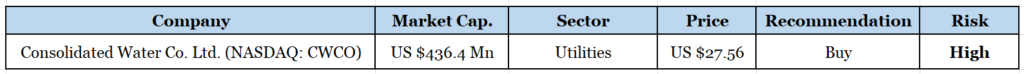

Consolidated Water Co. Ltd. (NASDAQ: CWCO): Innovating for a Sustainable Future

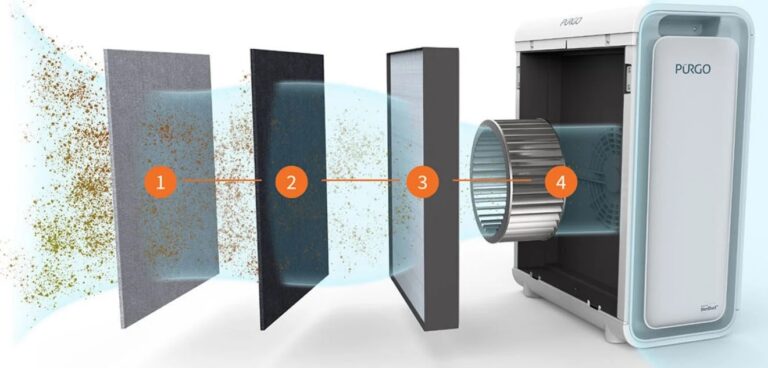

Consolidated Water Co. Ltd. (NASDAQ: CWCO) is a company engaged in the design, construction, operation, and management of water supply and treatment systems, primarily serving customers in the Caribbean and other regions with limited access to fresh water. The company operates through several segments: retail, bulk, services, and manufacturing. Additionally, the services segment encompasses the design, construction, and operation of water and wastewater plants for third parties, and the manufacturing segment involves the production and sale of water treatment products.

Financially, Consolidated Water generates revenue mainly through water sales, project development, and related services, with its growth driven by the increasing global demand for clean water, particularly in areas where natural water resources are scarce. Recently, Consolidated Water has been focusing on expanding its operations and exploring new opportunities in regions facing significant water scarcity issues, while also engaging in projects that prioritize sustainability and efficient water management practices.

Highlights and News Update

- On July 5th, 2024, Consolidated Water said that it had resumed normal operations as its property and equipment were not damaged when Hurricane Beryl passed south of the Cayman Islands.

- On June 13th, 2024, Consolidated Water Co. Ltd. continues to benefit from the use of the most advanced technology to convert seawater to potable water to meet customer needs.

- On June 5th, 2024, Consolidated water announces the settlement of the dispute with Mexico regarding Playas De Rosarito, Baja California desalination project.

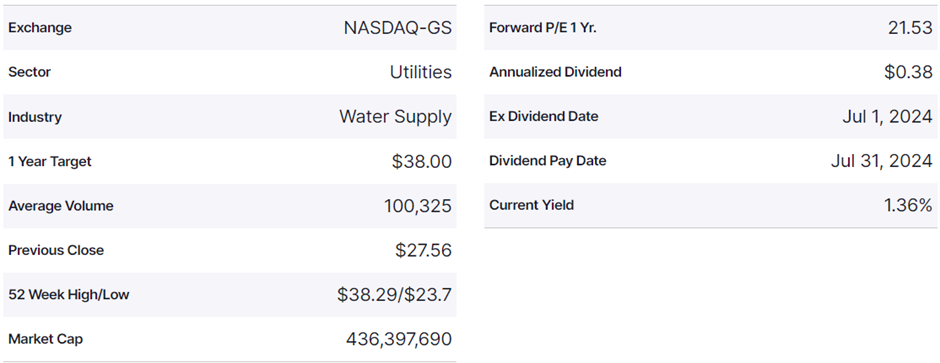

Key Data

Second Quarter 2024 Highlights

- Consolidated Water reported a total revenue of US $32.5 million, marking a 27% decline from the US $44.2 million reported in the same period of 2023.

- The company’s net income from continuing operations attributable to stockholders was US $4.2 million, or US $0.26 per diluted share, compared to US $7.5 million, or US $0.47 per diluted share, in the second quarter of 2023.

- The company completed the construction and commissioning of the new 2.6 million gallons per day Red Gate desalination plant for the Water Authority of the Cayman Islands.

Financials

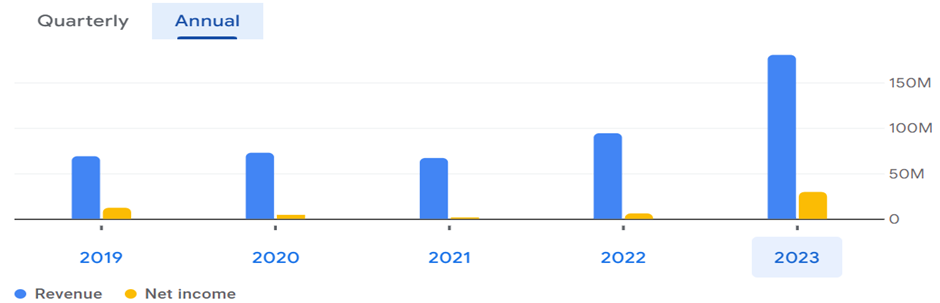

The company has exhibited remarkable growth and financial performance. Total revenue surged from US $72.6 million in 2020 to US $180.2 million in 2023. This revenue expansion was accompanied by a significant rise in the cost of revenue, from US $45.9 million to US $118.3 million. Despite these rising costs, gross profit increased from US $26.8 million to US $61.9 million, with the gross profit margin slightly declining from 36.8% to 34.4%, indicating improved profitability but with slightly increased cost pressures.

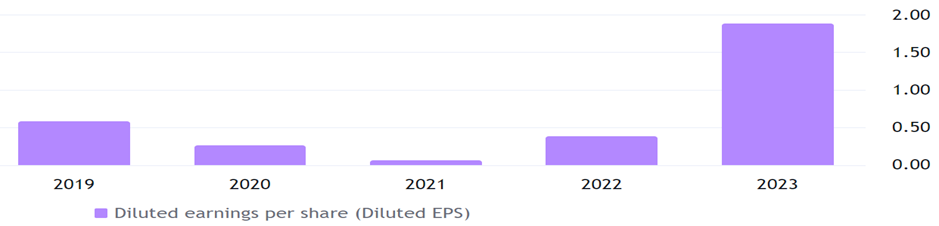

Operating income demonstrated substantial growth, climbing from US $8.3 million in 2020 to US $37.2 million in 2023. This positive trend is supported by a more moderate increase in sales, general, and administrative expenses, which grew from US $18.4 million to US $24.8 million. Net income saw a significant increase, rising from US $3.7 million in 2020 to US $29.6 million in 2023, reflecting the company’s enhanced profitability and financial health. Interest expenses remained low and stable, suggesting manageable debt levels, while the notable rise in income tax expenses in 2023 points to higher profitability and potentially increased tax liabilities.

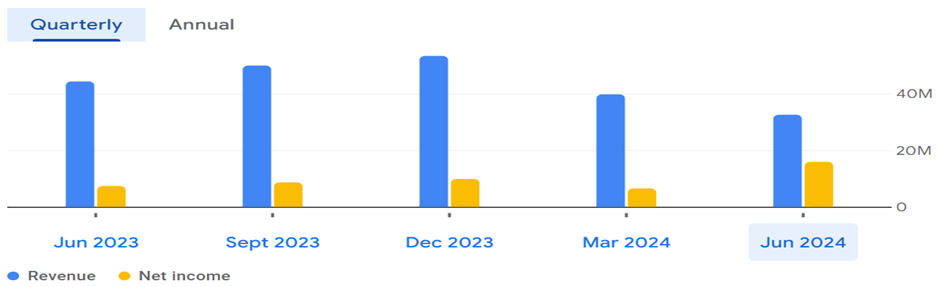

Analysing the recent quarterly financial data reveals several key trends in the company’s performance. Total revenue displayed variability, peaking at US $53.3 million in Q4 2023 before declining to US $32.5 million in Q2 2024. This fluctuation reflects some volatility in revenue streams. Gross profit followed the revenue trend, peaking at US $19.3 million in Q4 2023 and dropping to US $11.6 million in Q2 2024.

Operating income increased from US $10.7 million in Q3 2023 to US $12.4 million in Q4 2023 but fell to US $5.0 million in Q2 2024, suggesting variations in operational efficiency or revenue. Sales, general, and administrative expenses were relatively stable, rising slightly from US $5.9 million in Q3 2023 to US $6.9 million in Q4 2023 and maintaining around US $6.6 million in the subsequent quarters. Net income showed a notable increase from US $8.6 million in Q3 2023 to US $15.9 million in Q2 2024, largely due to lower income tax expenses and consistent operational performance. Interest expenses remained stable across the quarters, reflecting consistent financing costs. Income tax expenses varied significantly, peaking at US $2.4 million in Q4 2023 and dropping to US $1.1 million in Q2 2024.

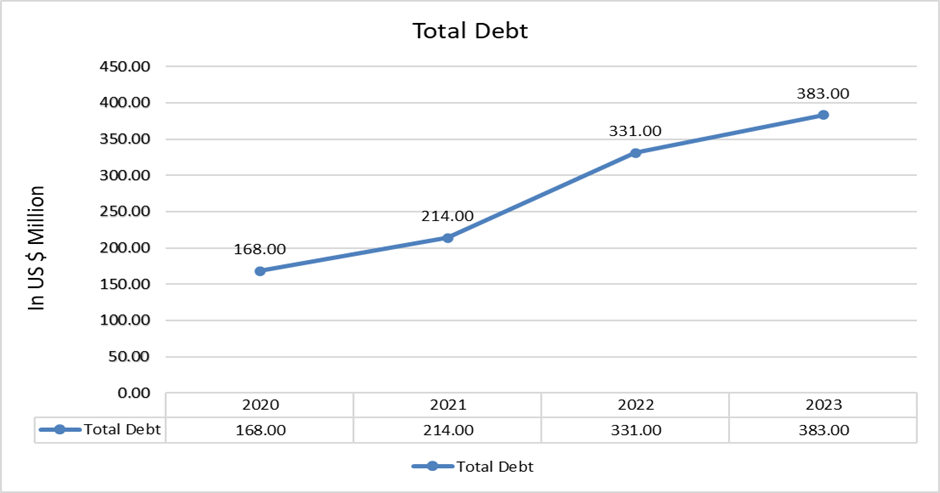

The company has a Total debt of US $383 thousand. The company has assets worth US $218.43 million including cash reserves of US $42.6 million. The company can manage its debt. The debt is not a concerning sign as of now.

Right now, the EPS of the company is at US $1.86 compared to last year’s EPS of US $0.38.

Forecast

Right now, the company is trading at US $27.56, with a 1-year projected target of around US $34.00 and a low estimation of US $23.93; the average price target will be US $30.37.

Technical Analysis

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Right now, the RSI (52.81) indicator gives a positive sign, which shows it is a good time to invest in this stock. It is also giving a bullish divergence.

- The stock has the potential to bounce back up to 10-23% from the current market price.

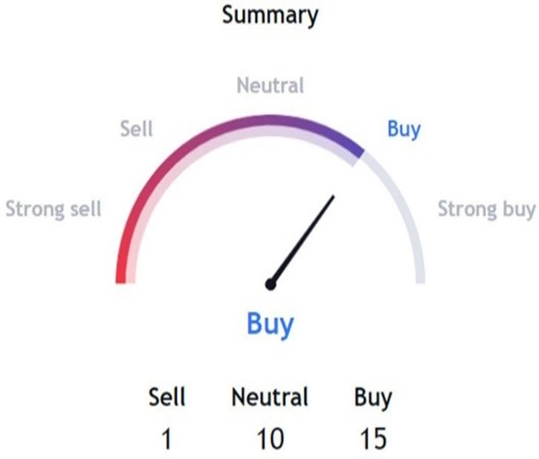

Indicators Summary- BUY

- Market sentiment is bullish, and stocks can go up further.

- 100 days EMA and 50 days EMA also give a positive sign pushing the price upwards.

- VWAP is also giving us a buy signal.

Risk factors

There are some risks involved with Consolidated Water Co. Ltd.

- The company primarily operates in the Caribbean, which can be vulnerable to political instability, regulatory changes, and economic downturns in the region.

- As a company operating in multiple Caribbean countries, CWCO faces risks related to currency exchange rates, particularly if local currencies weaken against the U.S. dollar.

- Any failure to meet water quality standards could result in legal liabilities, loss of customer trust, and regulatory penalties.

- Maintaining and upgrading water infrastructure is capital-intensive. Any failure to adequately maintain or improve infrastructure could lead to service disruptions.

- A downturn in the Caribbean economies could reduce demand for water services or lead to payment delays from customers.

Stock Recommendation

Investing in Consolidated Water Co. Ltd. (CWCO) can be compelling due to its stable business model, which centers around providing essential water services such as potable water production and wastewater treatment. The inelastic demand for clean water ensures steady revenue streams.

Additionally, the company’s geographic diversification across multiple countries, including the Cayman Islands, the Bahamas, Belize, and the United States, helps mitigate risks associated with economic downturns or regulatory changes in any single market. As global water scarcity becomes a more pressing issue, the company stands to benefit from increased demand for its services.

Furthermore, its strong balance sheet supports ongoing operations and investment in new projects. The company’s commitment to environmental and social responsibility also aligns with the growing emphasis on sustainability, making it a potential pick for ESG-focused investors.

These factors together make Consolidated Water a potentially solid investment for those seeking stability, income, and exposure to essential services.

Market Facts gives a “Buy” rating on the stock at the closing price of US $27.56 as of August 28th, 2024.

| CMP (US) (August 28, 2024) | $27.56 |

| Target Price | $34.00 |

| Recommendation | Buy |

Disclaimer:

The information provided in this document and the resources available for download are intended for informational purposes only and should not be interpreted as financial advice. While the content is based on thorough research and is accurate to the best of our knowledge, it is not a substitute for professional financial guidance. We strongly recommend consulting with a financial advisor to discuss your specific situation and obtain tailored advice before making any financial decisions.