Accommodative monetary policy: Bank of Canada Lowers Rate to 2.5%

The Bank of Canada has cut its benchmark rate to 2.5% in September 2025, marking the first policy easing in six months and signaling readiness to act further if risks to the economy persist or increase.

Reasons for the Rate Cut

Recent data showed the Canadian economy weakening with a sharp rise in unemployment and contraction in GDP for Q2 2025. The central bank moved its overnight rate from 2.75% to 2.5%, as job losses exceeded 100,000 over the past two months and the jobless rate reached a nine-year high of 7.1% (excluding COVID-impacted years), while inflationary pressures eased.

Governor Tiff Macklem emphasized that weakening economic momentum and modest inflation justified a rate cut, with possible further rate reductions if business conditions or inflation risks worsen due to elevated global uncertainty and ongoing U.S. trade tariffs.

Economic Impact and Market Reaction

- Canada’s GDP shrank by 1.6% in Q2 2025 and exports dropped 27%, reversing gains from companies stockpiling to avoid new US tariffs.

- Unemployment rose steadily, pressuring consumer spending and business investment.

- Core inflation remained below the 2% target, allowing the Bank flexibility for policy easing.

- Canadian stocks were modestly higher following the announcement, as investors anticipated looser monetary conditions and potential for further rate cuts.

- Lower interest rates reduce the cost of borrowing for companies, which can improve their profitability.

- The rate cut can cause a “rotation” in the stock market. Money may flow out of defensive and move towards more growth-oriented or cyclical stocks.

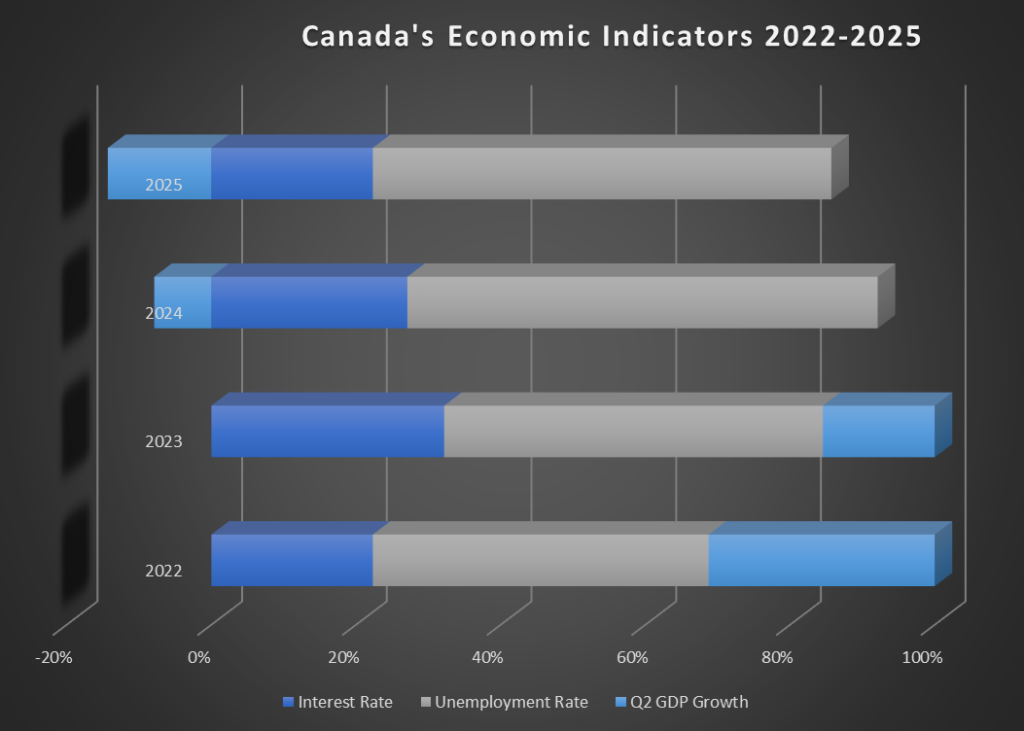

Table: Key Canadian Economic Indicators (2022–2025)

| Year | Interest Rate(%) | Unemployment Rate (%) | Q2 GDP (%) |

| 2022 | 2.5 | 5.2 | 3.5 |

| 2023 | 3.75 | 6.1 | 1.8 |

| 2024 | 2.75 | 6.6 | -0.8 |

| 2025 | 2.5 | 7.1 | -1.6 |

Analysis from Nasdaq and Economic Times

Nasdaq’s coverage highlighted that Canadian equities responded positively to the decision, as weak labor market and economic signals increased expectations for ongoing easing. Both Nasdaq and the Economic Times attributed the move to continued risk from US trade policy, falling exports, and slowing investment.

Economic Times noted that the unanimous decision by the Bank’s Governing Council was driven by persistent job losses and a deteriorating macro environment, while maintaining a strong focus on containing future inflation risks and managing financial stability.

The Bank of Canada may adjust rates further if downside risks—like trade barriers, persistent job losses, or weak global growth intensify. The next rate decision is scheduled for late October 2025.

Canadian stock markets reacted with modest gains and high volatility after the Bank of Canada’s decision to cut its benchmark rate to 2.5% in September 2025.

Market Sector Reactions

- Five out of eleven TSX sectors posted gains, with Communication Services leading the move upward.

- Consumer discretionary stocks also buoyed the market as investors hoped for further easing by the Bank of Canada.

- However, late-session volatility surfaced as concerns about exports and US trade tariffs persisted.

- The Canadian dollar remained stable around C$1.3760/USD after the announcement, signaling no panic reaction in currency markets.

- Volatility remains elevated as investors continue to assess risks related to the US Federal Reserve’s policies, global trade issues, and signs of a weakening domestic labor market.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.