PepsiCo Stock Investor need to know: Resilient but Facing Headwinds

PepsiCo is a powerhouse in the global food and beverage sector and is a favorite among income investors for its consistent dividends. However, in September 2025, there are several critical factors that investors should consider before making decisions to buy or sell shares.

Performance and Valuation

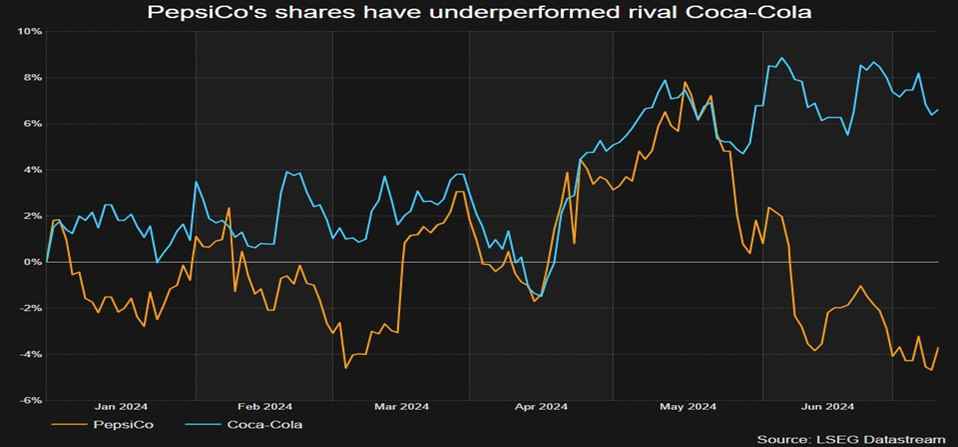

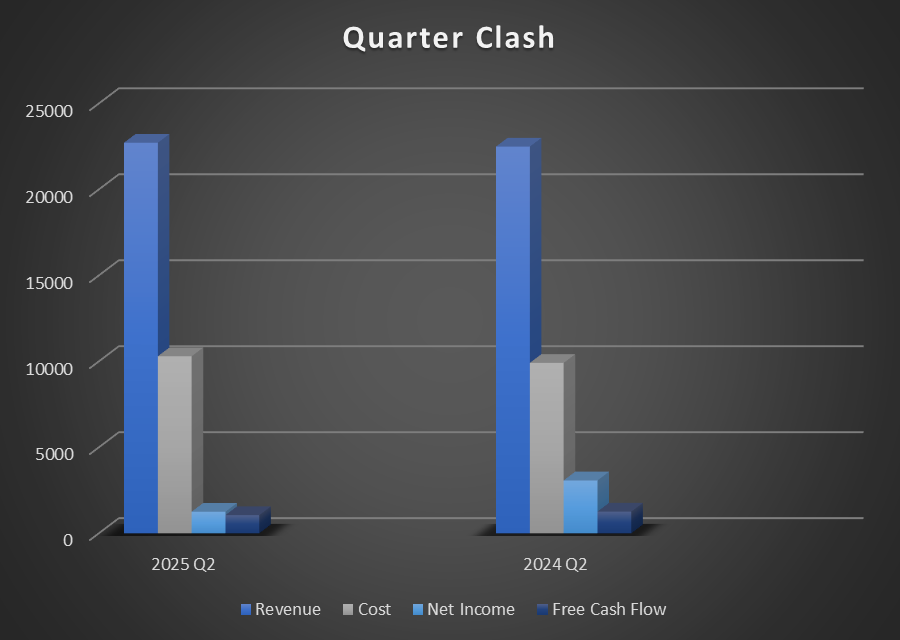

Despite their dividend appeal, PepsiCo shares have underperformed the broader market in the last year. Revenue growth slowed to just 1% in the latest quarter, and profit margins were squeezed highlighting a challenging environment for the company’s US operations.

Risks and Opportunities

Key risks include ongoing margin pressure, high debt and sluggish North American segment performance. Tariffs and global supply chain issues remain credible headwinds. On the flip side, PepsiCo’s recession-resistant business model and robust international expansion offer hope for improved results in 2026 and beyond.

Reasons for Sales and Margin Pressure

- Rising global supply chain costs and tariffs especially from US trade policies, have increased production expenses, squeezing margins.

- Weakening consumer confidence in key international markets such as China and Mexico has affected volume growth and sales, particularly in North America.

- Promotional discounts and competitive pricing pressure snacks and beverage segments, notably the Frito-Lay brand, reducing profitability.

- Ongoing geopolitical uncertainties and inflationary costs continue to challenge revenue growth despite a strong brand portfolio.

Strength

- Innovation and Product Diversification: PepsiCo has been expanding its healthier snack and beverage lines (low-sugar drinks, plant-based proteins, etc.), which may help it capture long-term demand as consumer preferences shift.

- Sustainability Initiatives: The company is investing in sustainability, including reducing plastic packaging and water usage. These efforts not only improve brand perception but also mitigate regulatory and environmental risks.

- Competitive Landscape: PepsiCo’s rivalry with Coca-Cola and emerging regional brands adds pressure, but its diversified portfolio (snacks + beverages) gives it a defensive edge compared to pure beverage peers.

- Currency Impact: A strong U.S. dollar remains a challenge, as it reduces the value of overseas revenue, particularly given PepsiCo’s large international presence.

Conclusion

In conclusion, PepsiCo remains a reliable dividend-paying stock with strong global brands and a resilient business model. However, near-term challenges—including weak North American performance, margin pressures, and global supply chain disruptions—may limit upside potential. For long-term investors, PepsiCo’s diversified portfolio, international expansion, and innovation in healthier products provide reasons for optimism, but short-term caution is warranted. Investors should weigh its defensive qualities against current valuation and margin risks before adding or trimming positions.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.