Rising Global Debt and Market Complacency Amid Trade Tensions

The global economy is facing a dual challenge in 2025, sky-high debt levels and an unsettling wave of investor complacency even as trade tensions escalate. These dynamics are quietly reshaping fiscal stability, asset valuation, and policy responses across both advanced and developing economies.

Escalating Global Debt

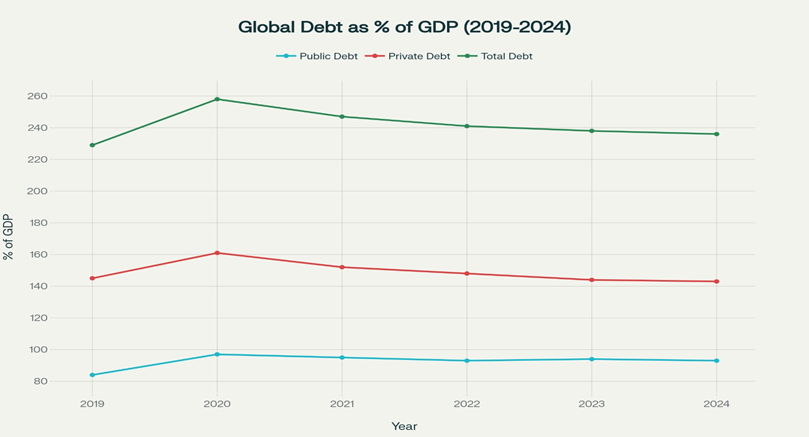

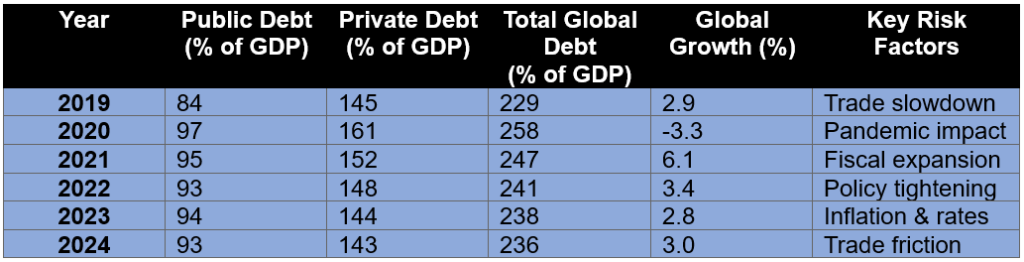

Global debt has reached a record 235% of world GDP, equivalent to $251 trillion, as reported by the IMF’s Global Debt Monitor 2025. Public debt ratios climbed from 84% in 2019 to 93% by 2024, while private debt moderated slightly from 145% to 143% as tighter credit conditions curbed corporate borrowing.

The chart below visualizes this six-year trajectory of global indebtedness:-

Market Complacency and Hidden Systemic Risks

The IMF’s October 2025 Global Financial Stability Report highlights that global markets have become dangerously complacent in the face of underlying fragility. Equity valuations remain stretched, with the U.S. S&P 500 up over 11% in 2025, largely driven by a handful of mega-cap AI and tech firms collectively controlling one-third of market capitalisation.

Trade Tensions and Macroeconomic Strain

Trade tensions, particularly between the U.S. and China, continue to exert pressure on financial and industrial ecosystems. The latest round of U.S. tariffs—such as a 50% levy on Brazilian imports and higher duties on Chinese goods—has disrupted global supply chains and eroded manufacturing confidence.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.