Are U.S. Stocks Overvalued in 2025?

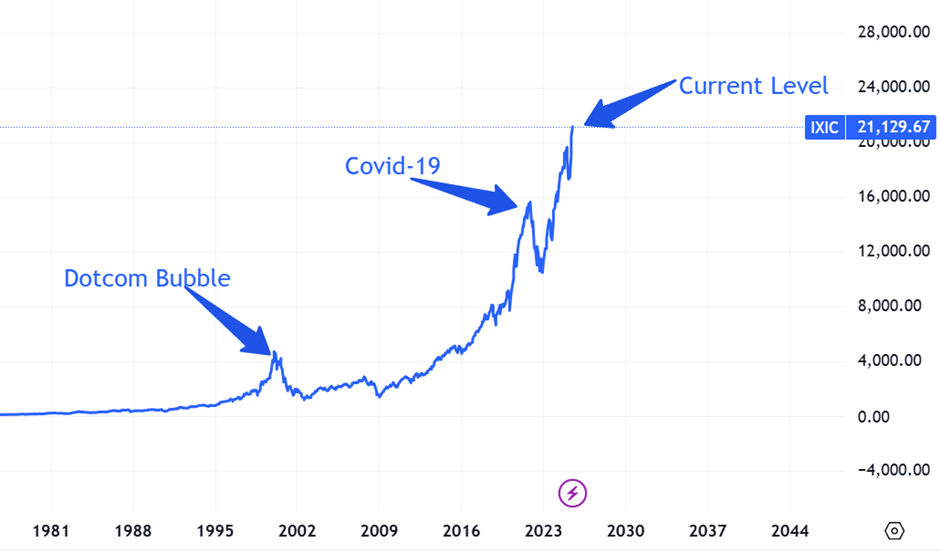

In 2025, investors are asking a critical question: Are U.S. stocks overvalued? With equity markets touching record highs and valuations approaching dot-com-era levels, there’s growing concern about whether current prices truly reflect fundamental economic reality or simply investor optimism.

📊 Valuations Are Flashing Red

The S&P 500 and Nasdaq Composite have surged to all-time highs, driven by AI euphoria and tech megacap dominance. But beneath the surface, key valuation metrics are sounding the alarm:

- Shiller P/E Ratio is above 35—well above the long-term average.

- Price-to-Sales (P/S) ratios for many tech stocks are in double digits.

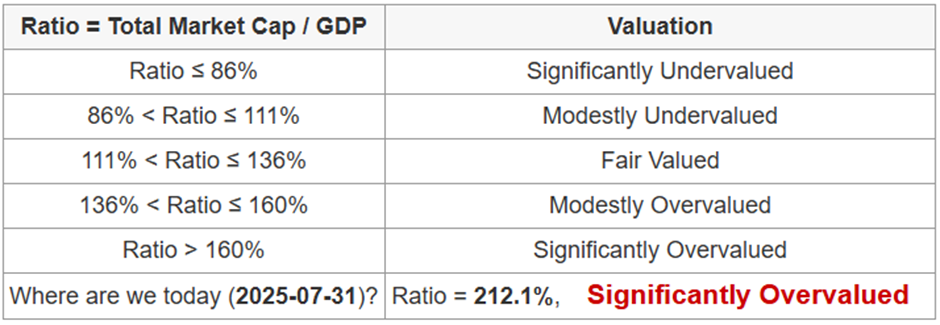

- Market cap to GDP (Buffett Indicator) has crossed 170%, suggesting overvaluation, and is around 212%.

These indicators suggest that U.S. stocks, especially in the technology sector, may be priced for perfection—with little room for error.

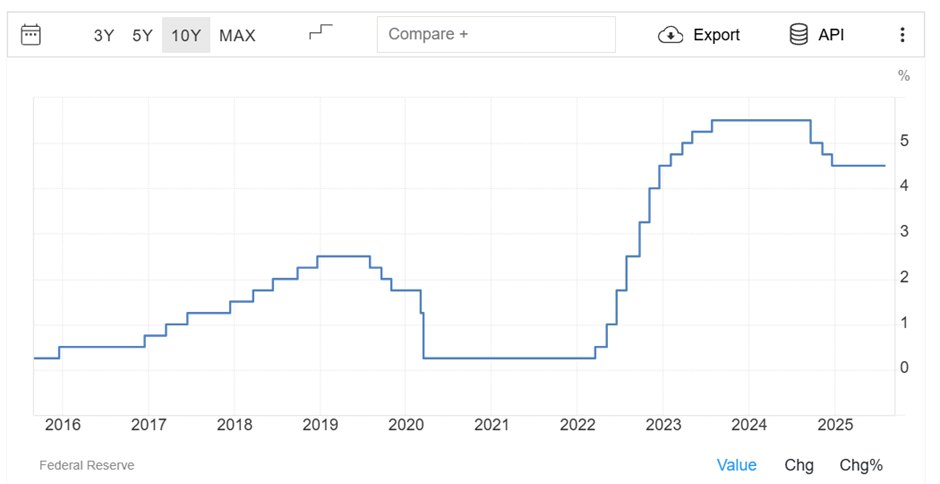

🏦 Low Interest Rates May Be Distorting Prices

The Federal Reserve paused rate hikes after inflation cooled off, and many investors expect a pivot to rate cuts by late 2025. This has led to higher equity risk appetite, pushing valuations further. However, if inflation resurges or the Fed stays hawkish, equities could face a serious correction.

📉 Earnings vs. Expectations: A Big Gap?

Corporate earnings are growing, but not as fast as stock prices. For many stocks, forward P/E ratios exceed 25–30, especially among AI and software firms. This disconnect between earnings growth and stock price momentum is a red flag.

Companies like Tesla, NVIDIA, and Microsoft continue to rally despite modest earnings upgrades, raising the question: Is this a bubble forming in plain sight?

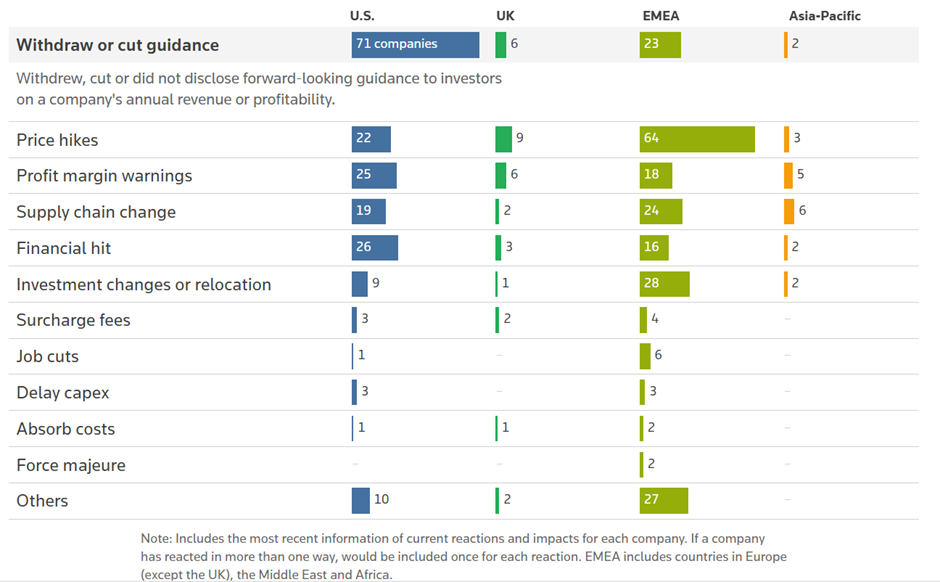

Impact of Trump’s tariff

🌍 Global Investors Are Watching Closely

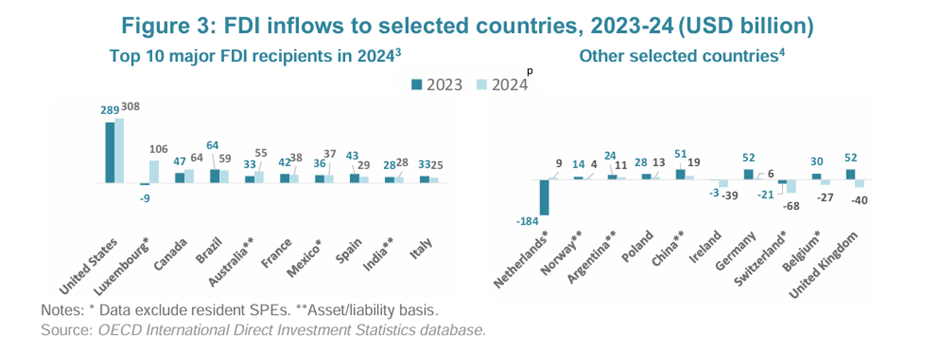

Despite rising caution around U.S. equity valuations in 2025, the United States remains the top destination for Foreign Direct Investment (FDI) globally. This sustained capital inflow—fueled by confidence in America’s innovation ecosystem, legal protections, and consumer scale—may actually be one of the key reasons U.S. stock valuations remain elevated.

When global funds, sovereign wealth funds, and MNCs invest directly into the U.S., much of that capital eventually finds its way into:

- U.S. stock markets, pushing demand for equities

- M&A deals involving public companies

Tech infrastructure and innovation hubs, indirectly lifting valuations of listed tech giants

🔍 Sectors That May Be Less Overvalued

Not all U.S. stocks are expensive. Healthcare, energy, and small-cap value stocks still offer attractive price-to-earnings ratios and dividend yields. Investors looking to balance risk may consider sector rotation strategies in 2025.

🚨 Conclusion: A Time for Caution, Not Panic

So, are U.S. stocks overvalued in 2025? The data suggests that select sectors are significantly overvalued, especially in tech. But with strong fundamentals in parts of the market, there’s still opportunity—if investors stay selective and valuation-aware.

About MarketFacts

MarketFacts provides in-depth investment research, market analysis, and portfolio insights across asset classes and geographies. Our mission is to help investors make informed decisions to invest safely in increasingly uncertain investment scenarios using our investment research reports.