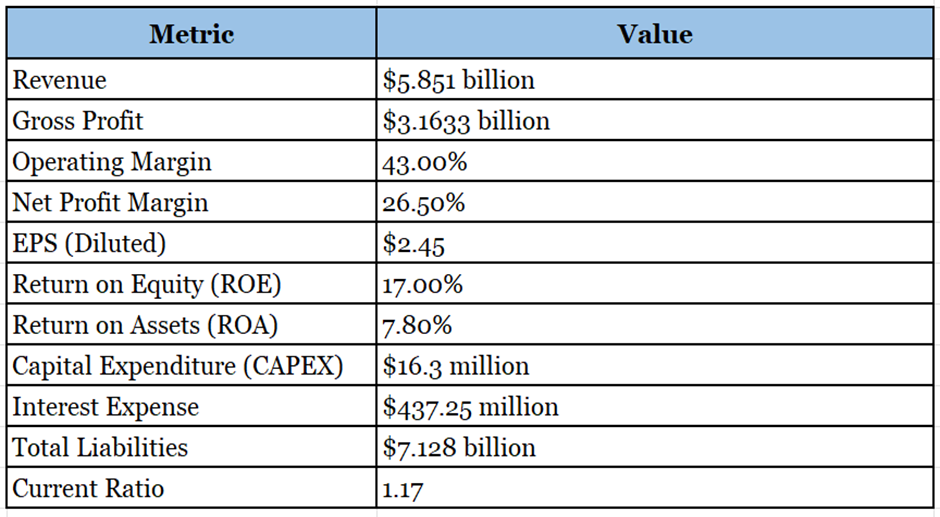

Financial Overview (FY 2024)

- Revenue: $5.851 billion

- Net Income: $1.551 billion

- Operating Income: $2.511 billion

- Total Assets: $13.106 billion

- Total Debt: $4.322 billion

- P/E Ratio (Current): 13.62

Key Financials

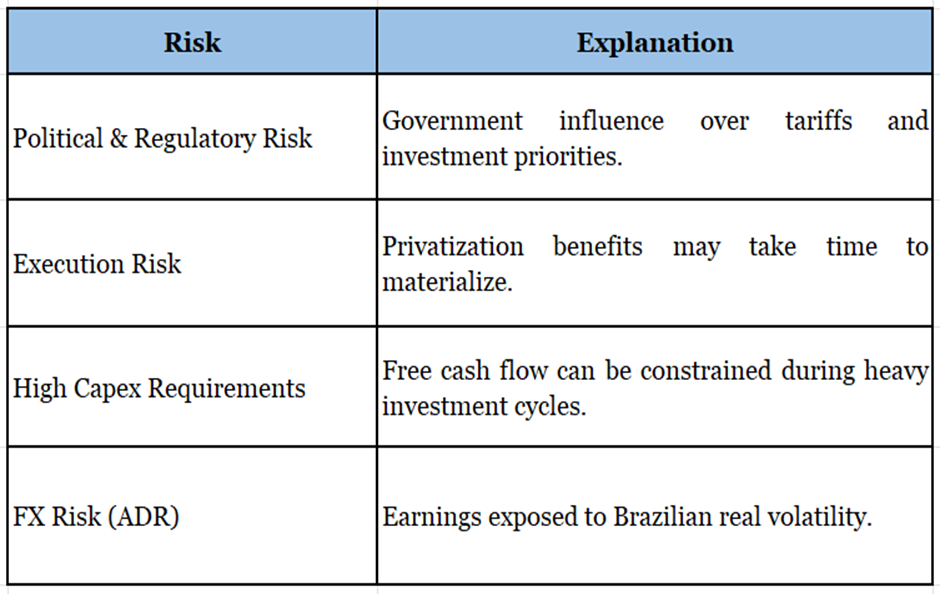

Risks

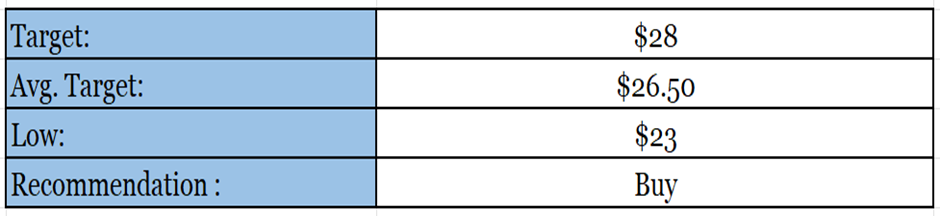

Target

Right now, the company is trading at US $23.92, with a 1-year projected target of around US $28 and a low estimation of US $23; the average price target will be US $26.50.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $23.92 as of January 20th, 2026.

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.