Sector Rotation: From Consumer Discretionary to Staple

One of the most telling rotations, signaling a shift in market sentiment, is the move from Consumer Discretionary to Consumer Staples. This movement isn’t random; it reflects a deep-seated change in investor psychology, moving from a growth-seeking stance to a more defensive, risk-averse position. This rotation is a classic indicator that market participants are bracing for an economic slowdown or, potentially, a recession.

The Cyclical Story: Why the Switch?

The key lies in the inherent nature of the two sectors:

- Consumer Discretionary (Cyclical):- This sector comprises companies selling non-essential goods and services—think luxury cars, high-end apparel, durable goods, and entertainment. Their fortunes are highly sensitive to the economic cycle. When the economy is expanding, job growth is strong, and consumer confidence is high, households readily spend on these optional items.

- Consumer Staples (Defensive/Non-Cyclical):- This sector includes companies that produce everyday essential food, beverages, household products, and hygiene items. Demand for these goods is relatively inelastic; consumers need soap, bread, and toothpaste regardless of economic conditions.

The Impetus for Rotation

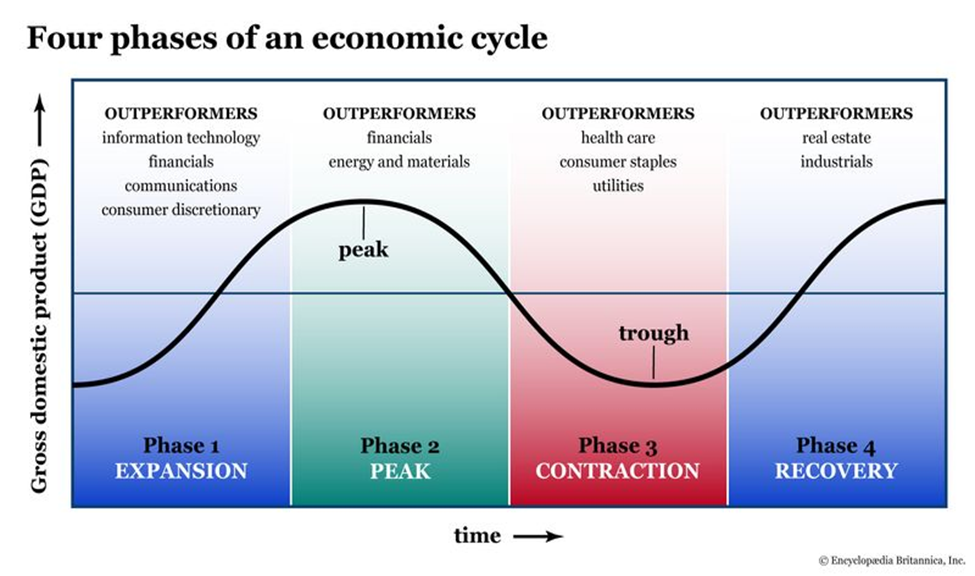

The shift from Discretionary to Staples occurs when investors anticipate a contraction phase in the business cycle. Several macro indicators typically fuel this rotation:

- Waning Consumer Confidence:- As reported by various financial news outlets, a decline in consumer sentiment is a powerful driver. When consumers are worried about their jobs, inflation, or the general economic outlook, they immediately cut back on optional, big-ticket purchases. This directly impacts the revenue and profit of Discretionary firms.

- Inflationary Pressures:- High and sustained inflation, particularly in essentials, squeezes household budgets. As more income is allocated to non-negotiables (staples, energy, housing), less is available for discretionary spending.

- Monetary Tightening:- When central banks raise interest rates to curb inflation, borrowing becomes more expensive. This slows down corporate expansion and dampens consumer demand for credit-dependent purchases (like cars), further accelerating the rotation into defensive sectors.

- Earnings Expectations:- Fund managers and institutional investors, anticipating lower earnings growth and potentially missed targets in cyclical sectors, proactively moving capital into Staples, where steady, albeit modest, earnings are a relative certainty.

Conclusion

The rotation from the high-growth, cyclical Consumer Discretionary sector to the defensive, income-generating Consumer Staples sector is more than just a stock market trend; it’s a collective vote of caution from the investment community, signaling an expectation of slowing growth and economic strain. Savvy investors pay close attention to this pivot as a playbook for navigating the shifting sands of the market cycle.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.