Geopolitical Tensions Triggering Volatility in Financial Markets (2025 Analysis)

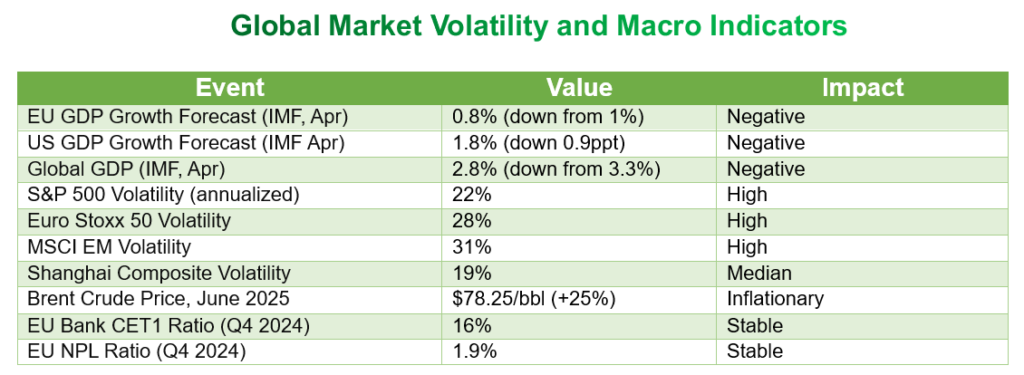

The year 2025 has seen geopolitical tensions emerge as a dominant driver of global financial market volatility, reshaping investment strategies and fueling inflationary pressures.

From the Ukraine conflict and Middle East hostilities to renewed U.S.–China trade frictions, investors are navigating one of the most unpredictable market environments of the decade.

Geopolitical Tensions and Market Volatility

Ukraine Conflict:- Persistent fighting and political uncertainty in Ukraine have driven sharp corrections in global equity markets, weakened the euro-area growth outlook, and caused sector-specific volatility, especially in energy, banking, and manufacturing. The risk of escalation or a broader regional conflict has further dampened investor confidence and increased credit spreads, indicating heightened risk aversion.

Middle East Escalation:- Recent Israeli Iranian hostilities have triggered a surge in oil and gas prices Brent crude rose 25% in June 2025 alone prompting concerns about inflation and global growth. Markets have responded with moves into safe-haven assets while riskier assets like equities and high-yield credit have underperformed.

China-US Relations: New trade tariffs and political unpredictability have created turbulence across equity and foreign exchange markets, exacerbating global supply chain reconfigurations. Markets initially sold off on tariff news but partially rebounded after a temporary US-China trade truce brokered in late October, although underlying uncertainty remains high.

Policy Implications

Policymakers and market authorities underscore the need for scenario analysis, stress testing, and robust contingency planning. Rising cyber and operational risks linked to both conflict and technological change are now central to risk management.

Structural shifts, such as the push for European “strategic autonomy” in energy and defense, could realign investment flows over the medium term as economies reduce exposures to global shocks.

Geopolitical risks remain the dominant driver of global financial volatility and are fundamentally altering how investors allocate capital in 2025. Asset managers and policymakers are compelled to recalibrate their strategies to adapt to an era of increased uncertainty, inflationary pressures, and rapid shifts in the international economic order.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.