Emerging Market vs Developed Market:The Trade-Off Between Emerging and Developed Markets

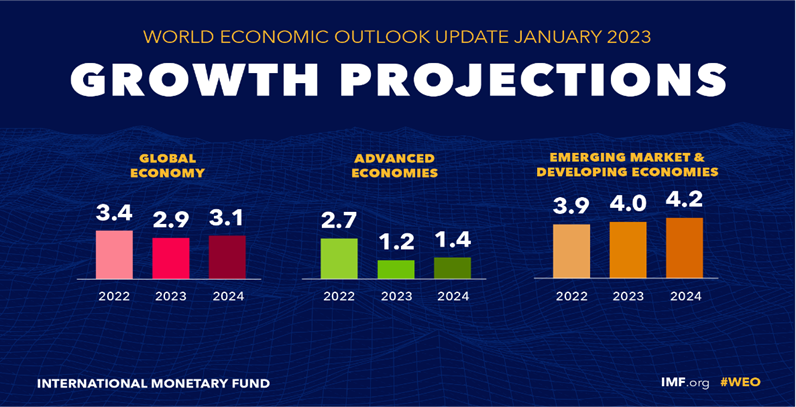

The global investment landscape is broadly categorized into emerging markets and developed markets. While both offer unique opportunities, they are characterized by different economic structures, growth drivers, risk profiles, and investment potential. Understanding these distinctions is crucial for investors looking to diversify their portfolios and capitalize on global economic trends.

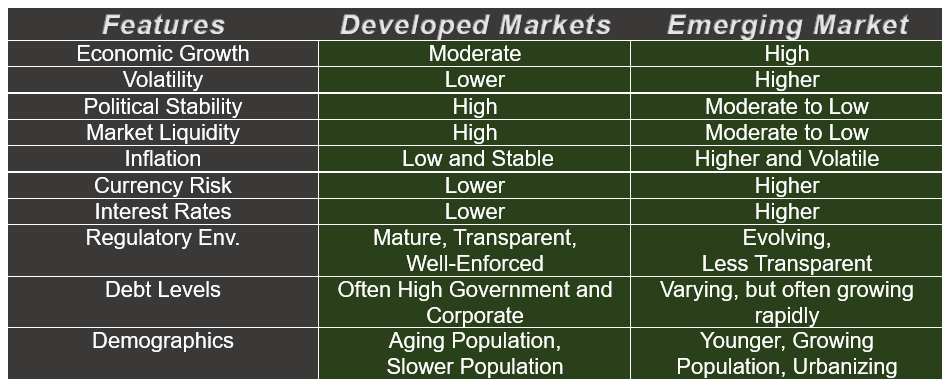

- Developed markets are typically characterized by high per capita income, stable political systems, mature economies, well-regulated financial institutions, and advanced infrastructure.

- Emerging markets are nations undergoing rapid economic growth and industrialization. They are transitioning from low-income, agrarian economies to more modern, industrial ones.

Comparing Key Metrics

Balancing Risk and Reward

Investors often allocate a portion of their portfolio to emerging markets to capture higher growth potential, while maintaining a core in developed markets for stability and diversification.

- For higher risk tolerance: A larger allocation to emerging markets might be suitable.

- For lower risk tolerance: A smaller, strategic allocation or exposure through diversified funds might be preferred.

Key Considerations for Investors:

- Diversification: Emerging markets offer diversification benefits as their economic cycles may not perfectly correlate with developed markets.

- Due Diligence: Thorough research is essential given the varying regulatory and political landscapes.

- Long-Term Horizon: The volatility of emerging markets often necessitates a longer investment horizon to ride out short-term fluctuations.

- Currency Exposure: Fluctuations in exchange rates can significantly impact returns.

- ESG Factors: Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in both market types, but especially in emerging markets where standards may be evolving.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.